in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Calculating the non-taxable portion of an RMD

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating the non-taxable portion of an RMD

I have a basis in my IRA. In previous years TT has asked me questions to assure that the basis is used to reduce the taxable amount of my RMD. This year I can't get TT to ask me these questions, so my entire RMD is entered as taxable.

1. Is there a way to get TT to interview me on this topic?

2. If not, what do I need to do to get the 8606 filled out correctly

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating the non-taxable portion of an RMD

Please follow these steps to enter your basis for the RMD distribution:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Continue through the questions

- On the "Your 1099-R Entries" screen click "continue"

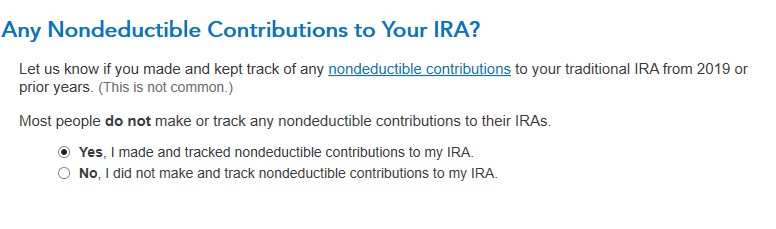

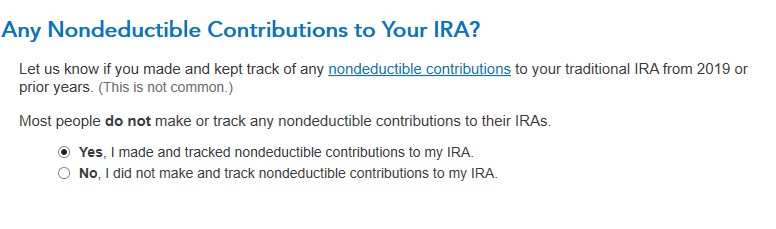

- Answer "yes" to "Any nondeductible Contribution to your IRA?"

- Answer the questions about the basis and value.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating the non-taxable portion of an RMD

Please follow these steps to enter your basis for the RMD distribution:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Continue through the questions

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contribution to your IRA?"

- Answer the questions about the basis and value.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating the non-taxable portion of an RMD

The instruction given do not match TurboTax 2021.

At no point TurboTax ask about Nondeductible contributions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating the non-taxable portion of an RMD

Please make sure that you click “Continue” on the “Review your 1099-R info” screen (“Your 1099-R Entries” screen TurboTax Desktop).

The question “Any Nondeductible Contributions to your IRA?” will only come up for distributions from a traditional IRA please make sure your IRA/SIMPLE/SEP box is checked:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click “Review” and verify the IRA/SIMPLE/SEP box is checked

- Click “Continue” on the “Review your 1099-R info” screen

- Continue through the questions until the “Any Nondeductible Contributions to your IRA?” screen

@Gongolo

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Al2531

Level 2

Acanex

Level 2

mjshort

Level 2

April151

New Member

KI2024

New Member