- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

@dcreed1 @VolvoGirl @xmasbaby0 @DoninGA

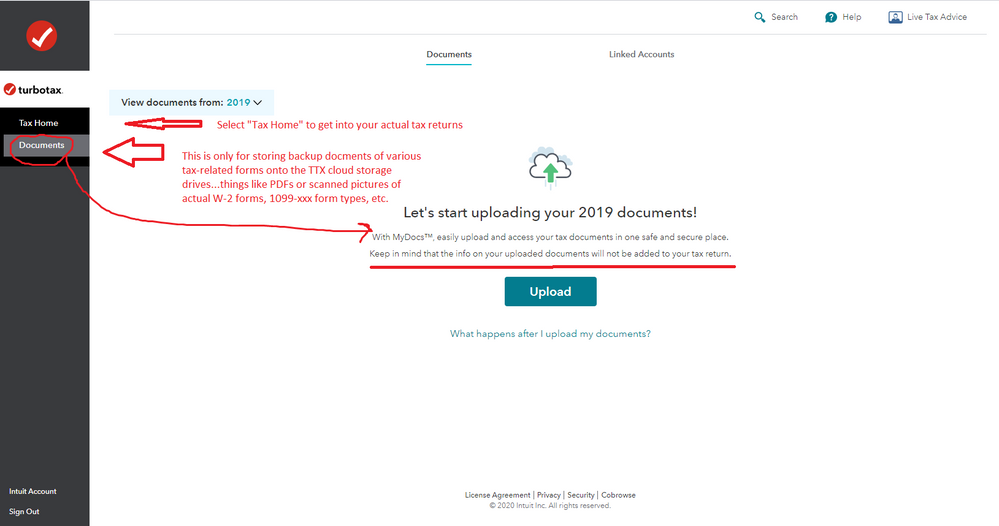

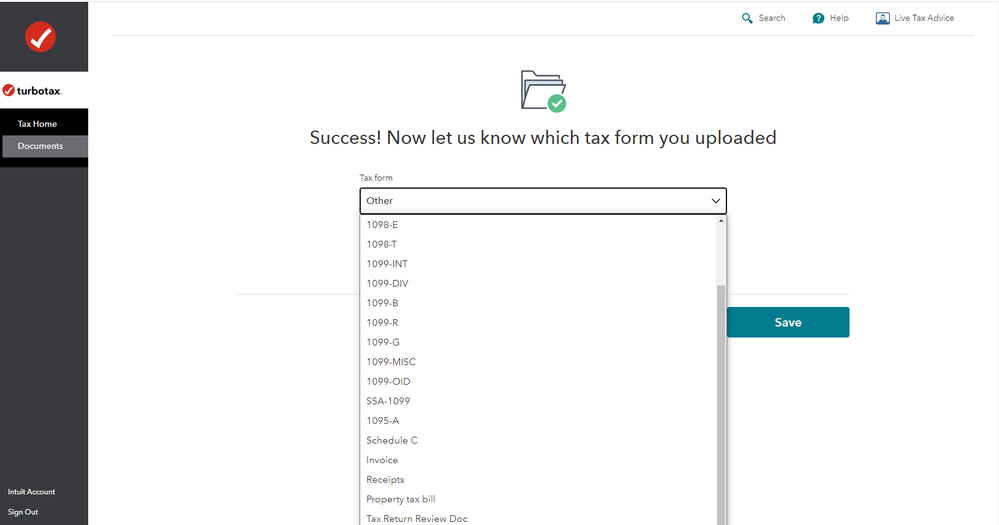

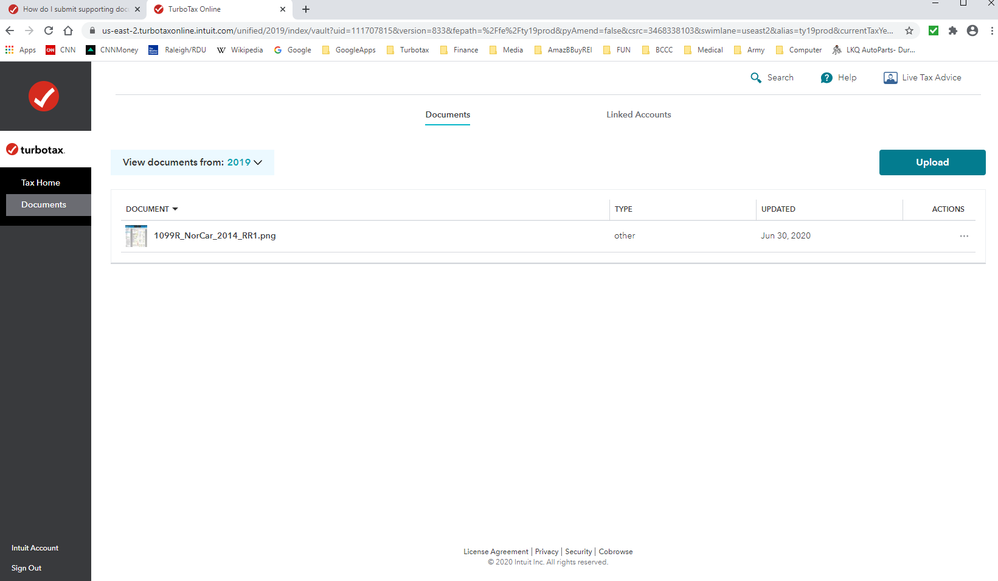

OK all, I thought that sounded, suspicious....What is being referred to here is the "Documents" section (MyDocs) of an Online account, not to an actual upload of data 'into" your actual tax return. (see pictures below)

TTX has made several somewhat aborted attempts to allow people to upload actual PDFs or scanned documents for W-2, 1099-R, 1099-INT, 1099-DIV, 1099-OID , tax bills, payment confirmations, charity lists...etc etc. into a separate "Documents" section of their Online account so that the user can put all their supporting documentation into the TTX servers...kind-of like a cloud drive storage. (personally, I don't trust storing any of that stuff online. Of course, I don't use the Online software except for test purposes anyhow)

Correct...this is not loading those forms into the tax software itself, these are only separate backup copies of your actual tax supporting documents.....and for the actual tax return, the user does have to make sure they use the real internal import process for those tax documents from within the tax software...or manually enter the data contained in them.

___________________________________________________

_______________________________________

______________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

Are you e-filing or filing by mail? If you e-file there is no need to mail anything--it is all electronic. If you are filing your tax return by mail, then you do need to attach paper copies of W-2's and 1099's that show tax withheld to your Form 1040 when you mail it to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

Hi,

Thanks for the response. I'm trying to efile and include the 1099-B and -R documents. But TurboTax seems not to offer a way to include those documents. The first screen at the "upload documents" routine says the uploaded documents won't be added to the tax return, but that's precisely what I want to happen: attach those documents to the tax return and send them to the IRS (or at least make them available to the IRS).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

@dcreed1 wrote:

Hi,

Thanks for the response. I'm trying to efile and include the 1099-B and -R documents. But TurboTax seems not to offer a way to include those documents. The first screen at the "upload documents" routine says the uploaded documents won't be added to the tax return, but that's precisely what I want to happen: attach those documents to the tax return and send them to the IRS (or at least make them available to the IRS).

As stated in the answer above -

When e-filing a tax return there is no need to mail or attach anything to the e-filed tax return. The tax information from the Form 1099-R and Form 1099-B is already included in the e-filed tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

OK, thanks. I've used TurboTax for 15 years or more, and this is the first time it's said I need to include the 1099-x forms. I'll take your advice and see what happens. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

Are we having a problem with the vocabulary that is being used here? When you refer to "uploading" -- are you talking about importing data by using your log in and password with a financial institution to import your 1099B and 1099R? If you IMPORTED the data from your financial institution into the tax software, that data will be used to calculate your tax return. TurboTax will not have actual images of your 1099's; it will only have the data that came from the bank, brokerage, etc. That information will be included when your tax return is e-filed. You do not have to mail those documents to the IRS if you file electronically (e-file).

Or....did you have trouble importing the data? Was your attempt to import financial data unsuccessful?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

Thanks -- maybe a semantic issue.

I had no problem getting the 1099-x files from the financial institutions. For most of them, the download to TurboTax was relatively seamless (there are a couple of financial institutions TurboTax doesn't recognize -- for those, I had the form and entered the data by hand). But for whatever reason, TurboTax flatly said I needed to upload the 1099-B statements and should upload the 1099-R statements if they showed tax withholding. I've got those statements and will upload if necessary ... and if TurboTax or one of you good folks can tell me how.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

Does Turbo Tax think you need to print and mail your 1040 return? You only need to include the 1099R and 1099B etc. if they show withholding on them (probably just on the 1099R) AND only if you are mailing your return.

If you efile you do not have to mail anything in. That is the benefit of efiling.

Sure would like to see a screen shot of that message or page saying you need to upload the 1099s. Or was that on an instruction sheet you printed out?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

It was instructions from the software, not anything I printed. I'd love to post a screen shot ... but then I'd need guidance on how to do that here. The irony is almost too much.

And I don't think TurboTax expects I'll print and mail the tax returns. It never has before.

Thanks for your response.

P.S. I was a Volvoboy from 1968 to 1990, and probably would still be driving it if I hadn't moved to New York City and gave up automobiles.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

@dcreed1 @VolvoGirl @xmasbaby0 @DoninGA

OK all, I thought that sounded, suspicious....What is being referred to here is the "Documents" section (MyDocs) of an Online account, not to an actual upload of data 'into" your actual tax return. (see pictures below)

TTX has made several somewhat aborted attempts to allow people to upload actual PDFs or scanned documents for W-2, 1099-R, 1099-INT, 1099-DIV, 1099-OID , tax bills, payment confirmations, charity lists...etc etc. into a separate "Documents" section of their Online account so that the user can put all their supporting documentation into the TTX servers...kind-of like a cloud drive storage. (personally, I don't trust storing any of that stuff online. Of course, I don't use the Online software except for test purposes anyhow)

Correct...this is not loading those forms into the tax software itself, these are only separate backup copies of your actual tax supporting documents.....and for the actual tax return, the user does have to make sure they use the real internal import process for those tax documents from within the tax software...or manually enter the data contained in them.

___________________________________________________

_______________________________________

______________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

@SteamTrain You are awesome--as always. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

Thanks Steam Train, et al,

This makes perfect sense (which is sorta scary, since few things do make sense these days). This is my first time using the on-line version -- not sure how i ended up with that and won't use it again.

Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

How do I submit supporting documents

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

@jangrochala Please explain what you are trying to do. Supporting documents for what exactly?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I submit supporting documents? TurboTax says I need to submit 1099-Bs, and 1099-Rs showing taxes withheld. Must I file the taxes as hard copies via USPS?

and to whom: The IRS? State? A Turbotax tax preparer?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

turbotax2025user

New Member

larrycs0731

Returning Member

taxhard47

Level 3

user17675539749

New Member

danele-n-carter

New Member