- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

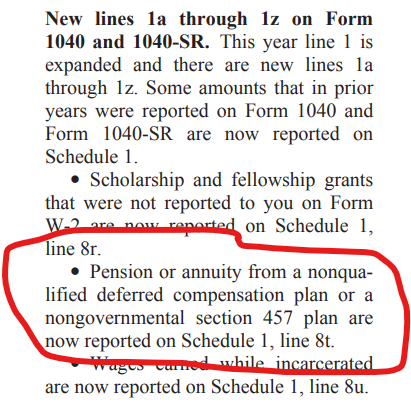

What changed is the way the IRS handles box 11 amounts. The instructions for form 1040 for 2022 page 6 (here) include a "What's new?" section. The deferred compensation for a pension/annuity (box 11 amount) now goes to a new line 8t on schedule 1 (see screenshot below).

That removes the amount from form 1040 line 1a which is part of earned income. According to Publication 596 (here) income that is not "Earned Income" includes "pension and annuity payments."

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 27, 2023

10:47 AM

9,998 Views