- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

You won't find the penalty exception for the first year a child was born or adopted in your 2019 tax return options.

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, enacted Dec. 20 is effective for IRA distributions after 2019. So, that exception to the 10% early withdrawal penalty will be available on your 2020 tax return, for withdrawals made on or after January 1, 2020.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

That's what I was expecting yet that option wasn't available when I was just in turbotax trying to file my 2020 return. There is no exemption in the list related to child birth when I entered my 1099-R info.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

To enter the exception for the penalty, follow these steps:

- Several questions after entering your 1099-R, you will get a screen that says: Let's see if we can reduce your early withdrawal penalty

- Select Continue

- Enter $5,000 in the area for Another reason, select Continue

- The next screen should remove the penalty.

For the Qualified Birth or Adoption Distributions, the IRS requires you to attach a statement that provides the name, age, and tax id number of the child or eligible adoptee. Because of this requirement, you will need to paper file your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

Wow ok. Thanks for the info. I did end up entering the amount that way I just wasn't sure about submitting it like that since there was no info about that exemption listed in TT.

Do you know what format the statement would need to be in? Does it have to be something from the state? Birth Cert? We have a verification of Birth from that was issued by the hospital but it doesn't have the SSN on it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

There is no required format for the statement, as long as it contains the required information (Name, Age (as of 12/31/20), and Tax ID number). List this information on a separate page with title "Qualified Birth Exception".

You can use (but don't need) a birth certificate or hospital verification of birth, but you will have to submit an Application for Social Security Card.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

just because of this Qualified Birth or Adoption Distributions statement now i have to paper file it. not fun

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

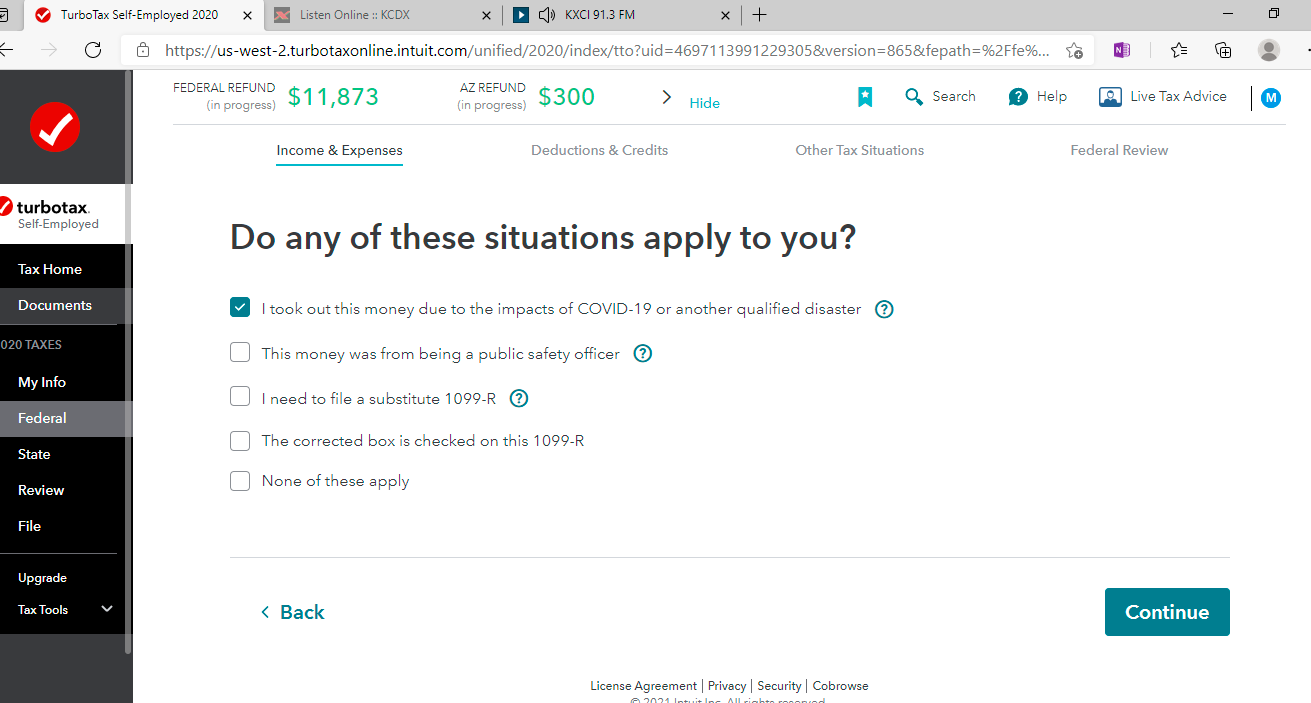

@july007A When you enter your 1099-R, if you indicate it was 'covid-related' (financial hardship), you will not be subject to any penalty and will be able to Efile (screenshot).

You may want to delete your 1099-R and re-enter it to make this election.

Click this link for more info How to Enter 1099-R.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

I am not sure if I fall under any of these

You are a qualified individual if –

- You are diagnosed with the virus SARS-CoV-2 or with coronavirus disease 2019 (COVID-19) by a test approved by the Centers for Disease Control and Prevention;

- Your spouse or dependent is diagnosed with SARS-CoV-2 or with COVID-19 by a test approved by the Centers for Disease Control and Prevention;

- You experience adverse financial consequences as a result of being quarantined, being furloughed or laid off, or having work hours reduced due to SARS-CoV-2 or COVID-19;

- You experience adverse financial consequences as a result of being unable to work due to lack of child care due to SARS-CoV-2 or COVID-19; or

- You experience adverse financial consequences as a result of closing or reducing hours of a business that you own or operate due to SARS-CoV-2 or COVID-19.

Under section 2202 of the CARES Act, the Treasury Department and the IRS may issue guidance that expands the list of factors taken into account to determine whether an individual is a qualified individual as a result of experiencing adverse financial consequences. The Treasury Department and the IRS have received and are reviewing comments from the public requesting that the list of factors be expanded.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

This is something you will have to decide based on your individual situation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

Hi,

I'm trying to file my 2021 taxes and I don't see any options described above to enter the exception. We had twins last year (in 2021) and so withdrew $10,000. We've added them onto our taxes (married, filed jointly) with ssn's, but after I enter the 1099R (it got imported) there's just a note that says "we'll check for exceptions later" but then it never happens. I'm using TT deluxe online. I went ahead an paid and can see the $1000 penalty is being added.

Also, please don't tell me we have to paper file because of this...

P.S. It appears that my financial institution entered a distribution code of 1 on the 1099R, but it looks like it maybe should be 2 because exceptions apply...so do we need to try to get them to fix it? If I just change it to 2 then the penalty does get removed, but...seems kind of dodgy to just do that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

There is not an area in TurboTax to indicate an exception for the 10% penalty if Box 7 is coded with a (1). You are correct, by entering a (2) in Box 7 it will eliminate the 10% penalty.

There is no way to make this correction yourself. You must contact the issuing entity to get it changed,

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

I reached out to Vanguard and they said they couldn't make the change and that with TT I should be able to attach a form 5329 showing I qualify for the exemption. Not sure how to do that or if like you say it's even possible.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

You can claim a Penalty Exception for an IRA withdrawal for Unreimbursed Medical Expenses.

Click this link for more info on IRA Early Withdrawal Penalty Exceptions.

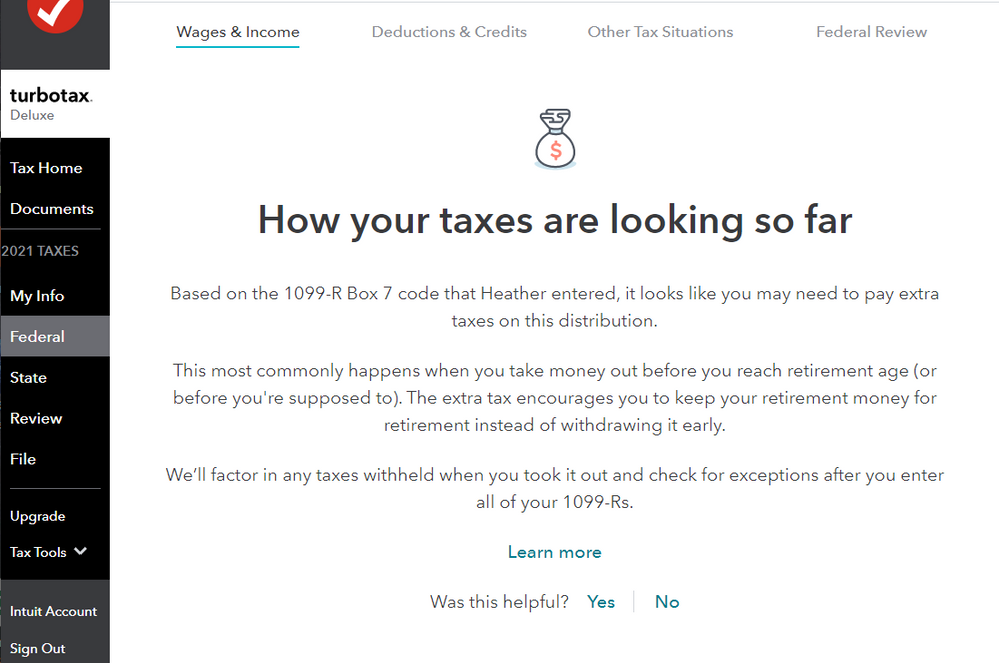

In TurboTax Online, after you enter your 1099-R (with a Code 1 in Box 7), you will come to a screen titled 'Let's see if we can reduce your early withdrawal penalty'.

The next screen is 'These Situations May Lower Your Tax Bill' (screenshot).

Enter your Medical Expenses (equal to or greater than the amount of your withdrawal), whether you itemize or not on your return.

This will create Form 5329 for you. Save your medical bills in case you are asked for documentation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the penalty on an ira withdrawal to credit for for the year a child was born (secure act)

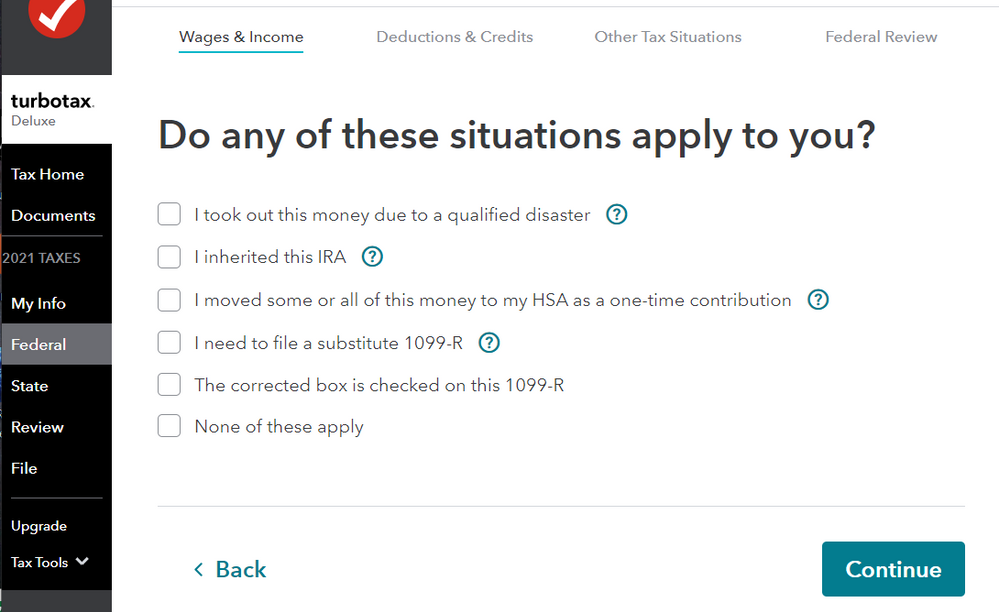

That screen doesn't appear for me. As soon I finish the screen that has the 1099R info on it I get these two screens:

The medical part doesn't look like it's the right method anyway since this isn't a medical cost exemption. It's simply the fact we had twins and qualify for the exemption. In spite of it saying it'll check for exemptions, it never asks or gives me the opportunity to enter it. I've called Vanguard twice and got the same answer both times. They say they can't fix it and I'm supposed to add a form 5329 to my taxes to get it waved.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jjon12346

New Member

STAN30

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

anonymouse1

Level 5

in Education

douglasjia

Level 3

johntheretiree

Level 2