- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

IF you see that as an error...then you didn't set it on a follow-up page after you entered your 1099-R form itself during the interview.

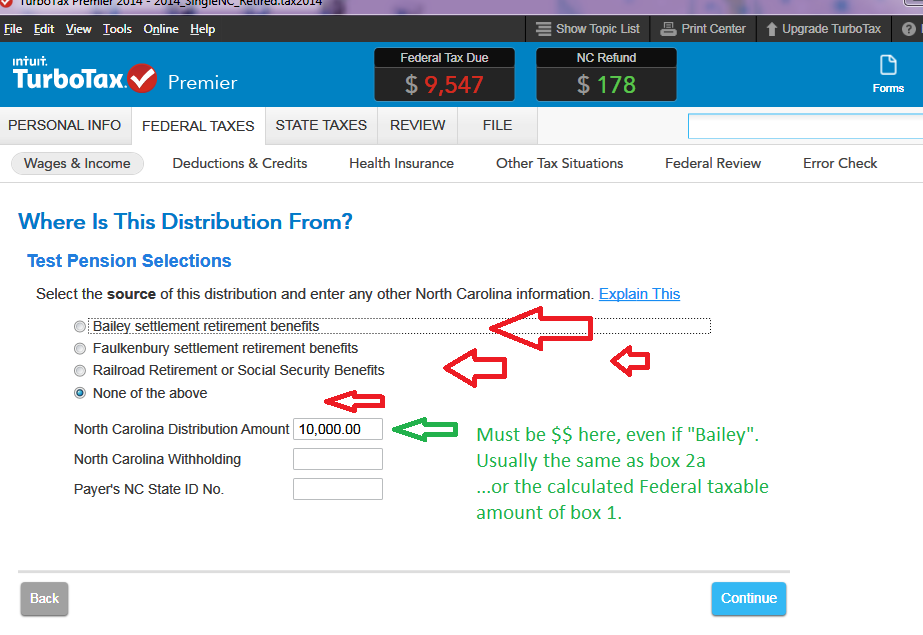

Go back to the actual 1099-R form in the Wages&Income section and edit that 1099-R....on one of the the pages AFTER the main form, you need to indicate what the source/type of the pension was....and make a selection (picture below) . Usually it is a "None" selection, unless is either a State employee pension, or Federal/Military pension which was 5-year vested before Aug 12 1989....then it can be marked as Bailey Settlement. (the other two, Faulkenbury and RailroadRoad are rarely used for a plain 1099-R form):

____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*

February 10, 2021

10:30 AM