- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

So here's the story with this. If you are reporting the income as 1099 SSA, there is nowhere to report that this as inheritance income become SS benefits are benefits that are paid directly to you. If you wish to report the foreign income as inherited income, then you would repoort it as 1099R. When you type in Search 1099R, then jump to 1099R. When you get to the screen where they ask you to input your information, you would choose code 4- Death like this

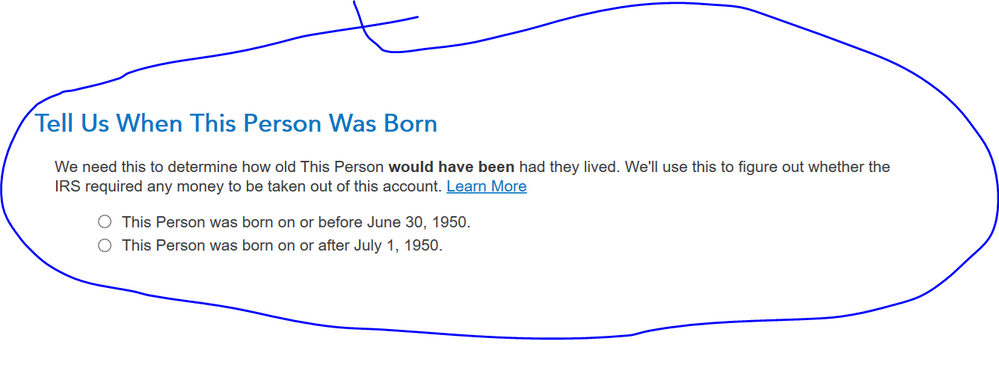

then continue to the screen till where it says Tell Us when this person was born like this

As far as entering the code 40 for the foreign tax withheld, see HERE

As far entering the code 61, simply enter as interest income under 1099INT

[Edited 01/31/22|4:15 pm PST]

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 31, 2023

1:25 PM