- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

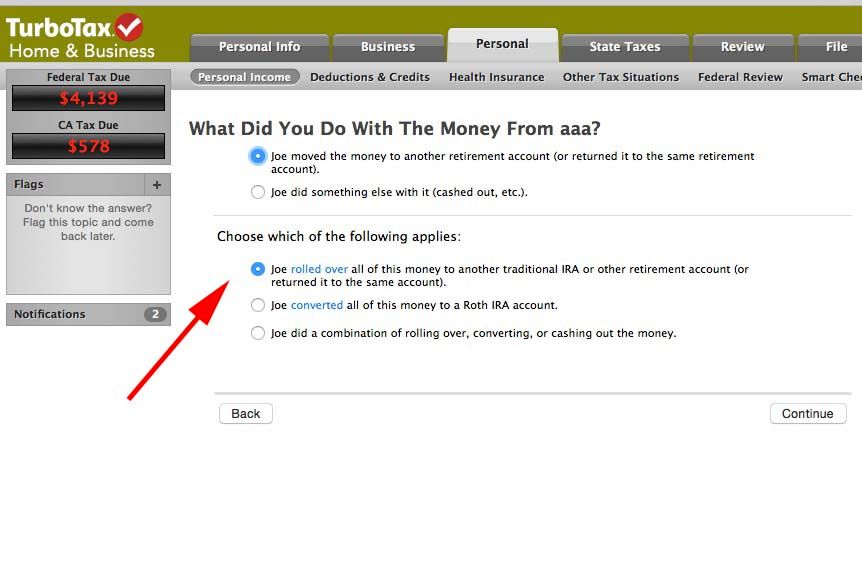

That indicated that when the 1099-R was entered into TurboTax you answered the interview questions that the money was all moved to another retirement account so only the amount of tax withheld was not rolled over that it is taxable.

Line 4c shows $29,276 was rolled over and line 4d is the $5,482 amount of tax withholding that is still a taxable distribution and it says ROLLOVER. Looks fine to me.

**Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the accuracy of any information in this post.**

April 30, 2020

8:12 AM