- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: I was furloughed because of covid and i did not make any repayments during that time and i was taxed on the balance. how do i explain this was because of covid?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

@catspaw21 wrote:

i tried that. it seems not to be accepting it. i may delete it and just try to re-enter it again. But at least now i know why it wasnt giving me the three year option, so thank you.

If you have a loan from your 401(k) and you default on the loan payments, you have a "deemed distribution." That's code L. This distribution is subject to a 10% early withdrawal penalty unless you are over age 59-1/2. It can't be offset by performing a rollover to a new plan or by repaying the loan. The tax can't be extended over 3 years because the deemed distribution is not covered under the CARES act. Unfortunately, you just owe the tax.

If you separated from service, so the loan payments were not made, I believe that would be an "offset" distribution, and you could avoid the tax and penalty by making a rollover contribution before the deadline of your next tax return (which was May 17 unless you got the extension). But deemed distributions are not eligible for rollover.

You are just stuck with the tax and penalty, sorry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

Repayments of what? Why do you need to explain it? To who? Just enter the W2 and/or 1099 income you got.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

No one can see your screen or your tax return. We do not know what repayment you are referring to or what balance you are saying that you were taxed on. Please explain. We do not know how to help since we cannot figure out what you are talking about.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

sorry obviously the system did not repost the entire question! i had loans from my 401k that i was making repayments through my paychecks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

Did you get a 1099R reporting the unpaid loans as Distributions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

yes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

the system does not seem to be giving me the option to break the taxes down over the next 3 years either

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

What were the codes in box 7?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

codes were 1L

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

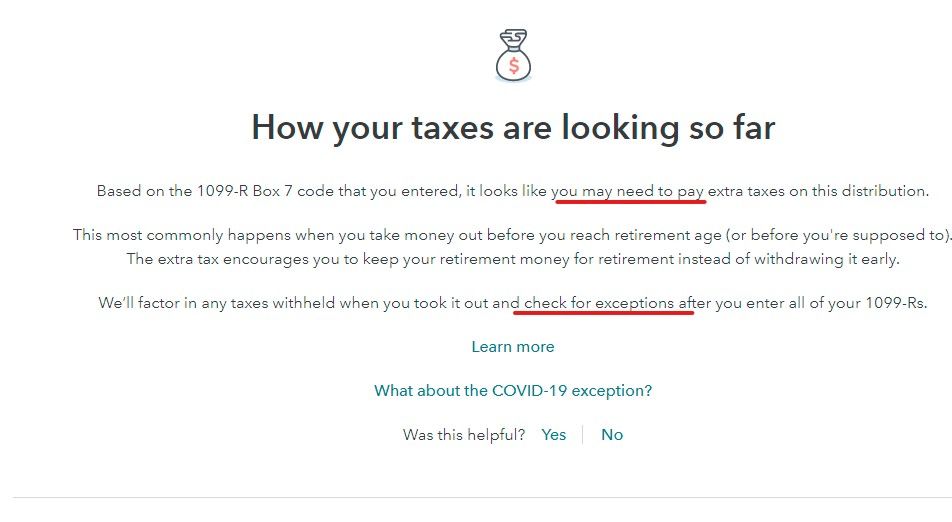

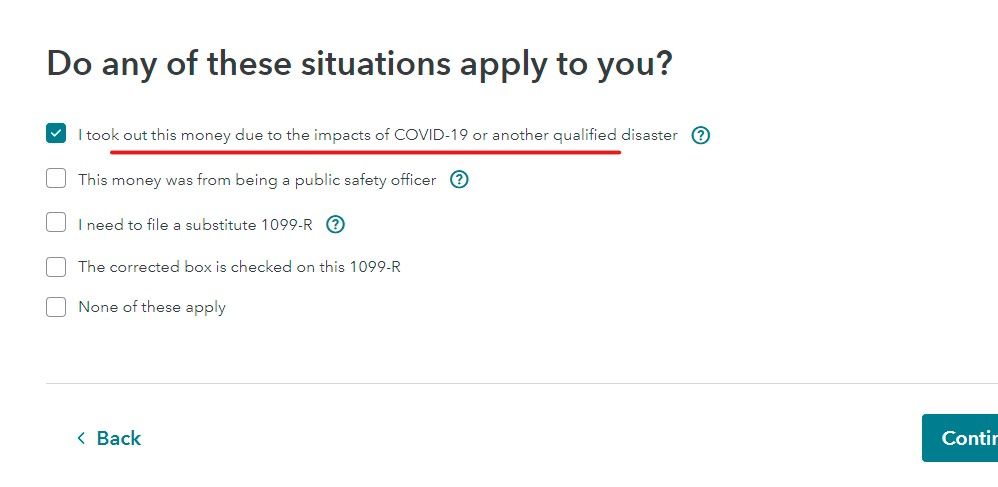

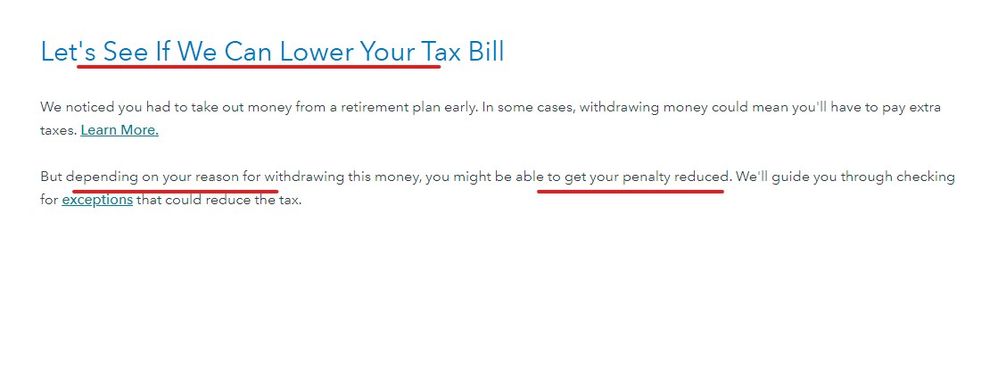

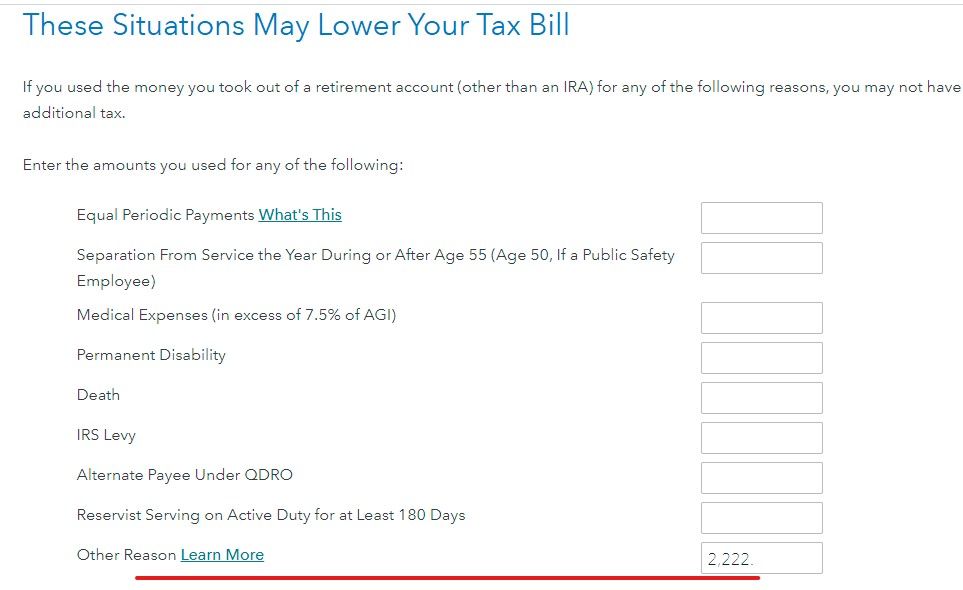

Code L does not allow the option to spread it out over 3 years since you took the loan out before 2020.

And if you follow the screens you can get rid of the penalty ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

i tried that. it seems not to be accepting it. i may delete it and just try to re-enter it again. But at least now i know why it wasnt giving me the three year option, so thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

@catspaw21 wrote:

i tried that. it seems not to be accepting it. i may delete it and just try to re-enter it again. But at least now i know why it wasnt giving me the three year option, so thank you.

If you have a loan from your 401(k) and you default on the loan payments, you have a "deemed distribution." That's code L. This distribution is subject to a 10% early withdrawal penalty unless you are over age 59-1/2. It can't be offset by performing a rollover to a new plan or by repaying the loan. The tax can't be extended over 3 years because the deemed distribution is not covered under the CARES act. Unfortunately, you just owe the tax.

If you separated from service, so the loan payments were not made, I believe that would be an "offset" distribution, and you could avoid the tax and penalty by making a rollover contribution before the deadline of your next tax return (which was May 17 unless you got the extension). But deemed distributions are not eligible for rollover.

You are just stuck with the tax and penalty, sorry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

thanks. it certainly seems there is no way around it. i have the extension. i was hoping to make a payment towards the loan - but i can't do that and pay the taxes too!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

@catspaw21 wrote:

thanks. it certainly seems there is no way around it. i have the extension. i was hoping to make a payment towards the loan - but i can't do that and pay the taxes too!

The other thing about paying back the loan is you don't get a tax break for it, but it creates a taxable basis in the 401(k). (This can get complicated to explain.)

For example, suppose you have $100,000 in your plan in a S&P index fund, and you borrow $50,000. Now your plan assets are a $50,000 index fund and a $50,000 loan to yourself; the loan is counted as a plan asset. Even though you get the deemed distribution, the loan is still considered a plan asset. But now, if you pay it off, that becomes a taxable basis in the account. Suppose you manage to pay back the entire loan over time. You don't get any tax deduction for repaying the loan, but now your plan assets consist of $50,000 of pre-tax and $50,000 of after-tax assets. In the end, that means that when you make withdrawals in retirement, your withdrawals would only be 50% taxable instead of 100% taxable.

So repaying the loan will still ultimately be to your long-term benefit, just in a different way. And unfortunately you are stuck this year. You should ask the plan administrator if there is any time limit to making loan repayments. You might consider temporarily stopping your pre-tax contributions and making after-tax loan payments instead, unless you would lose out on a match by doing that.

Then if you separate from service (quit, retire, get fired) you have a whole other group of options for your 401(k) money.

It can get complicated, and professional advice might be helpful going forward. Good luck.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was furloughed because of covid and i did not make any repayments on my 401k loans during that time because i had been do i ng through my paychecks. i was taxed on the balance. how do i explain this was because of covid?

Repaying the loan to avoid taxes is not an option since the 1099-R was coded L and not the new M.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hstewartsr

New Member

inge

New Member

evakeys99

New Member

jjon12346

New Member

user17549300303

New Member