- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- NR4 from Canada

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

I have 3 NR4 from Canada and I am a US citizen.

My mother passed a few months back. I have 3 NR4, 1 with code 61 and 2 with code 40.

I'm a little confused on how I enter these. My understanding is that I enter them as mock 1099-R but is there a breakdown of what boxes I fill out on the 1099-R

- The NR4 forms have very little information, they have:

- Box 16 - Gross income

- Box 17 - Non-resident tax withheld

- When doing the exchange rate do I do it based on todays currency exchange?

- Where do I get the TIN or do I leave it blank?

- Do I have to fill out a separate form as well or will the 1099-R suffice?

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

"39 - Superannuation or pension benefits – Periodic payments

40 - Superannuation or pension benefits – Lump-sum payments"

Since both of these are government "pension" payments, using form SSA-1099 is a closer fit than a 1099-R. Besides, there is a tax benefit from using the SSA-1099, because SS payments are never taxed at 100%.

The form with code 61 should be treated as if it were on a 1099-INT, since it is "61- Arm’s length interest payments". (See the "Canada says" link above).

You also asked about what exchange rate to use. The IRS generally says that whatever exchange rate you use, you have to be able to justify it. John's link above is a solid choice - it is the IRS's own listing of average exchange rates.

I will ask that the FAQ be updated to reflect the different answers based on the codes on the Canadian forms.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

You should post an NR4 as a Social Security transaction.

- Boxes 16 & 17 are all you will need.

- Enter the NR4, treat it as if it is an SSA-1099

- Enter it in the Retirement Plans

- Social Security section, under ‘Social Security (SSA-1099, RRB-1099)’.

- Then, go to the Deductions and Credits

- Select Foreign Taxes under ‘Estimates and Other Taxes Paid’

- enter any foreign tax you already paid to Canada on that income.

- For more info specific to the US/Canadian tax treaty, please see http://www.irs.gov/pub/irs-pdf/p597.pdf

- Currency exchange may not have been updated for 2022 yet, but they will be published here: Yearly Average Currency Exchange Rates - IRS

- There is no TIN for Social Security.

- You should combine all of the NR4's together.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

@JohnB5677 I went in to add SSA-1099 and it states:

Don't confuse the SSA-1099 with the 1099-R that reports retirement benefits from non-SSA sources like pensions, 401(k)s, and IRAs. 1099-Rs are entered elsewhere in TurboTax. As I mentioned in my original post the codes are 40 and 61. This is not retirement benefits.

40 is lump sum payment of pension benefits

61 is arm's length interest payment

These are both inheritance from my mother who passed in Canada. It was her pension that I inherited and the interest is on an insurance policy I received.

Can you please confirm as the SSA-1099 doesn't sound correct based on the info I read above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

Please see this Turbotax FAQ. It will confirm that the SSA-1099 is the right way to go.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

@BillM223 I just spoke to multiple "tax experts" after upgrading my account and they said it's SSA-1099 for code 39. I do not have code 39. They said for code 40 it's 1099-R and code 61 it's 1099INT.

I'm really concerned that I'm being given such different information depending on who answers. It makes it very difficult to trust that I'm going to do this correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

"39 - Superannuation or pension benefits – Periodic payments

40 - Superannuation or pension benefits – Lump-sum payments"

Since both of these are government "pension" payments, using form SSA-1099 is a closer fit than a 1099-R. Besides, there is a tax benefit from using the SSA-1099, because SS payments are never taxed at 100%.

The form with code 61 should be treated as if it were on a 1099-INT, since it is "61- Arm’s length interest payments". (See the "Canada says" link above).

You also asked about what exchange rate to use. The IRS generally says that whatever exchange rate you use, you have to be able to justify it. John's link above is a solid choice - it is the IRS's own listing of average exchange rates.

I will ask that the FAQ be updated to reflect the different answers based on the codes on the Canadian forms.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

Thank you @BillM223 so my next question, should I be getting money back? I thought that money was gone forever but when I plugged in those numbers (see below) I'm getting a over $20,000 of it back. I'm nervous. I've never paid someone to do my taxes but I think with these numbers I'm a little more nervous than usual.

| GROSS (CDN) | GROSS (USD) | TAX WITHHELD (CND) | TAX WITHHELD (USD) | |

| CO. 1 | $158,925.57 | $119,194.18 | $39,731.39 | $29,798.54 |

| CO. 2 | $6,222.29 | $4,666.72 | $1,555.57 | $1,166.68 |

| $123,860.90 | $30,965.22 |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

One of the other knowledgeable posters may return shortly with some specifics (and I need to refrain from commenting on actual foreign tax forms and systems, as that’s out of my area). But I can say that the SSA-1099 box 6 field you’re seeing in TurboTax is only for amounts that have been withheld and remitted specifically to the U.S. Treasury, and definitely not for amounts withheld by a foreign government for its own treasury.

Actual foreign withholding normally would be either refunded or not within the context of their system, with a possible “Foreign Tax Credit” here (as JohnB5677 wrote) for what the U.S. resident ends up paying there on double-taxed income, after the dust clears. (You may already be on top of this, calums_mom, but I thought I’d throw it out there just in case!)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

@RalphH1 thank you, there should be somewhere to put foreign tax paid and since each code on the back of an NR4 indicates something different there should be a way to specify this is inheritance not just foreign income which is also provided on the same form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

To follow up on Ralph's response, as he said, money withheld on NR-4 goes to Canada.

This requires filing in Canada to get a refund or claiming a tax credit on the US return for any amount that isn't refundable.

Options:

1. I don't know if you are filing a return in Canada, for yourself or for your late mother's estate. If so, apply these NR-4 forms and see if an adequate amount is refunded to you.

2. If not filing in Canada, file in Canada using the NR-7, Application for Refund Part XIII Tax Withheld. Note the instruction on page 2: "Non-Residents of Canada Applicant • The only person/entity entitled to the refund is typically the beneficial owner. A refund will only be issued in another name, if a qualifying situation arises (e.g., partnership, multiple beneficial owners, Canadian Securities Dealers etc.). One (1) NR7-R application per year, per income type, per beneficial owner, per Canadian payer or agent's non-resident tax account number is required."

3. Otherwise, on your US return, for any tax paid in Canada (less amounts refunded to you in options 1 and 2), you can claim the Foreign Tax Credit. This is because as a U.S. citizen, you have to report this income on your return in any case, and the Foreign Tax Credit can be used to "pay off" the tax due.

I realize that that doesn't answer your question about "Do I get any money back", but we do not have enough information about your situation to be able to say.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

So here's the story with this. If you are reporting the income as 1099 SSA, there is nowhere to report that this as inheritance income become SS benefits are benefits that are paid directly to you. If you wish to report the foreign income as inherited income, then you would repoort it as 1099R. When you type in Search 1099R, then jump to 1099R. When you get to the screen where they ask you to input your information, you would choose code 4- Death like this

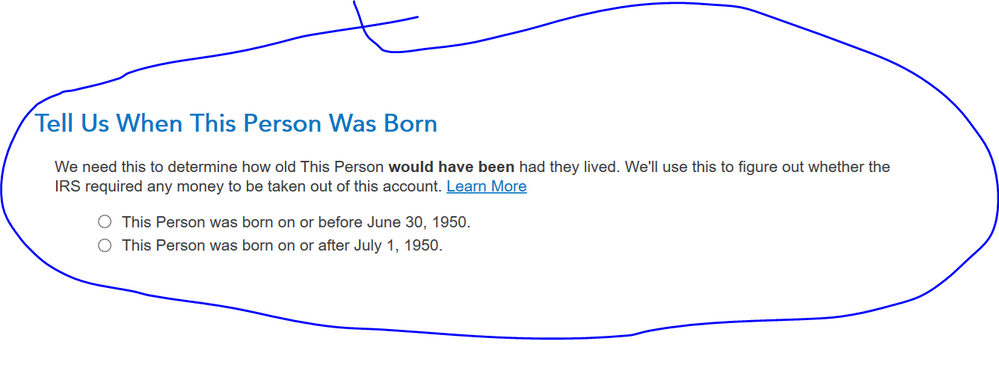

then continue to the screen till where it says Tell Us when this person was born like this

As far as entering the code 40 for the foreign tax withheld, see HERE

As far entering the code 61, simply enter as interest income under 1099INT

[Edited 01/31/22|4:15 pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

Thank you @BillM223 I will not be filing in Canada as this is the only tie I have to Canada. I have no reason to be filing there other than this inheritance. I don't really care if I get money back. I just want to do this right. I've been told way too many different ways to file this and multiple forms, one way I'm getting back 60% of what I paid to Canada and one way I'm owing $20,000 to the IRS. I've called a few CPAs locally and can't find anyone with experience with these NR4 forms and since ultimately I'm liable for this I'm not sure how to proceed. Even with Upgrading my turbotax they couldn't help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

@AbrahamT unfortunately only one of those images came though and the link doesn't work. Would you mind trying again? Thanks 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

There is a place in TurboTax to enter income from a Canadian pension.

To enter Canadian RRSP information, go to:

- Across the top, select tab Federal taxes / Wages & Income

- Scroll down to Retirement Plans and Social Security / Canadian Registered Pension Income, select Start

This creates a Canadian Registered Retirement Plans Worksheet. You will be able to indicate that you were the 'beneficiary' of the funds from the questions in TurboTax.

Basically, you want to report the income, but you also want to report the Canadian Tax paid (in the Foreign Tax section), so the US will not tax you again on that portion.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NR4 from Canada

@calums_mom Would you mind sharing what your resolution to this was? I am in the EXACT same boat, but for far less money.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jbar

Returning Member

yanashia642

New Member

user17705019283

New Member

user17701524502

Level 1

gz9gjg

Returning Member