- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Multiple Year State Tax Refunds Received in the Same Year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple Year State Tax Refunds Received in the Same Year

How do I report multiple previous year Maryland Tax Refunds in the same 2019 year if I have itemized for all years? Also, because it appears I only included only one of the state refunds when I originally submitted my 2019 returned and it's been processed by the IRS and MD, it seems I need to amend it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple Year State Tax Refunds Received in the Same Year

If you filed multiple years of state returns in one year, then received all of the refunds in 2019, then all of the refunds would be added together for your state refund. Go back into the program and change the amount of the one year to the total of all that were received in that tax year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple Year State Tax Refunds Received in the Same Year

If you filed multiple years of state returns in one year, then received all of the refunds in 2019, then all of the refunds would be added together for your state refund. Go back into the program and change the amount of the one year to the total of all that were received in that tax year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple Year State Tax Refunds Received in the Same Year

Hi Amy. I have a follow-up question on this topic. I filed amended state returns for prior years (2018-2020) in early 2022 and received refunds later that year. All three years we took the standard deduction which would have made the state tax refund non-taxable. Yet when I enter them individually (to correctly identify the tax years) they increase my tax liability. Is this correct? If not, is this a Turbotax error? What is my path forward? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple Year State Tax Refunds Received in the Same Year

If you took the Standard Deduction for those years you do not need to enter them at all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple Year State Tax Refunds Received in the Same Year

Hello,

My situation is similar, but for the 2019 amended return, which I should have included 3 state refund amounts. Do I have to attach a copy of the 1099-Gs that contain the two of three amounts that I failed to include on the original return? Also, in one of the other replies, it was mentioned that there is a Part III in the TT Amendment CD app to use to document what changed, but one was not in the 2019 PDF amended return (with 1040-X) that was produced. Then how would I indicate to the IRS what changed? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple Year State Tax Refunds Received in the Same Year

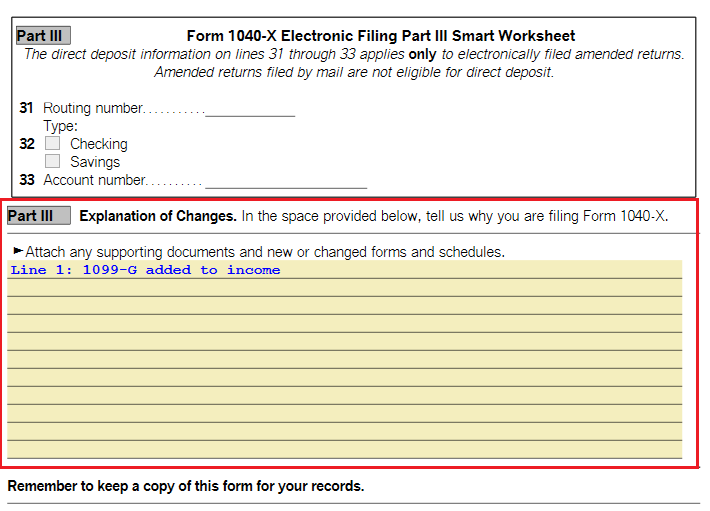

The amended return has a section on page 2 that allows an explanation of the changes. You can write it in if you are mailing your amended return or you can add a letter of explanation. The 1099-Gs do not need to be included unless there is federal withholding, but you can choose to include a copy if you wish when mailing the amended return.

If you are using TurboTax CD/Download Desktop version you can change to Forms (upper right) and select the 1040-X, then scroll to Part III to type your explanation if you want to e-file the return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple Year State Tax Refunds Received in the Same Year

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

margohigh30

New Member

dudai4

New Member

kamalmoezi

New Member

user17696156687

New Member

courtney.hansford

New Member