- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

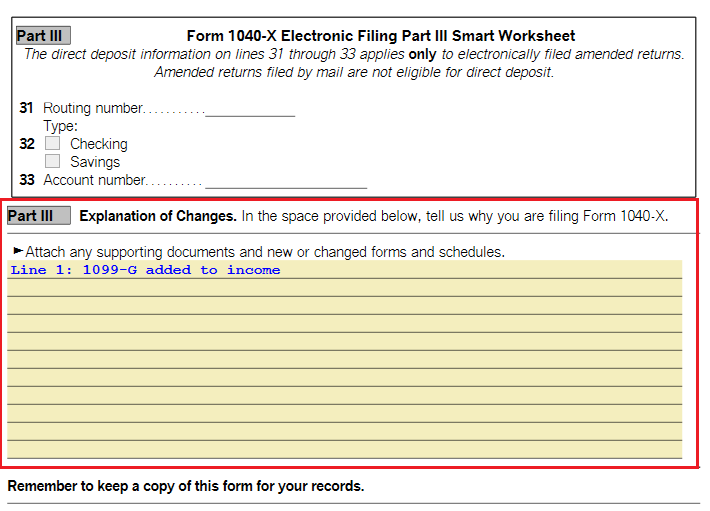

The amended return has a section on page 2 that allows an explanation of the changes. You can write it in if you are mailing your amended return or you can add a letter of explanation. The 1099-Gs do not need to be included unless there is federal withholding, but you can choose to include a copy if you wish when mailing the amended return.

If you are using TurboTax CD/Download Desktop version you can change to Forms (upper right) and select the 1040-X, then scroll to Part III to type your explanation if you want to e-file the return.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 27, 2023

6:33 AM