- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I can't seem to find the EIN for Social Security Administration

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

What can we do to bypass putting in Social Security Administration EIN/TIN? It's not on the SSA-1099-SM.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

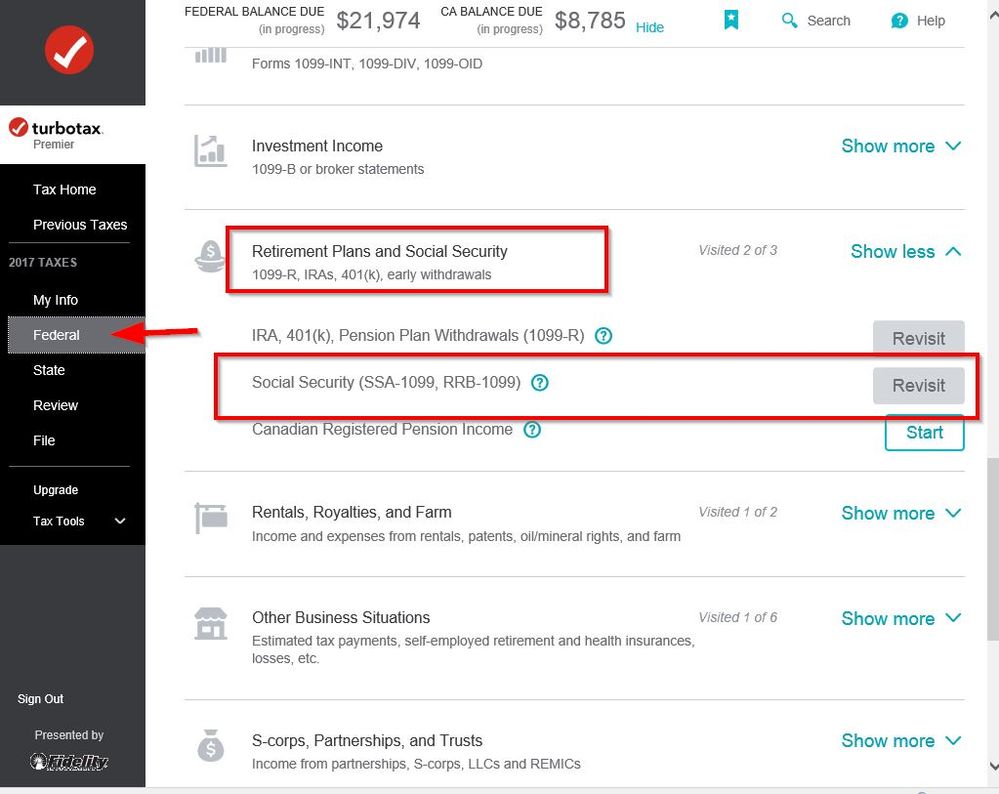

@kenyattabalewa31 You are on the wrong screen. Social Security goes somewhere else. Get out of this screen,

Enter a SSA-1099, SSA-1099-SM or RRB-1099 under

Federal Taxes on the left side or top

Wages and Income

Then scroll down to Retirement Plans and Social Security

Then the second line - Social Security (SSA-1099. RRB-1099) - click the Start or Revisit button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

[removed] belongs to the Payroll dept of SSA, I know cuz I log in my pay under that EIN

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

If you want SSA EIN , email me [email address removed], cuz they won't allow it to be posted here

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

@bobbilynnfagan Not sure what you are trying to do here. The users above were not employees of the Social Security Administration and did not receive W-2's from Social Security. They received benefits from Social Security which were reported on a document called a SSA1099. The users were trying to enter their SSA1099s in the wrong place in the software. A SSA1099 does NOT have an EIN---the fact that they were looking for an EIN is a huge clue that they were in the wrong place in the software to enter Social Security benefits they had received.

Users should NEVER post their phone number or e-mail addresses in this user forum. This is a public user forum which can be seen by anyone---including scammers and identity thieves who troll for unsuspecting users and want to contact them and pretend to be from TurboTax. The filter removes phone numbers and e-mail addresses for the protection of the users.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

This is not true. If you work for Social Security, you get a W2 like everyone else and they have an EIN

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

@wdlndgreasil What is not true? Yes if you work for Social Security you will get a W2 from them like any other job. But most of the people asking here are not Social Security employees but getting Social Security checks for disability or retirement. They don't get a W2 but a SSA-1099 to report their benefits.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

@wdlndgreasil And where in this thread did you see someone post that they actually WORKED for Social Security and received a W-2? The users who posted to this thread have been trying to figure out where to enter a SSA1099 because they received Social Security benefits. There is not an EIN on a SSA1099.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

Because you did not read the original post which says "I can't find an EIN For the SSA" and the "expert" from Intuit states because the SSA does not have one. This is not true. The SSA is also an employer, therefore they have an EIN. All federal agencies do. The answer should be "it depends - are you inquiring about a W2 or a 1099."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

The original post in this thread may be years old. When the user forum changed from Answer Xchange to Real Money Talk in 2019, a lot of old threads migrated over and they put 2019 dates on them even if they were lots older. So guess you can argue with a reply that might be five or six years old if you want to. Most of the users posting here are asking how to enter the document received for their SS benefits--which is a SSA1099.

We concede---if a person is an employee of the Social Security Administration they would receive a W-2 and the Social Security Administration has an EIN.

A person receiving Social Security benefits does not receive a W-2. We want to steer them away from entering it in the wrong place, so we make sure they know where to enter a SSA1099.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

I have been answering questions here for over 10 years. No one who works for SS and got a W2 has ever asked for the EIN. We automatically know if they are asking about a EIN for Social Security they are trying to enter a SSA-1099 in the the wrong place as a W2. It's a very common question here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

Then you need to re-word your answer because a blanket "the SSA doesn't have an EIN" is factually and literally not true. Making presumptions about what everyone is "generally" asking is misleading.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

I can’t find the payer’s Federal ID number for Social Security

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

@travelusa777 wrote:

I can’t find the payer’s Federal ID number for Social Security

There is no payer ID for Social Security benefits received. You are in the wrong section of the program to enter the SSA-1099. Social Security benefits are not entered in the W-2 section or the Form 1099-R section for retirement income.

To enter Social Security benefits reported on form SSA-1099

- Click on Federal Taxes (Personal using Home and Business)

- Click on Wages and Income (Personal Income using Home and Business)

- Click on I'll choose what I work on (if shown)

- Scroll down to Retirement Plans and Social Security

- On Social Security (SSA-1099, RRB-1099), click the start or update button

Or enter ssa-1099 in the Search box located in the upper right of the program screen. Click on Jump to ssa-1099

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

@travelusa777 Social Security SSA-1099 does not have a payers number or EIN.

If it's asking for an EIN number you are entering it in the wrong place. There is no EIN on social security SSA-1099.

If you only get ssi or SS or SSDI it is not taxable and you do not have to file a return.

Try going to the search box and type in SSA-1099 or Social Security Benefits. That will give you a Jump To link to take you directly to it.

OR

Enter a SSA-1099, SSA-1099-SM or RRB-1099 under

Federal Taxes on the left side or top

Wages and Income

Then scroll down to Retirement Plans and Social Security

Then the second line - Social Security (SSA-1099. RRB-1099) - click the Start or Revisit button

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dkd1ms

New Member

mayorcleve

New Member

johnnytthompson3

New Member

bobw75087

Level 2

DenverDad

Level 4