- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I don't know what code to enter in the Retirement Type Checkbox... "N", "B", or "R". On my 1099-R form, I have a 1 in Box 7, which is the only code I see.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't know what code to enter in the Retirement Type Checkbox... "N", "B", or "R". On my 1099-R form, I have a 1 in Box 7, which is the only code I see.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't know what code to enter in the Retirement Type Checkbox... "N", "B", or "R". On my 1099-R form, I have a 1 in Box 7, which is the only code I see.

When you enter your 1099-R select "1" for the box 7 entry. Enter Form 1099-R exactly as it shows on the Form.

- Login to your TurboTax Account

- Click on the Search box on the top and type “1099-R”

- Click on “Jump to 1099-R”

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't know what code to enter in the Retirement Type Checkbox... "N", "B", or "R". On my 1099-R form, I have a 1 in Box 7, which is the only code I see.

IF you see that as an error...then you didn't set it on a follow-up page after you entered your 1099-R form itself during the interview.

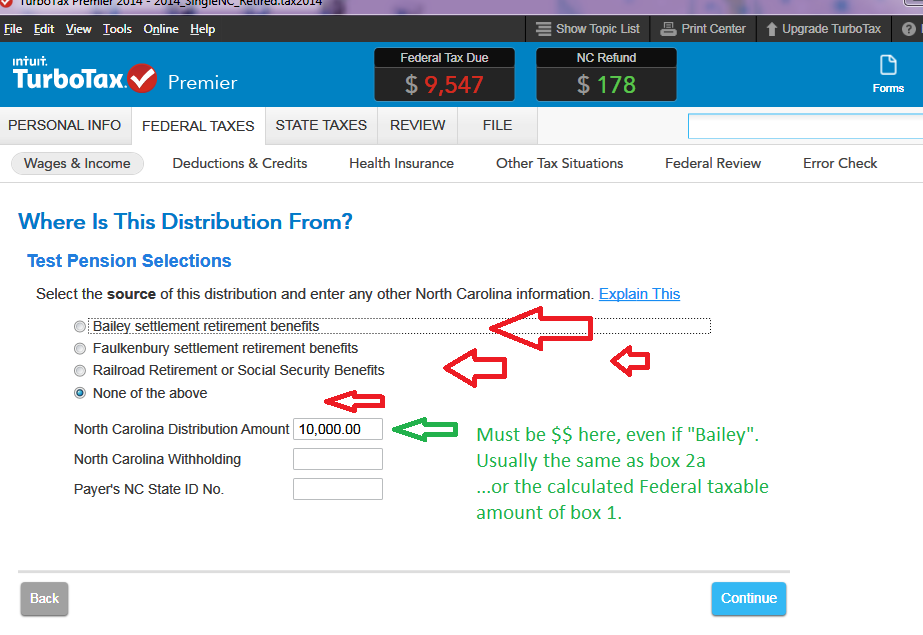

Go back to the actual 1099-R form in the Wages&Income section and edit that 1099-R....on one of the the pages AFTER the main form, you need to indicate what the source/type of the pension was....and make a selection (picture below) . Usually it is a "None" selection, unless is either a State employee pension, or Federal/Military pension which was 5-year vested before Aug 12 1989....then it can be marked as Bailey Settlement. (the other two, Faulkenbury and RailroadRoad are rarely used for a plain 1099-R form):

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17660820562

New Member

cwr64

New Member

cwr64

New Member

d-schinkel

New Member

techynld

New Member