- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

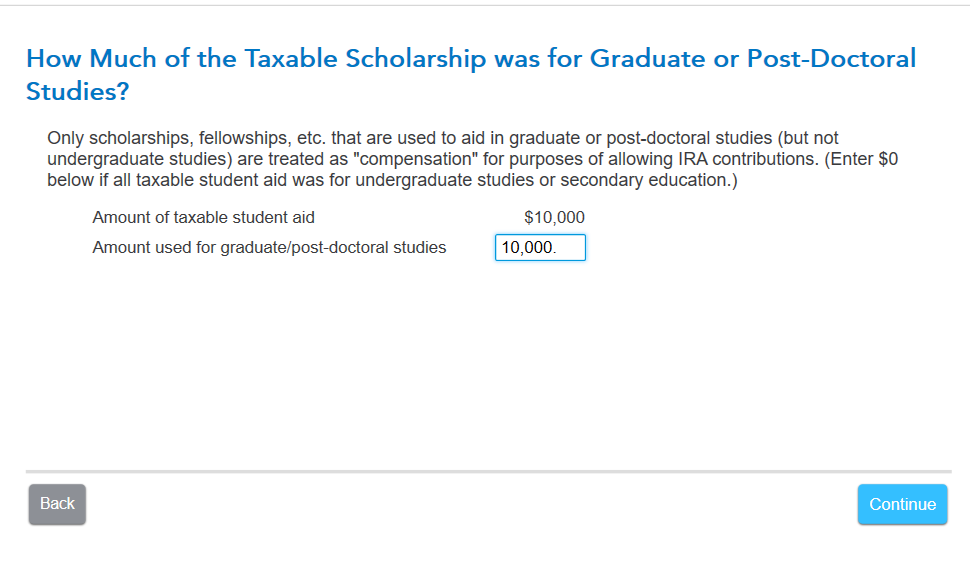

During the IRA contribution interview, you will get a screen "How much of the taxable Scholarship was for Graduate or Post-Doctoral Studies". You will need to enter the amount that applies to it here.

"Certain non-tuition fellowship and stipend payments not reported to you on Form W-2 are treated as taxable compensation for IRA purposes. These amounts include taxable non-tuition fellowship and stipend payments made to aid you in the pursuit of graduate or postdoctoral study and included in your gross income under the rules discussed in chapter 1 of Pub. 970." (Pub 590-A)

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 10, 2023

6:40 AM