- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

I did this on the web version for you. Follow these steps:

- Open your return

- Federal

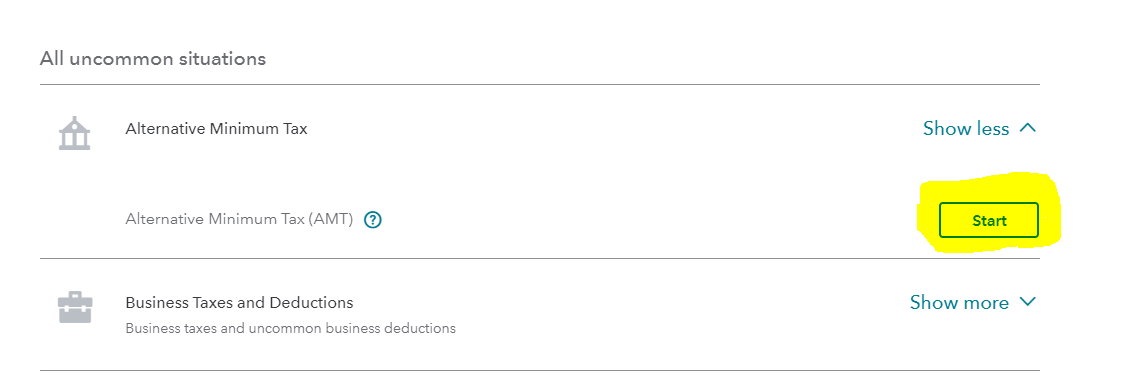

- Other Tax Situations

- Alternative Minimum Tax, start

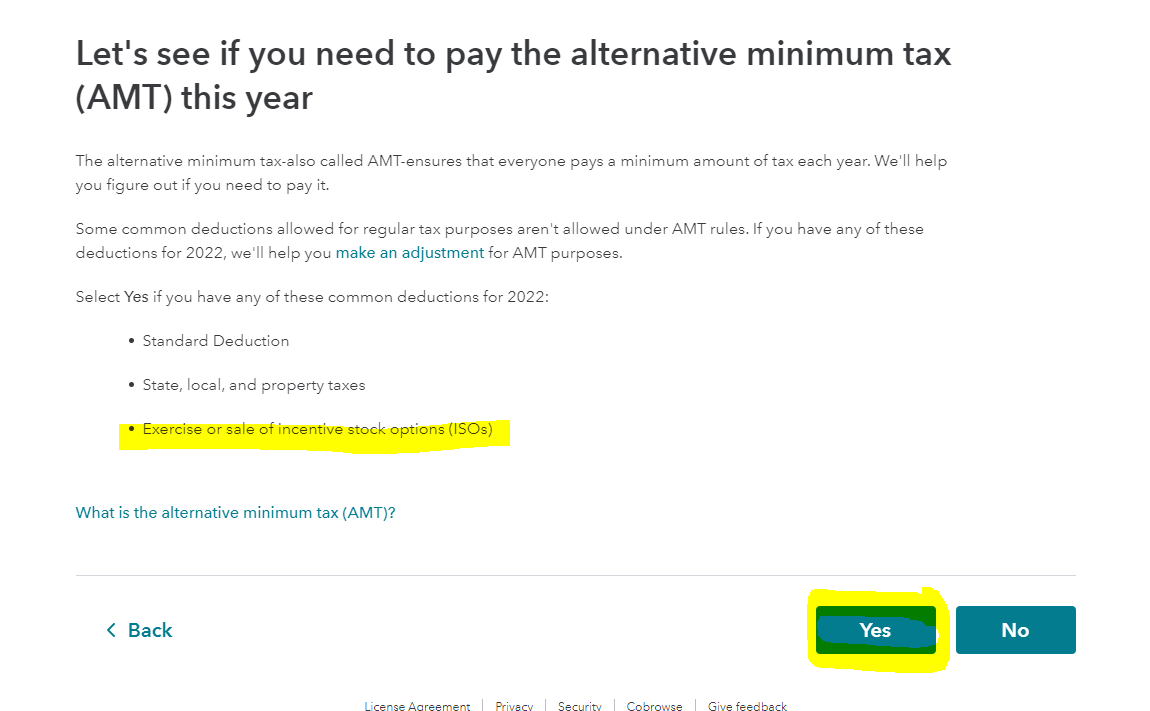

- Yes

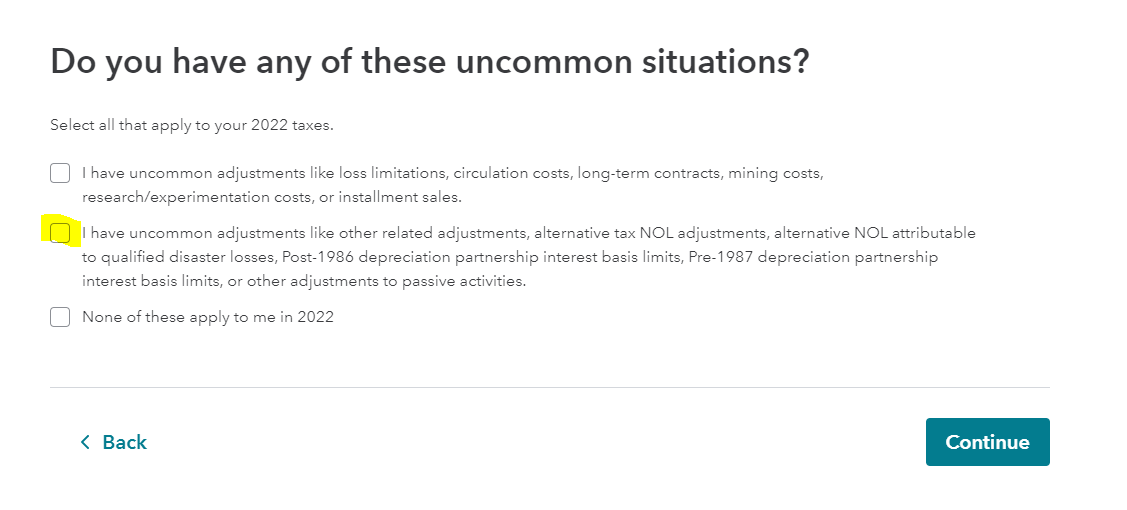

- Select the middle option for uncommon situation

- Enter your adjustment

For future reference, the program will not let you add AMT carryover when you are paying AMT. You will need to keep track of AMT paid separately. I suggest a notebook (paper or digital). Keep it safe and each year, add your year-end statements from all your financial accounts plus a copy of your W2’s, your carryover information, and proof of your basis in your various investments.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 28, 2023

9:53 AM