- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How should I report income generated from an early exercise of ISOs in 2021 that vested in 2022 that I have not sold in TurboTax for my 2022 Tax Filing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report income generated from an early exercise of ISOs in 2021 that vested in 2022 that I have not sold in TurboTax for my 2022 Tax Filing?

I received my ISO grant May 2021, exercised a few months later in July 2021 when the strike price and FMV were the same. I did not file 83(b) election. All of my exercised shares vested in April 2022 (FMV had risen at time of vesting). I have not sold and I am still with my company. How do I report this in TurboTax "Income & Wages" for my 2022 filing?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report income generated from an early exercise of ISOs in 2021 that vested in 2022 that I have not sold in TurboTax for my 2022 Tax Filing?

If you haven't sold yet then there is nothing to report for Tax year 2022.

An employee who exercises an ISO must report the bargain element of the transaction as earned income that is subject to withholding tax. ISO holders will report nothing at this point; no tax reporting of any kind is made until the stock is sold.

Taxation of ISOs

ISOs are eligible to receive more favorable tax treatment than any other type of employee stock purchase plan. This treatment is what sets these options apart from most other forms of share-based compensation. However, the employee must meet certain obligations in order to receive the tax benefit. There are two types of dispositions for ISOs:

- Qualifying Disposition: A sale of ISO stock made at least two years after the grant date and one year after the options were exercised. Both conditions must be met in order for the sale of stock to be classified in this manner.

- Disqualifying Disposition: A sale of ISO stock that does not meet the prescribed holding period requirements.

It is good to know now that employers are not required to withhold any tax from ISO exercises, so those who intend to make a disqualifying disposition should take care to set aside funds to pay for federal, state, and local taxes, as well as Social Security, Medicare, and FUTA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report income generated from an early exercise of ISOs in 2021 that vested in 2022 that I have not sold in TurboTax for my 2022 Tax Filing?

Hi @SantinoD ,

Thanks for replying. I do think however there is something to report this year because of this key reason: I did not file Section 83(b) for the early exercise in 2021. Therefor the spread between the FMV at the vesting date and my exercise price needs to be factored into my 2022 filing as part of the AMT calculation.

As a result, I do believe I need to report this in Turbotax in some fashion.

Thanks again for your help, let me know what you think. Cheers!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report income generated from an early exercise of ISOs in 2021 that vested in 2022 that I have not sold in TurboTax for my 2022 Tax Filing?

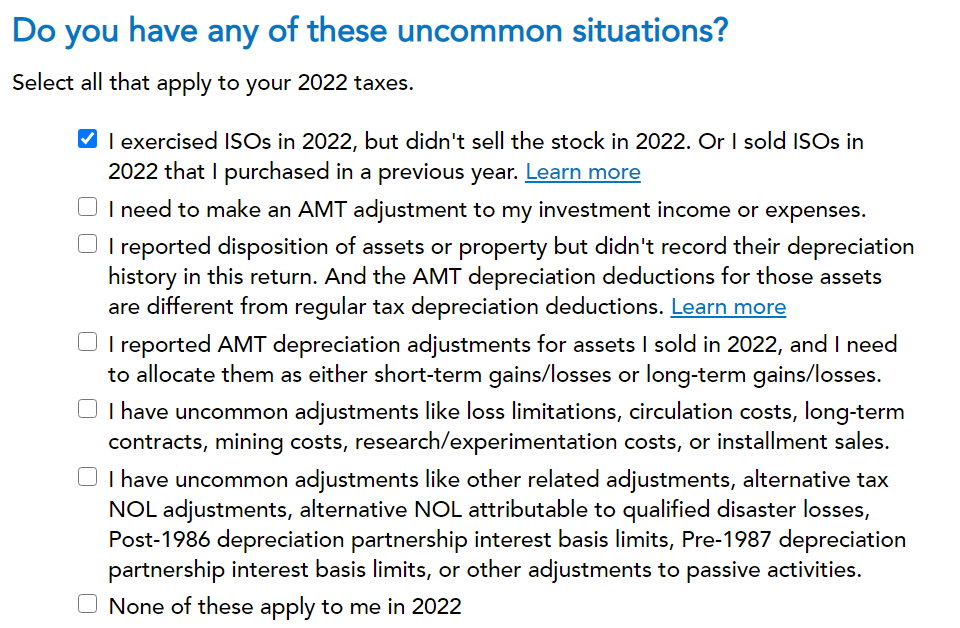

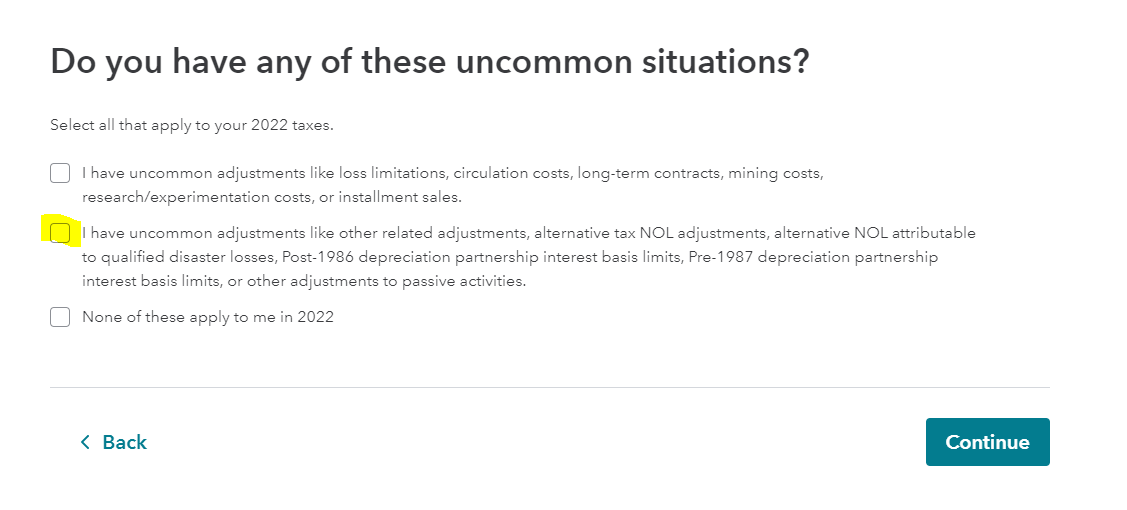

You are correct, you need to enter your ISO adjustment for AMT purposes in TurboTax. You do this in the Other Tax Situations section and then Alternative Minimum Tax. You will see a screen that says Do you have any of these uncommon situations? One of the options will reference that you exercised ISO's in 2022, but didn't sell the stock in 2022. You need to pick that option and you will be asked to enter your ISO adjustment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report income generated from an early exercise of ISOs in 2021 that vested in 2022 that I have not sold in TurboTax for my 2022 Tax Filing?

Thank you! Do I need to fill out "ISO Exercise and Hold" on Wages and Income as well?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report income generated from an early exercise of ISOs in 2021 that vested in 2022 that I have not sold in TurboTax for my 2022 Tax Filing?

Follow these steps

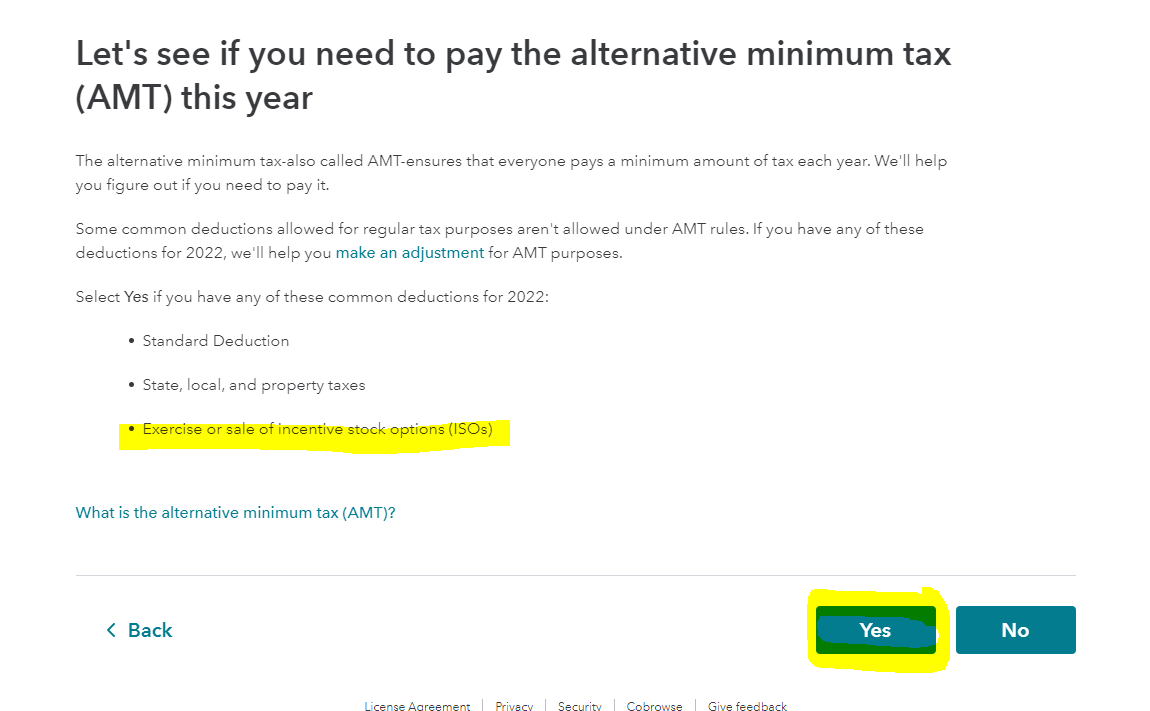

Other Tax situations/ then Exercise or sale of incentive stock options/ then

then next screen enter your ISO adjustment

then next screen Did you sell ISO's in 2022 that you purchased in a previous year, skip

After that, TT should automatically calculate your AMT adjustment.

There is nothing more to report because your bargain element was already picked up as income in 2021 and you are now only reporting the AMT element from the exercise price in July to the fmv at the time of vesting in April of 2022.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report income generated from an early exercise of ISOs in 2021 that vested in 2022 that I have not sold in TurboTax for my 2022 Tax Filing?

@AbrahamTthank you so much for your response and walkthrough. This makes sense and I will do this. I just want to confirm to be crystal clear: Is there anything to report on the "Wages and Income", "Less Common Investments and Savings" section? Or is it solely "Other Tax Situations" as described by your response?

Again just trying to be extremely sure, thanks so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report income generated from an early exercise of ISOs in 2021 that vested in 2022 that I have not sold in TurboTax for my 2022 Tax Filing?

Precisely, Only on "Other Tax Situations." Nothing on the "Wages and Income", "Less Common Investments and Savings" section"?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report income generated from an early exercise of ISOs in 2021 that vested in 2022 that I have not sold in TurboTax for my 2022 Tax Filing?

Thanks for confirming @AbrahamT . I appear to not have that option tho, here's what I can see:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report income generated from an early exercise of ISOs in 2021 that vested in 2022 that I have not sold in TurboTax for my 2022 Tax Filing?

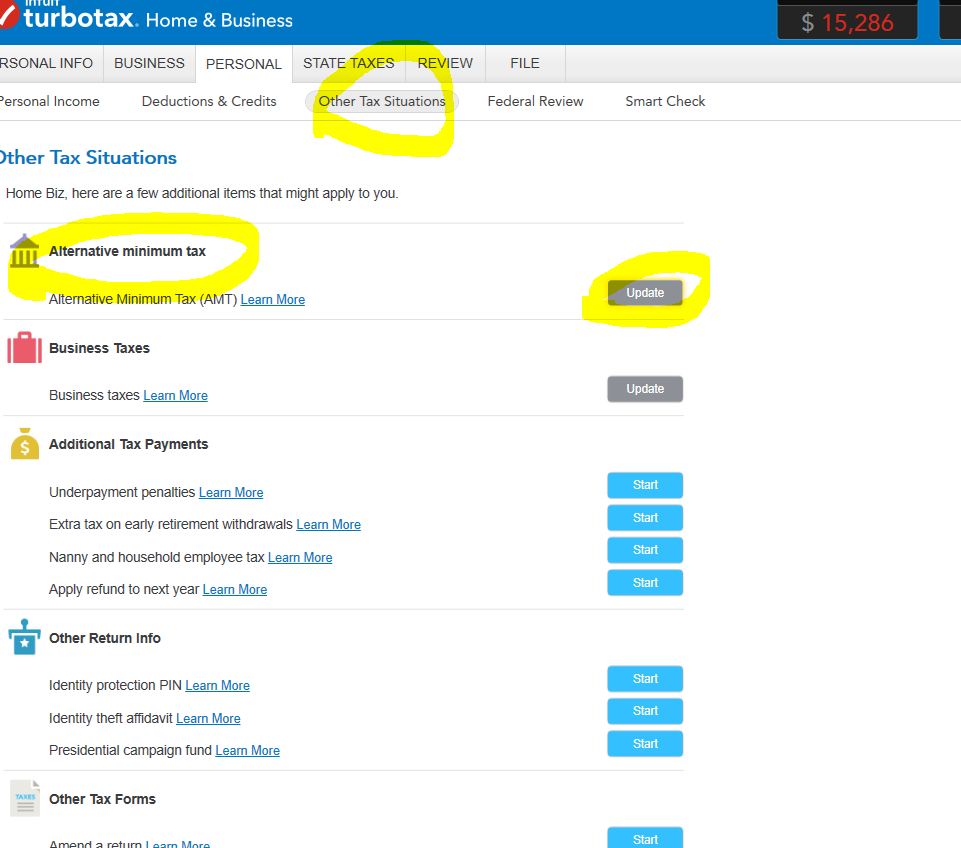

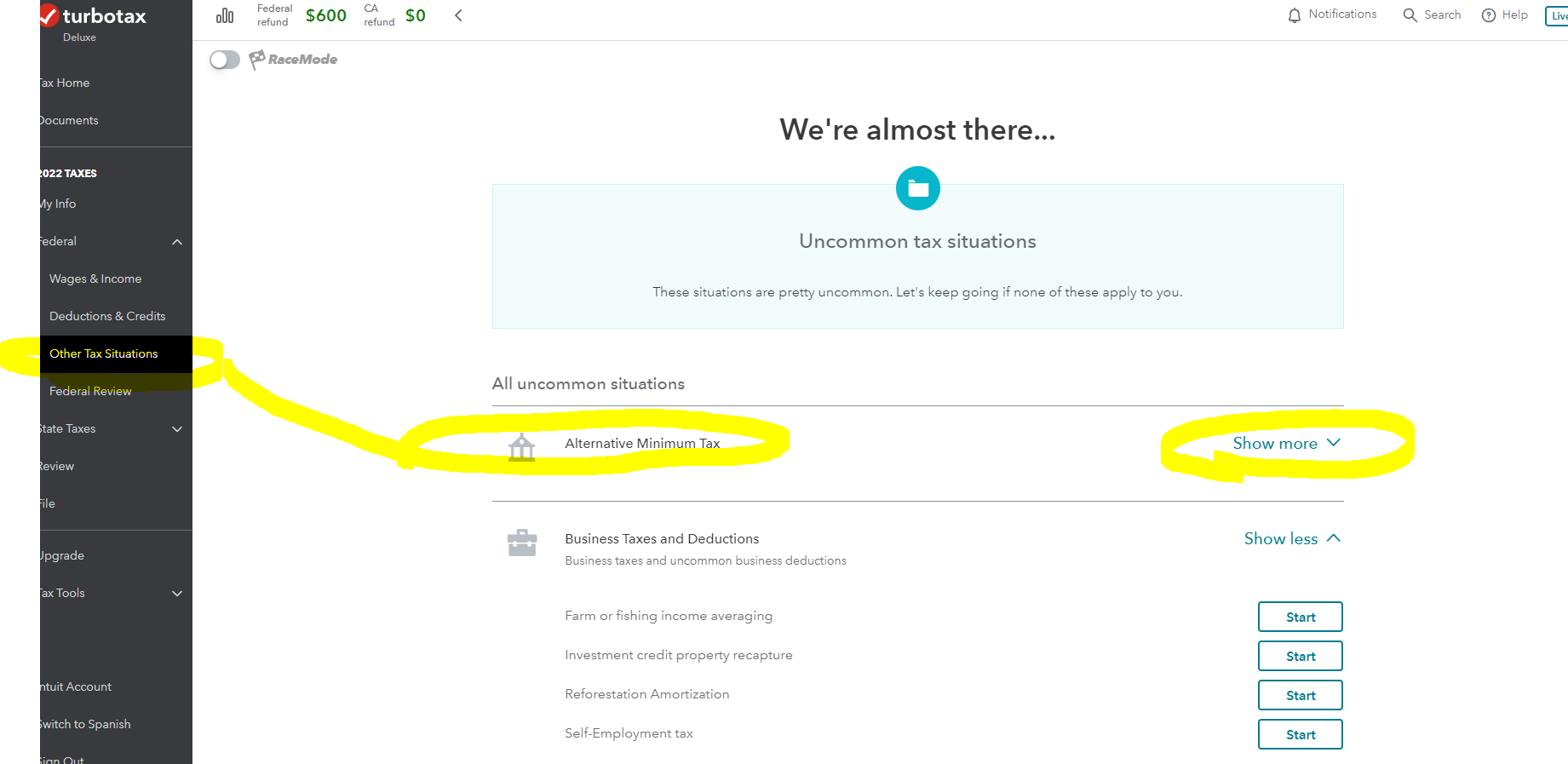

Go back to the home screen

Click OTHER TAX SITUATIONS

(for Desktop, that is a tab along the top)

(for Online it is listed on the left side-bar)

Answer yes on the first screen and the next screen has the option for exercised ISOs

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report income generated from an early exercise of ISOs in 2021 that vested in 2022 that I have not sold in TurboTax for my 2022 Tax Filing?

Thanks @KrisD15, that is what I've done in the screenshot above. There is not an option for exercised ISOs. My options are what are in the screenshot. I am using web, not desktop.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report income generated from an early exercise of ISOs in 2021 that vested in 2022 that I have not sold in TurboTax for my 2022 Tax Filing?

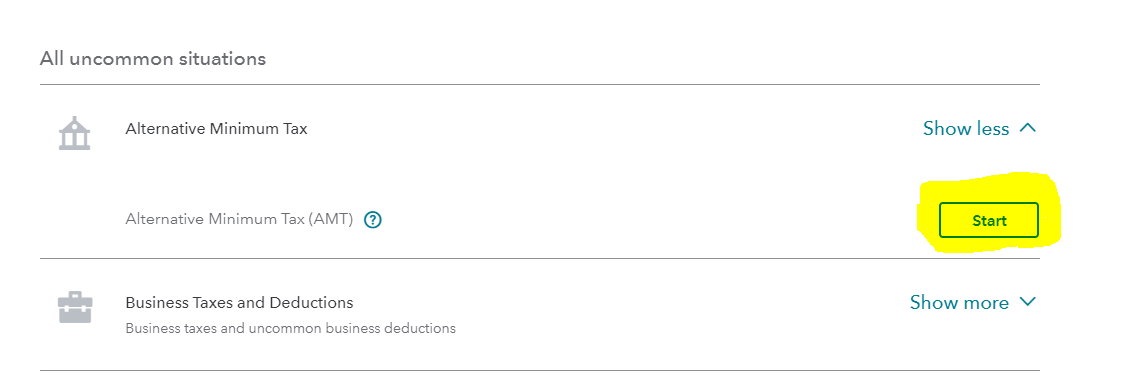

I did this on the web version for you. Follow these steps:

- Open your return

- Federal

- Other Tax Situations

- Alternative Minimum Tax, start

- Yes

- Select the middle option for uncommon situation

- Enter your adjustment

For future reference, the program will not let you add AMT carryover when you are paying AMT. You will need to keep track of AMT paid separately. I suggest a notebook (paper or digital). Keep it safe and each year, add your year-end statements from all your financial accounts plus a copy of your W2’s, your carryover information, and proof of your basis in your various investments.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MCSmith1974

Level 2

lukethe4th

Returning Member

rgreeneusa

New Member

gtchen66

Level 2

statusquo

Level 3