- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Error in TurboTax handling of (new) Schedule 1 line 8r scholarship income for determining IRA...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax handling of (new) Schedule 1 line 8r scholarship income for determining IRA contribution limits

it is April 9th and this is not fixed. And yes my stipend is reported on line 8r

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax handling of (new) Schedule 1 line 8r scholarship income for determining IRA contribution limits

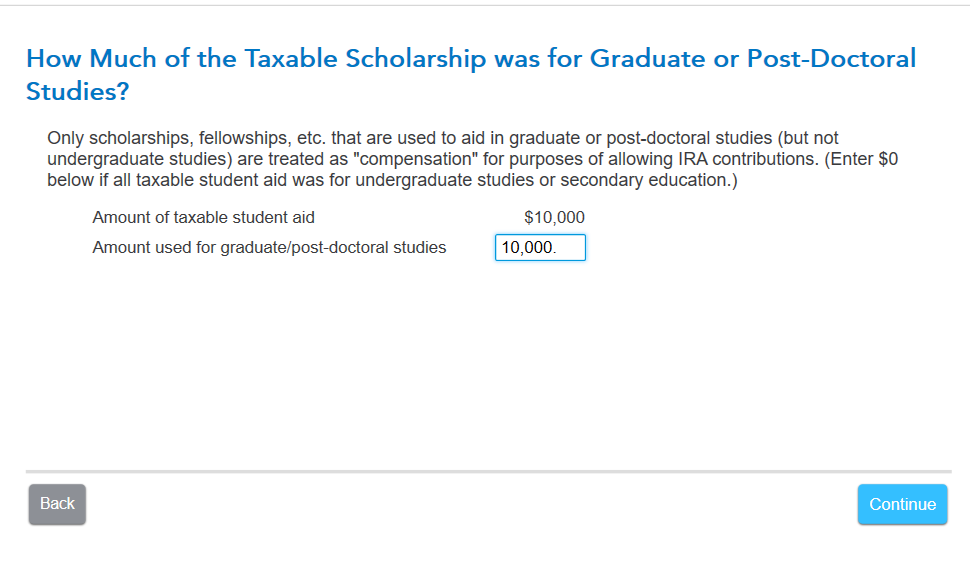

During the IRA contribution interview, you will get a screen "How much of the taxable Scholarship was for Graduate or Post-Doctoral Studies". You will need to enter the amount that applies to it here.

"Certain non-tuition fellowship and stipend payments not reported to you on Form W-2 are treated as taxable compensation for IRA purposes. These amounts include taxable non-tuition fellowship and stipend payments made to aid you in the pursuit of graduate or postdoctoral study and included in your gross income under the rules discussed in chapter 1 of Pub. 970." (Pub 590-A)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax handling of (new) Schedule 1 line 8r scholarship income for determining IRA contribution limits

Dana,

I am using the premier version of TurboTax. You stated "During the IRA contribution interview, you will get a screen "How much of the taxable Scholarship was for Graduate or Post-Doctoral Studies". You will need to enter the amount that applies to it here." I do not see any prompt in the IRA section that asks about graduate studies.

In the education section, under the 1098-T section, I checked the box graduate student, as directed by other advisors on this board.

There is also a prompt that says "did your aid include amounts not awarded for 2022 expenses?" I checked "no", because all of the award was for 2002.

Then there is a prompt "did you pay for room and board with a scholarship or grant" - I said yes, because that is what my fellowship is for. How much ....was used to pay the expense, I inserted all of my taxable scholarship money here.

However, I still cannot make an IRA contribution without getting a penalty, and on my state taxes the amount from schedule 1, line 8r transfers as unearned income. Which because I am a post-graduate fellow it should be earned income.

I have spend hours on this. I'm hoping you can help me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax handling of (new) Schedule 1 line 8r scholarship income for determining IRA contribution limits

please ignore my last post - 5 minutes ago - I found the prompt you were referring to. I needed to say yes to the question "Do you have any excess Roth contributions" to get to this prompt.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax handling of (new) Schedule 1 line 8r scholarship income for determining IRA contribution limits

Turbotax does not treat taxable non-tuition fellowship and stipend payments reported via a 1099-G correctly (i.e. not on a W-2), but HR Block does. IRS Publication 590-a is absolutely crystal clear in stating for IRA purposes that "Compensation includes ... taxable non-tuition fellowship and stipend payments" and since 2019, "Taxable non-tuition fellowship and stipend payments. For tax years beginning after 2019, taxable non-tuition fellowship and stipend payments are treated as taxable compensation for the purpose of IRA contributions".

I was on the phone with Turbotax support for over an hour, but they refused to admit this glaring error in their application and tried to force me to upgrade for a fee.

I re-entered everything into HR Block's application, which asked the proper questions and treated the 1099-G-reported fellowship grant as income for IRA contribution purposes.

I'm considering moving another five family member's tax preparation to HR Block as a result.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jeff7

Level 3

johntheretiree

Level 2

maya-cooper-brill

New Member

BrettS1

New Member

in Education

dabreujr

New Member