- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Can I use turbo tax deluxe to file form 1099 s?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

No - If you are using the online version of TurboTax, you will need Premier to enter the information from for 1099-S. It is considered the sale of an investment.

If you are using the CD/Download version of TurboTax, you can report the 1099-S using the Deluxe version.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

No - If you are using the online version of TurboTax, you will need Premier to enter the information from for 1099-S. It is considered the sale of an investment.

If you are using the CD/Download version of TurboTax, you can report the 1099-S using the Deluxe version.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

I'm using the CD deluxe version. The Investment Income section (where is said to enter second homes etc.) mentions 1009-S, but the process proceeds as if a stock sale. I'm never prompted to enter details from the 1099-S. I entered it as "other" sales, but this does not seem right. How do I enter 1099-S info for sale of non-primary resident real estate, in this case a time share? As is, its treating it as a capital loss, which I'm not sure can be claimed on second homes, etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

I am having the same issue, it won't let me through the 1099-B section to get to the 1099-S section. I need to enter proceeds from the sale of vacant land but an unable to access the 1099-S.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

There is not a specific entry screen for the 1099-S. The sale of land is considered the sale of an investment.

You can report the sale in TurboTax using these steps:

- Click on Federal Taxes > Wages & Income

- In the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other.

- [If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.]

- Answer Yes on the Did you sell any investments in 2020? screen.

- Answer No on the “Did you get a 1099-B or a brokerage statement for these sales?” screen.

- The next screen is “Tell us about this sale”. Mark the radio button next to I’ll enter one sale at a time

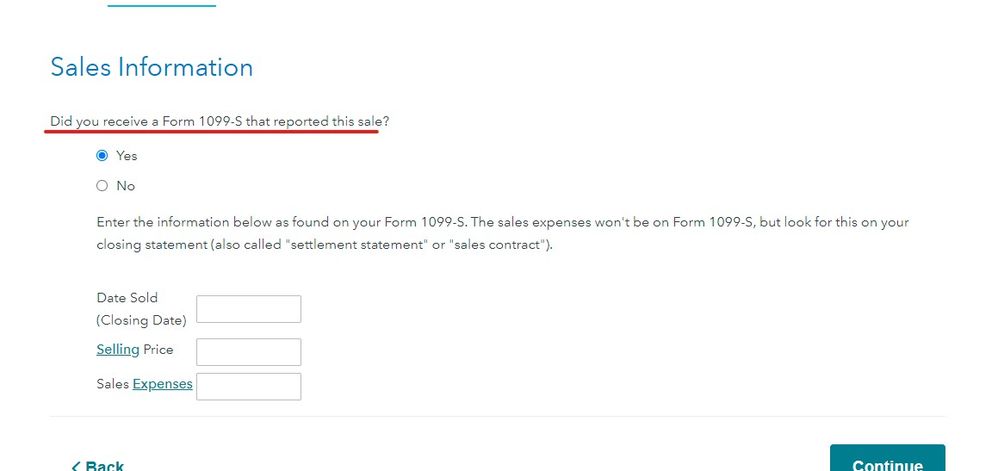

- On the screen, Tell us about this sale, enter the total sales proceeds as well as the other information requested. [See Screenshot #1, below.]

- Continue to the screen, Select any less common adjustments that apply. (In TurboTax Online: Let us know if any of these situations apply to this sale)

- Mark the first box The reported sales price did not deduct all fees or selling expenses. [Screenshot #2]

- Enter the sales expenses not deducted from the sales price entered earlier.

Screenshot #1

Screenshot #2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

Thanks, this is the process I stumbled through, so thanks for the confirmation. In addition, since this was a sale of personal use property, I checked the appropriate box to preclude the generation of usable loss carryover.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

I have the downloaded version of Deluxe and cannot report a 1099-S form, sale of second (vacation) home. I was told to upgrade to Premier. That didn't help. Spoke with 2 representatives, problem not resolved. I am still trying, but believe there is a software problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

Here is how to enter a 1099-S for the sale of a vacation home in TurboTax Deluxe Desktop:

- Select the Federal tab toward the upper left corner.

- Select Wages and Income.

- Click I'll choose what I work on, on the right.

- Scroll down to Investment Income.

- Expand if needed and select Stocks, Mutual Funds, Bonds, Other.

- Click Add account.

- On the screen titled, Did you get a 1099-B for these sales? select No.

- On the next screen select, I'll enter one sale at a time.

- For description enter Vacation Home.

- For Date sold and Sales proceeds, enter the information form your 1099-S.

- For Date acquired enter the date you bought the home.

- For Cost basis, enter the amount you paid for the property plus any major improvements and the closing costs that you paid on both the sale and the purchase.

- Click Continue.

- On the screen titled, Any of these less common items for this sale? you shouldn't need to enter anything unless income tax was withheld from your real estate transaction.

- Click Done.

- On the next screen select, Any loss from this sale is not deductible for reasons other than wash sale.

- Select This is a personal use property.

- Click Continue.

- Select No, if you don't have any other sales.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

I use the CD version of Turbo Tax Deluxe version for the year 2021. I see the Sale of Your Home under the Less Common Income. But when I go there, it is not available for me to enter the Form 1099-S. Should I upgrade to the Premier version in order to see it? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

There is no spot to directly enter the information that is on the 1099-S. The information on the 1099-S is used to enter the Sale of Your Home along with other information about the purchase of your home that you have from the initial purchase on the settlement sheets.

In the Sale of Your Home that you mentioned in your question, answer the questions for the sale:

Date Sold: Date from 1099-S

Sales Proceeds: Amount from 1099-S

Date Acquired: From your records for the purchase of the home

Cost Basis: Amount paid for the property

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

I paid $30 to upgrade to the Premier version of Turbo. Then I saw the Sale of Your Home option available. I sold (transferred) my house to my son in last August. That's why I need to provide the 1099-S info. This option is definitely unavailable in the Deluxe version. Thanks for your reply.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

If you have a 1099-S this is the only place you will indicate it ... failure tp do so will get you an IRS CP2000 notice in a couple of years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

I cannot determine what page of the program in TurboTax you are on. ??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

Where do I indicate that not all the proceeds reported in 1099-S belong to me in Turbo Tax Deluxe? My siblings and I co-owned a property and the 1099-S is under my SSN. I need to be able to declare just my income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use turbo tax deluxe to file form 1099 s?

I think you will first have to pay $30 to get the upgrade of the Turbo Tax Deluxe version to the Premier version in order to report the proceeds in the 1099-S for the Sale of Your Home under the Less Common Income section. This option is not available in the Deluxe version.

Before you jump into the upgrade, I would suggest you break out the 1009-S into different owners of your property. You should ask the same attorney who issued the 1099-S for you. If your house was co-owned by 3 peoples, then you would need 3 separate 1099-S for each individual. I think this is the law.

I have recently sold my house. It was co-owned by my wife. Upon the closing, my attorney gave us 2 separate 1099-S.

Good luck!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

robbieashmore77

New Member

u0d4n7a0p

Level 3

fruben

New Member

jacksonhdj

New Member

ghideok

New Member