- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- On Form 1099-INT, Box 15 - State, I get an error and can't continue without picking a state. TX is not an income tax state and so is not listed in the drop-down.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On Form 1099-INT, Box 15 - State, I get an error and can't continue without picking a state. TX is not an income tax state and so is not listed in the drop-down.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On Form 1099-INT, Box 15 - State, I get an error and can't continue without picking a state. TX is not an income tax state and so is not listed in the drop-down.

Yes, please do that. any entry, including "0" can trigger the error. Be sure that boxes 15 through are blank.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On Form 1099-INT, Box 15 - State, I get an error and can't continue without picking a state. TX is not an income tax state and so is not listed in the drop-down.

If your W-2 has information reported in box 16 for state income, then you should include something in boxes 14 and 15. If your state is Texas, then box 17 should be blank.

If you have to enter something, enter TX for box 14, and you can enter anything in box 15 like '1234'. Box 16 and 17 should be blank.

If you have numbers in 16, or 17, please contact us again and give additional details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On Form 1099-INT, Box 15 - State, I get an error and can't continue without picking a state. TX is not an income tax state and so is not listed in the drop-down.

Hi - thanks for the quick reply. This seems to be a system error. I agree with the "how it should work" statements you provided but the system will NOT let me move on and gives an error message as long as Box 15 is blank, which it is blank on my form (as it should be for TX). However, you asked about boxes 16 and 17. Box 16 contains "[removed]/000" and 17 contains "$0". Thanks for any additional help on resolving this. I suppose I could just blank out the data in box 16?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On Form 1099-INT, Box 15 - State, I get an error and can't continue without picking a state. TX is not an income tax state and so is not listed in the drop-down.

Yes, please do that. any entry, including "0" can trigger the error. Be sure that boxes 15 through are blank.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On Form 1099-INT, Box 15 - State, I get an error and can't continue without picking a state. TX is not an income tax state and so is not listed in the drop-down.

Thanks again for the assistance. I blanked out the state ID code (box 16) and the $0 amount (box 17) and the "interview" script allowed me to continue error-free. However, when I did the Federal Review step, I had to re-enter the state ID in box 16 manually and the $0 amount to resolve an error at that step. Clearly, the system has some bugs/issues but at least I am past it (for now). This should be reported as a problem if anyone is able to report it to Intuit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On Form 1099-INT, Box 15 - State, I get an error and can't continue without picking a state. TX is not an income tax state and so is not listed in the drop-down.

I agree, I am having the same problem and cannot submit because I cannot get past the federal review of the 1099-int for leaving state tax blank

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On Form 1099-INT, Box 15 - State, I get an error and can't continue without picking a state. TX is not an income tax state and so is not listed in the drop-down.

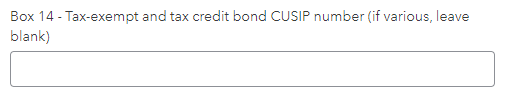

Are you able to leave Box 14 blank as if reporting Various?

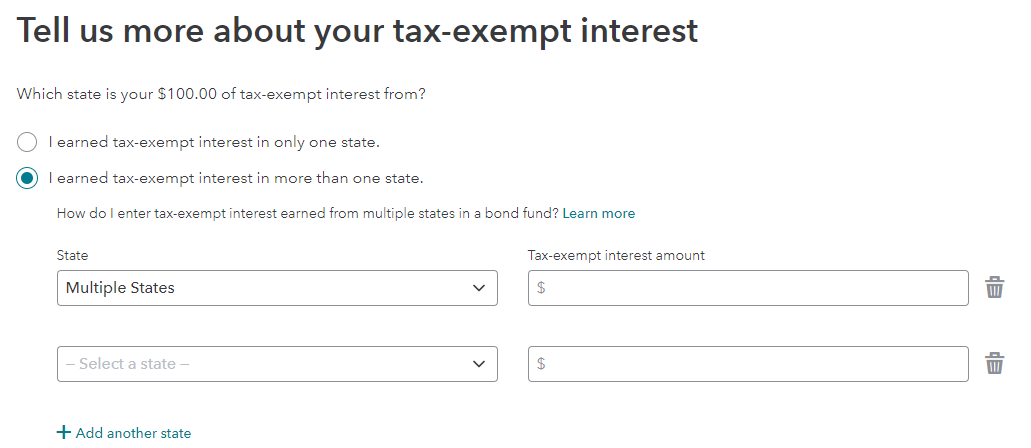

At the screen Tell us more about your tax-exempt interest, report Multiple States and the tax-exempt interest amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cpoconn7

New Member

blugopher

Level 2

doin_taxes

Level 3

hlschwabe

New Member

0cf5f0dc6bc5

New Member