- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: My income is received via a 1098-T (grad student stipend). I contributed to Roth IRA and Turb...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My income is received via a 1098-T (grad student stipend). I contributed to Roth IRA and Turbotax is saying I owe penalty because contribution exceeds income (it doesn't)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My income is received via a 1098-T (grad student stipend). I contributed to Roth IRA and Turbotax is saying I owe penalty because contribution exceeds income (it doesn't)

Income from an education loan is not compensation from work which is required to contribute to an IRA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My income is received via a 1098-T (grad student stipend). I contributed to Roth IRA and Turbotax is saying I owe penalty because contribution exceeds income (it doesn't)

As far as I can tell, that was previously correct until 2019 when the omnibus spending bill passed which now allows taxable fellowship/scholarship income to be applied toward IRA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My income is received via a 1098-T (grad student stipend). I contributed to Roth IRA and Turbotax is saying I owe penalty because contribution exceeds income (it doesn't)

From the IRS 590-A instructions for IRAs:

"However, for tax years beginning after 2019, certain non-tuition fellowship and stipend payments not reported to you on Form W-2 are treated as taxable compensation for IRA purposes. These amounts include taxable non-tuition fellowship and stipend payments made to aid you in the pursuit of graduate or postdoctoral study and included in your gross income under the rules discussed in chapter 1 of Pub. 970, Tax Benefits for Education.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My income is received via a 1098-T (grad student stipend). I contributed to Roth IRA and Turbotax is saying I owe penalty because contribution exceeds income (it doesn't)

The taxable amount is allowed towards a ROTH as shown in IRS pub 590a. Is your scholarship showing as taxable income? Would you please preview your return and check the taxable income and then let us know if the program is in fact showing a taxable income at least equal to the contribution? To view your return:

- If you are using the online version:

- go to Tax Tools,

- then select Tools,

- select View Tax Summary,

- on the left side, select Preview My 1040.

- In the desktop program, switch to forms mode.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My income is received via a 1098-T (grad student stipend). I contributed to Roth IRA and Turbotax is saying I owe penalty because contribution exceeds income (it doesn't)

Yes, my stipend is registered as taxable income. I see from perusing the forums that this is an issue other users have had, so I presume it is a Turbotax software issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My income is received via a 1098-T (grad student stipend). I contributed to Roth IRA and Turbotax is saying I owe penalty because contribution exceeds income (it doesn't)

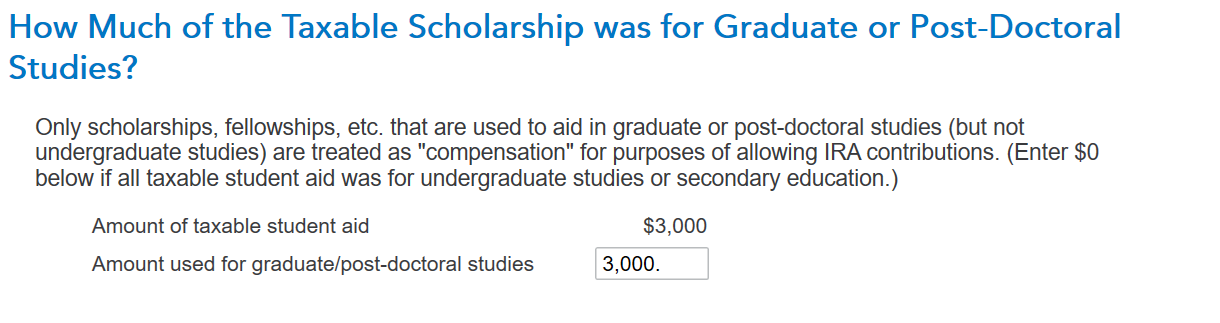

I ran your scenario through TurboTax and I did not receive a penalty for excess contribution to a ROTH IRA. I noticed that you are asked to enter the amount of your scholarship income that is for post graduate studies, I am wondering if you saw this and entered the proper amount? You see the screen in the form 1098-T entry area.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My income is received via a 1098-T (grad student stipend). I contributed to Roth IRA and Turbotax is saying I owe penalty because contribution exceeds income (it doesn't)

I'm facing this same issue but don't see this screen? How do I access it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My income is received via a 1098-T (grad student stipend). I contributed to Roth IRA and Turbotax is saying I owe penalty because contribution exceeds income (it doesn't)

If the income is not actually taxable, you won't see the screen. Take a look at your tax forms and see how it is showing up.

- In desktop, switch to Forms Mode.

- For online:

- On the left side, select Tax Tools

- Select Print center

- Select Print, save or preview this year's return

- If you have not paid, select pay now.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17549282037

New Member

jbweed98

New Member

in Education

strawberrypizza

Level 2

in Education

srtadi

Returning Member

CRAM5

Level 2