- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: 1099 div with ira

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 div with ira

hi, I am drawing social security, & I have traditional and Roth IRA's I am not drawing any money out. my broker is preparing 1099's div & int's for them. do i need to report these as income, even tho i am not drawing anything out of the IRA's? thx

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 div with ira

If the income was generated within the retirement accounts and you had no withdrawals you would not have to report that information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 div with ira

If the income was generated within the retirement accounts and you had no withdrawals you would not have to report that information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 div with ira

If your investments are in retirement accounts, the broker should not be preparing any Forms 1099-DIV and 1099-INT related to those investments. If you receive any of these, ask the broker for an explanation. If the broker files them indicating you as the recipient, failing to include these on the tax return would result in the IRS issuing to you a notice of underreported income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 div with ira

as it turns out, the income was generated in any IRA. it is in a joint account with me & my wife, so it is taxable

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 div with ira

I am not sure I completely understand but agree that the end result is a joint account will produce taxable forms.

- You are not allowed to have a joint IRA account.

- If the money is coming from a joint account, it will not be retirement related and you do need to report the dividends and interest. A brokerage will not create forms you don't need, normally.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 div with ira

These forms ended up having nothing to do with an IRA but were instead related to activity in a non-retirement brokerage account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 div with ira

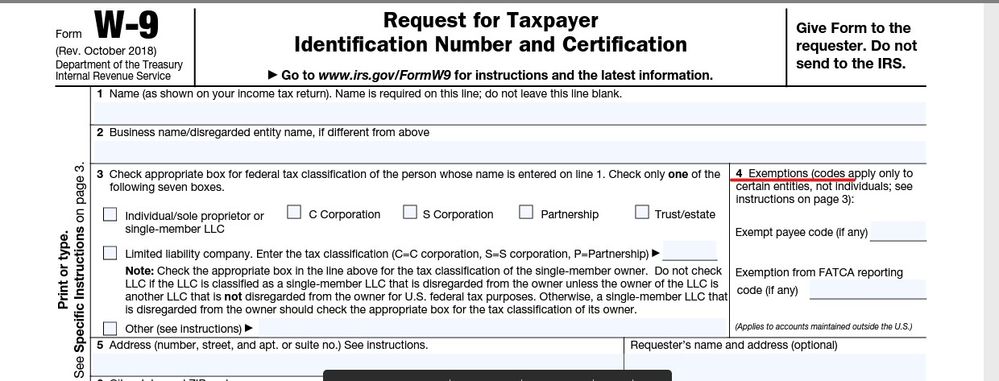

Would it be correct to understand that a 1099 or 1099-DIV should not be issued by a corporation if the distribution is being made in a Roth IRA account, and therefore should have no tax consequences? The reason I ask is that a corporation is asking for a W-9 related to a distribution they will make into my self directed Roth IRA account. I guess they can require the W-9 but don't think they should issue any 1099 or 1099-DIV to that account at year end. True?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 div with ira

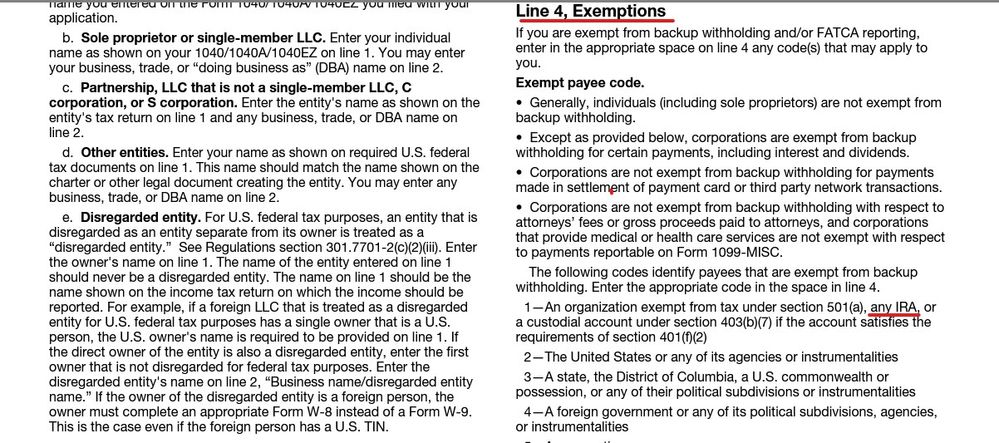

They can require you to fill in the W-9 so they know if a 1099 needs to be issued ... READ the form to fill it in correctly ... https://www.irs.gov/forms-pubs/about-form-w-9

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 div with ira

Thank you for that fast answer pointing that out!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 div with ira

Regarding Line 4 on the W-9, it is not 100% clear if the last sentence in that box ("Applies to accounts maintained outside the U.S.") is referring ONLY to the line above it ("Exemption from FATCA reporting code (if any)"), or, if that refers to BOTH items above it in that box for line 4 Exemptions. ("Exempt payee code (if any)" and "Exemption from FATCA reporting code (if any)")

One reason I began to question that is in one example of a self directed IRA custodian instructing how to fill out a W-9 they said leave line 4 blank, but another IRA custodian's example said to enter 1 for the exempt payee code. (This is for a domestic account.)

I guess it couldn't hurt to enter 1 for Exempt payee code and also enter A for Exemption from FATCA reporting code, as a Youtube presentation by a tax attorney explained. (even though this is domestic, not maintained outside the US)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

PipiR

Level 3

JR2318

New Member

JR2318

New Member

spBob

New Member

robadele

New Member