- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

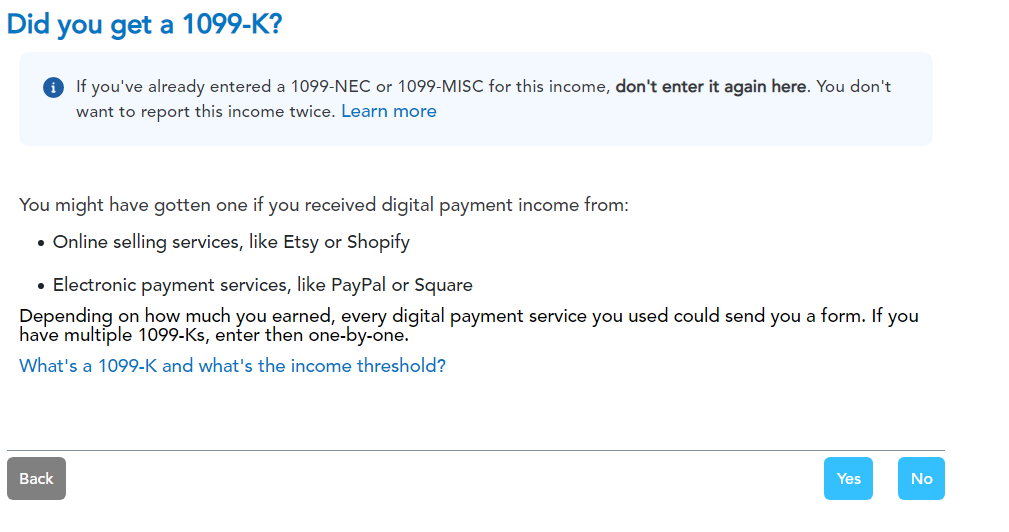

- My husband used square to receive payments for services he provided for his business. He is not sure how to report this income or where he would receive a 1099-k from.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband used square to receive payments for services he provided for his business. He is not sure how to report this income or where he would receive a 1099-k from.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband used square to receive payments for services he provided for his business. He is not sure how to report this income or where he would receive a 1099-k from.

Depending on how he tracks his income, he may not need to do anything with the 1099-K as it would create double reporting of the income.

Ex. He is a plumber and tracks all of his income and expenses using QuickBooks Self-Employed. He would report ALL of the income and expenses that he has made or spent throughout the year no matter the payment method. This income would include the income he received using Square, Cash and Checks. So he will just use the numbers from QuickBooks to report ALL income and not enter the 1099-K. If he would then enter the 1099-K, this part of his income would end up being double reported and he would end up paying more in taxes than he should.

As long as the 1099-K income is included, it is fine. He will just keep the 1099-K for his records.

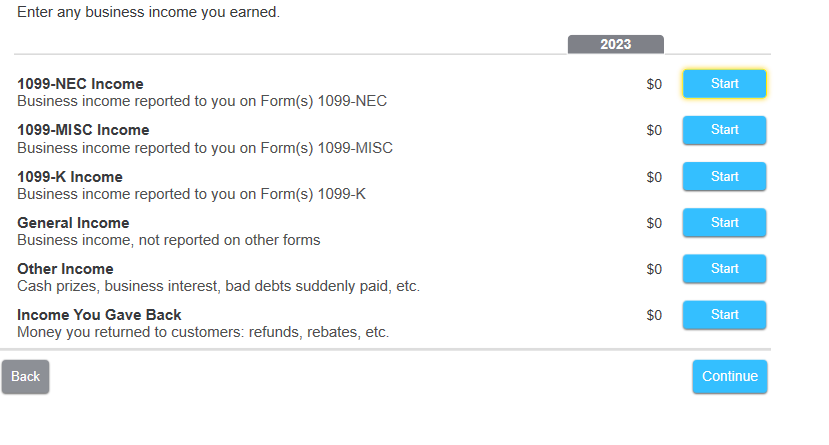

If he did track the income separately then he can report it in the business income section under income (This would not be common for most business owners)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kimbrz222

New Member

udo_san

New Member

pjenk1984

Level 1

swick

Returning Member

brad-gerstein

Level 1