- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

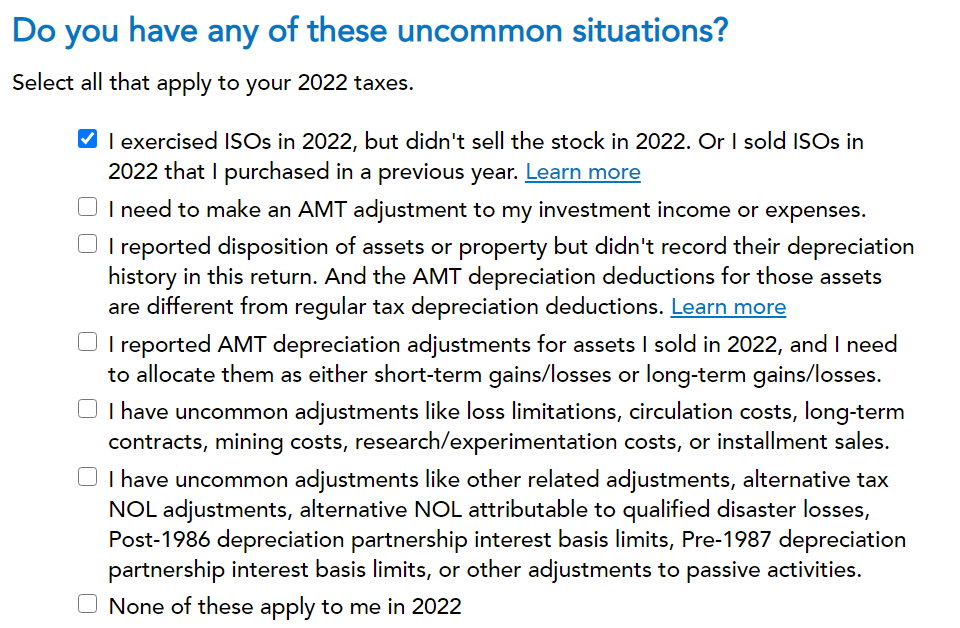

Follow these steps

Other Tax situations/ then Exercise or sale of incentive stock options/ then

then next screen enter your ISO adjustment

then next screen Did you sell ISO's in 2022 that you purchased in a previous year, skip

After that, TT should automatically calculate your AMT adjustment.

There is nothing more to report because your bargain element was already picked up as income in 2021 and you are now only reporting the AMT element from the exercise price in July to the fmv at the time of vesting in April of 2022.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 22, 2023

11:47 AM