- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: My husband retired in 2019. I am looking for the page where it asked that as I accidently checked no.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband retired in 2019. I am looking for the page where it asked that as I accidently checked no.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband retired in 2019. I am looking for the page where it asked that as I accidently checked no.

Not really sure what you are looking for. You do not have to enter on a tax return that one of you is retired. If your spouse received retirement income--like Social Security or pension income, or distributions from a retirement account--that income must be entered.

As for "occupation" -- if you want to use "retired" as his occupation you can enter that in My Info if you want to . The IRS does not use occupation for anything that affects your tax due or refund. It is only for statistical purposes.

Do you need to enter retirement income?

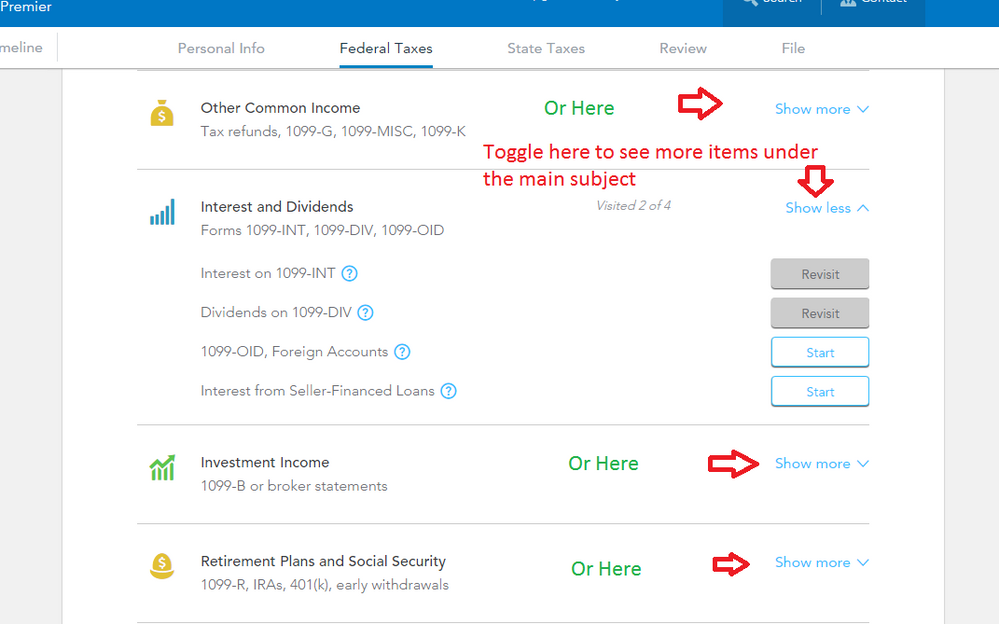

Do not try to enter your SSA1099 or RR1099RB as a W-2. Go to Federal> Wages & Income>>Retirement Plans and Social Security (SSA1099 and 1099RRB) to enter your SSA1099.

To enter your retirement income, Go to Federal> Wages and Income>Retirement Plans and Social Security>IRA 401 k) Pension Plan Withdrawals to enter your 1099R.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband retired in 2019. I am looking for the page where it asked that as I accidently checked no.

The Question may have been part of the "Guide Me" interview

In no way does that stop you from dealing with the various income items, deductions, credits etc, as long as you carefully go thru the full set of software menus . (especially if you get out of the "Guide Me" ). Even if you said NO to having Interest or Investment or Retirement Income in that Guide Me set, you can go back to that page at any time before you actually file, to add in Any & All income items you may have from the full menu...and then go thru the various credits and deductions too...

_________________________

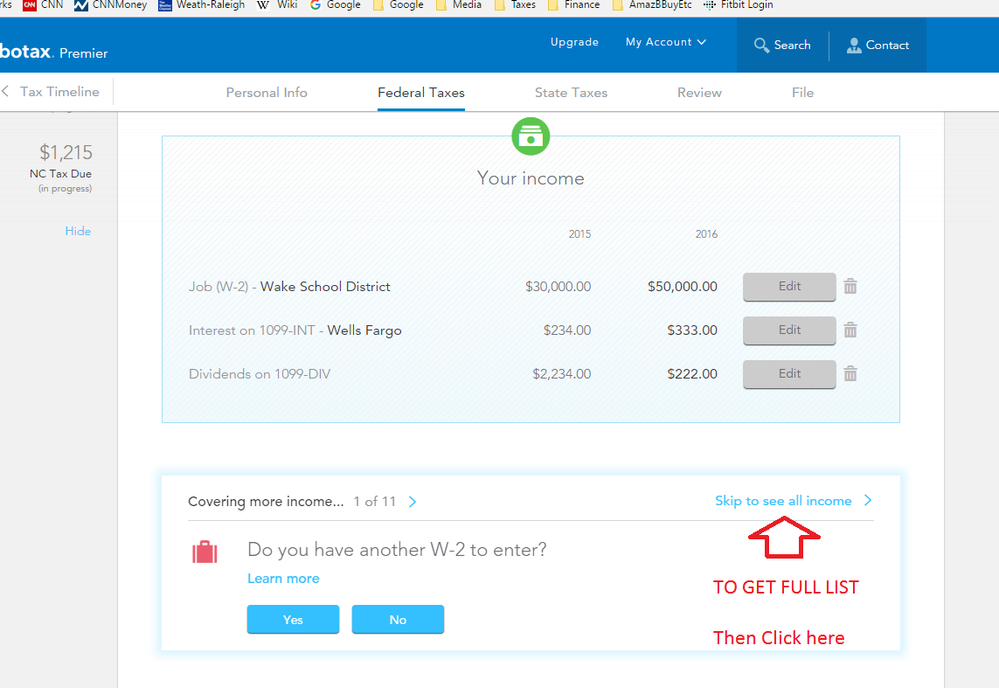

IF you don't see the full menu of income items below the top box of what you have entered already, you may be in Guide Me mode. Get out of that and find everything you need to enter (in the "Personal" income section for you SE users). These pictures are from "Premier" , your SE Version has some different tabs at the top, but the rest should be similar:

_____________________________

_____________________________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

w-ahlers

New Member

robertrgiffin

New Member

stevekewley

New Member

davekelle

New Member

martha

New Member