- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- My w2 includes deferred compensation which shows in box 11 as a non qualified plan distribution. does this count as earned income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My w2 includes deferred compensation which shows in box 11 as a non qualified plan distribution. does this count as earned income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My w2 includes deferred compensation which shows in box 11 as a non qualified plan distribution. does this count as earned income?

No. Deferred income is not earned income in the year it is deferred.

It will be earned income in the year it is received.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My w2 includes deferred compensation which shows in box 11 as a non qualified plan distribution. does this count as earned income?

Why is income from a nonqualified pension on a W-2 not considered "earned income" in the year you receive the non-qualified income on a W-2? For 2021 taxes turbotax told me it was earned income and as a result advised I should open a Roth for 2021. This year for 2022 Turbotax it is saying it is not "earned income" and I need to cancel the Roth I opened, because I have no earned income. That is a nightmare. What changed from 2021 turbo tax to 2022 turbo tax? In 2021 taxes it said it was earned income, now it is saying the same nonqualified pension distributions are not earned income, one year later for 2022. Help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My w2 includes deferred compensation which shows in box 11 as a non qualified plan distribution. does this count as earned income?

It's not a change in the TurboTax programming; rather, it's a situation in which amounts reflected in Box 11 of your Form W-2 can have a different characterization from one year to the next.

According to Box 11 in the Instructions for Employee on the back of Form W-2:

This amount is (a) reported in box 1 if it is a distribution made to you from a nonqualified deferred compensation or nongovernmental section 457(b) plan, or (b) included in box 3 and/or box 5 if it is a prior year deferral under a nonqualified or section 457(b) plan that became taxable for social security and Medicare taxes this year because there is no longer a substantial risk of forfeiture of your right to the deferred amount.

So, if a Box 11 amount was reported in Box 1 of Form W-2 one year, an amount can be included in Box 3 and/or 5 the next, characterized differently because "there is no longer a substantial risk of forfeiture of your right to the deferred amount."

Please see Box 11 -- Nonqualified plans in the General Instructions for Forms W-2 and W-3 for more information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My w2 includes deferred compensation which shows in box 11 as a non qualified plan distribution. does this count as earned income?

The W-2 in both years looks exactly the same.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My w2 includes deferred compensation which shows in box 11 as a non qualified plan distribution. does this count as earned income?

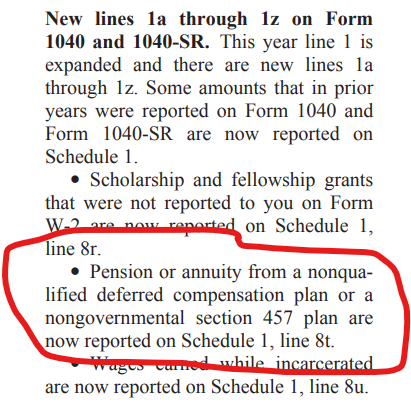

What changed is the way the IRS handles box 11 amounts. The instructions for form 1040 for 2022 page 6 (here) include a "What's new?" section. The deferred compensation for a pension/annuity (box 11 amount) now goes to a new line 8t on schedule 1 (see screenshot below).

That removes the amount from form 1040 line 1a which is part of earned income. According to Publication 596 (here) income that is not "Earned Income" includes "pension and annuity payments."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rj-markham1

New Member

Larryware

New Member

William Baldwin

Returning Member

elml331

New Member

aculyer

Level 1

in Education