- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: 1099R imported correctly but processed on 1040 incorrectly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R imported correctly but processed on 1040 incorrectly

My 1099R shows that the taxable amount was $14,000 and the tax withheld was $2,100. On the 1040, it shows on line 4b that the taxable AMOUNT was $2,100, not the $14,000. The 1099R was imported from the Merrill Lynch website directly and appears to me to be imported correctly on the 1099R worksheet.

I believe I'm looking at having to file an amended return, and most likely pay the difference. But, I don't know how to amend my Turbo Tax return to get the correct result.

Am I going to have to do it manually and not through the software? This seems that it should fall under the 100% accuracy guarantee also. I don't have a notice from the IRS, but something is wrong with the mapping/processing of the information it appears.

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R imported correctly but processed on 1040 incorrectly

No this is not covered by the accuracy guarantee ... all imported information must be reviewed and confirmed by the user PRIOR to filing the return .... since this was not caught you must wait to see if the IRS catches it when they process the return which they should if the box 4 amount that should be $2100 was reported as zero.

If you do need to amend, then all you will do after starting the amendment process is to go back to that 1099-R and make the corrections needed ... you may need to delete the 1099-R and enter it again manually. Also you will need to amend the state return as well if this effects it too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R imported correctly but processed on 1040 incorrectly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R imported correctly but processed on 1040 incorrectly

Did you ever get a solution for this and determine what happened and what to do? I am seeing the same situation and this is the first one I've seen about the same problem!! It is correct from 1099r but wrong on filed 1040. Makes no sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R imported correctly but processed on 1040 incorrectly

@haleyc77 wrote:

Did you ever get a solution for this and determine what happened and what to do? I am seeing the same situation and this is the first one I've seen about the same problem!! It is correct from 1099r but wrong on filed 1040. Makes no sense.

Exactly what is the problem that you are having? What do you see that is wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R imported correctly but processed on 1040 incorrectly

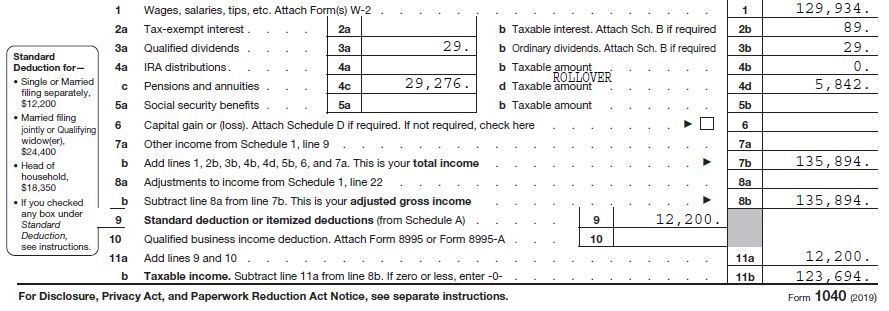

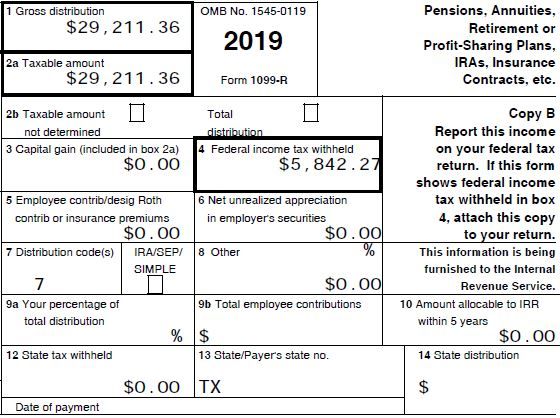

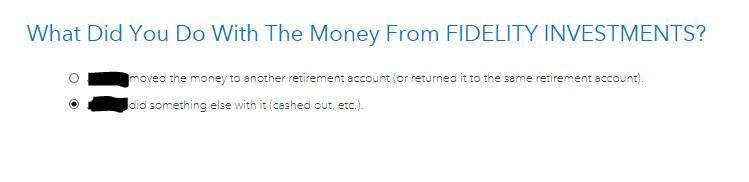

Same like the original poster. Attached photos below. The 1099 shows entered correctly even when looking at amending.

This was a 401k distribution in cash, not a rollover, and the entire amount is taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R imported correctly but processed on 1040 incorrectly

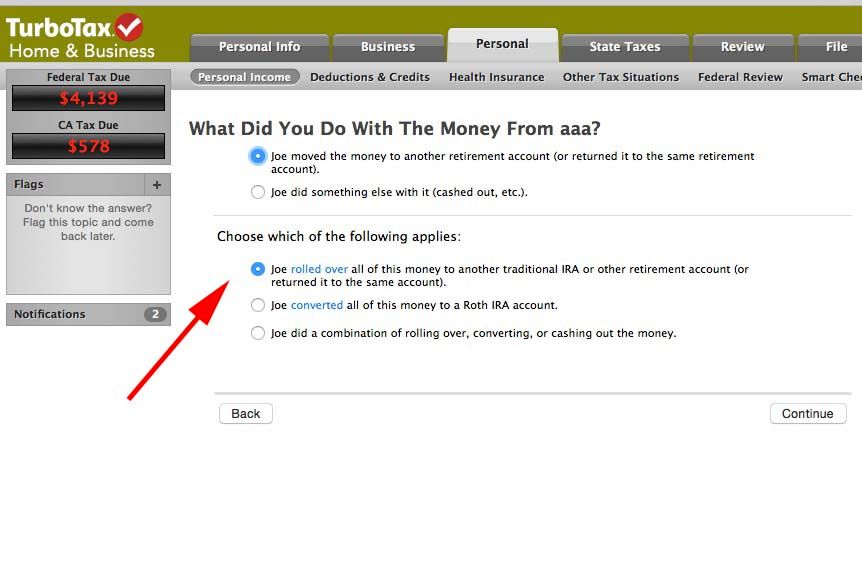

That indicated that when the 1099-R was entered into TurboTax you answered the interview questions that the money was all moved to another retirement account so only the amount of tax withheld was not rolled over that it is taxable.

Line 4c shows $29,276 was rolled over and line 4d is the $5,482 amount of tax withholding that is still a taxable distribution and it says ROLLOVER. Looks fine to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R imported correctly but processed on 1040 incorrectly

It was not marked as a rollover.. that's what I said... that's the problem....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R imported correctly but processed on 1040 incorrectly

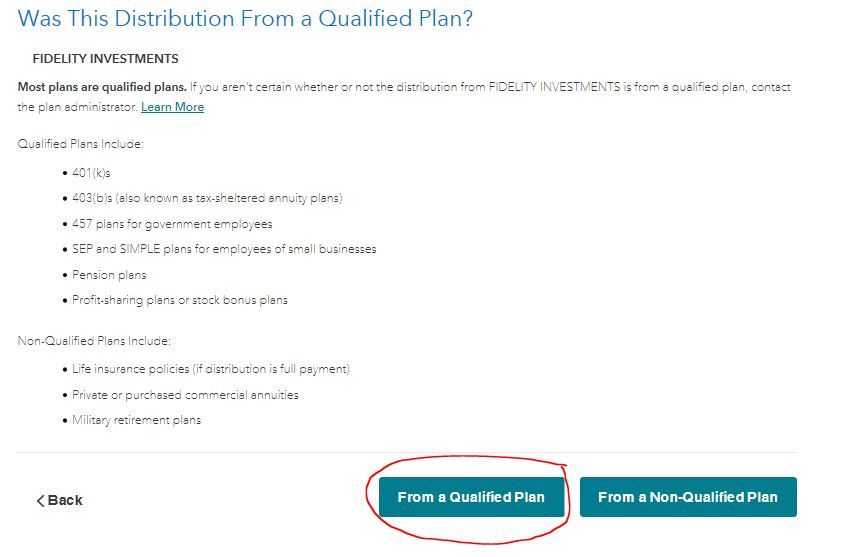

The only way for it to be a rollover is the interview question or if you entered a code G into box 7 which is automatically a rollover. If imported, perhaps the code imported incorrectly or was wrong in the import.

Delete the 1099-R and re-enter manually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R imported correctly but processed on 1040 incorrectly

Exactly the problem... I am fully aware of the different distribution codes and questions asked. It is marked correctly. I guess upon looking at amending I will try to remove it and add again. Doesn't make sense to have to do that when it is all correctly entered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R imported correctly but processed on 1040 incorrectly

I cannot tell you how it happened, only how to fix it. This is a well tested section of the software that has not changed in years. In 10 years I have never seen such a problem when it was not caused by a bad import or user error. (Some times entered incorrectly and then trying to edit to change things will remember the first entity so is is best to delete and re-enter.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R imported correctly but processed on 1040 incorrectly

By the way, if you go back and review or edit a 1099R it doesn't keep your answers from before but resets them to the defaults so you will have to enter all the boxes again and go though all the questions again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R imported correctly but processed on 1040 incorrectly

Delete and reenter the Form 1099-R.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R imported correctly but processed on 1040 incorrectly

@dmertz When you are in the forum can you look at this one too? https://ttlc.intuit.com/community/taxes/discussion/re-amending-errors/01/1553873

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lionintexas

New Member

NMPaul

Level 1

saunder1

Level 3

Rudy_V

New Member

rwilsond

Level 3

in Education