- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

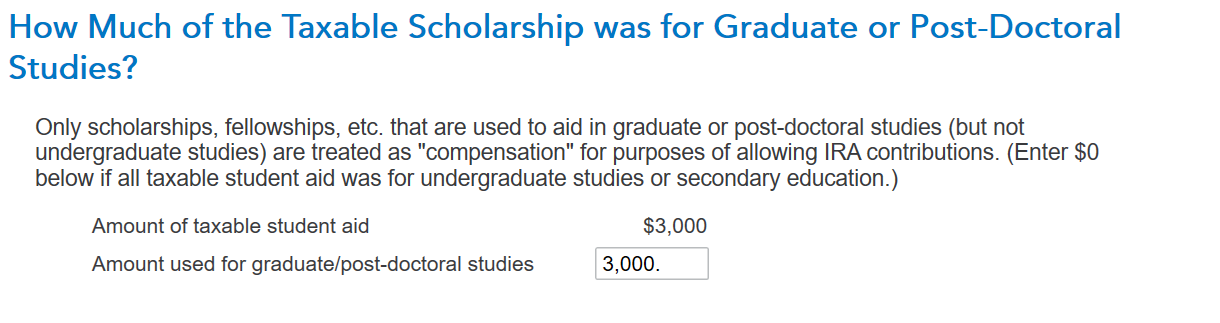

I ran your scenario through TurboTax and I did not receive a penalty for excess contribution to a ROTH IRA. I noticed that you are asked to enter the amount of your scholarship income that is for post graduate studies, I am wondering if you saw this and entered the proper amount? You see the screen in the form 1098-T entry area.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 22, 2023

2:36 PM