- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- !099R lumps Roth conversion and RMD withdrawal in Box 1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

I made an RMD withdawal and a Roth conversion from the same account in 2020. Before August I restored the entire RMD withdrawal to the IRA account as permitted by 2020 rules.

Box 1 of my 1099R is a lump sum of the RMD withdrawal and the Roth conversion. I don't see how to use TurboTax to recognize the payback of the RMD and recognize the Roth conversion.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

Yes you must split it into two 1099-Rs. TurboTax cannot handle two different destinations on one 1099-R.

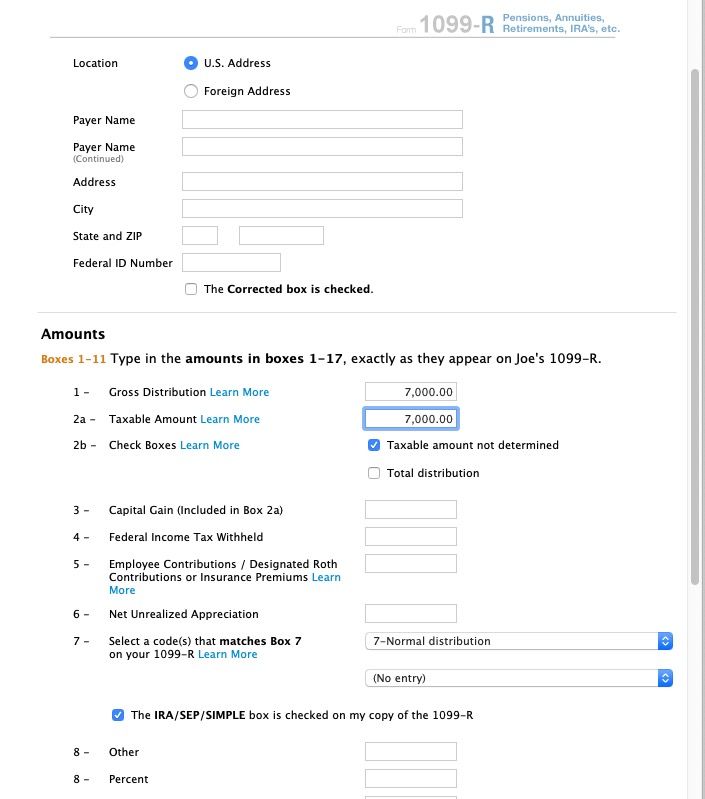

Enter them both exactally the same as the original except for the box 1, and 2a amounts.

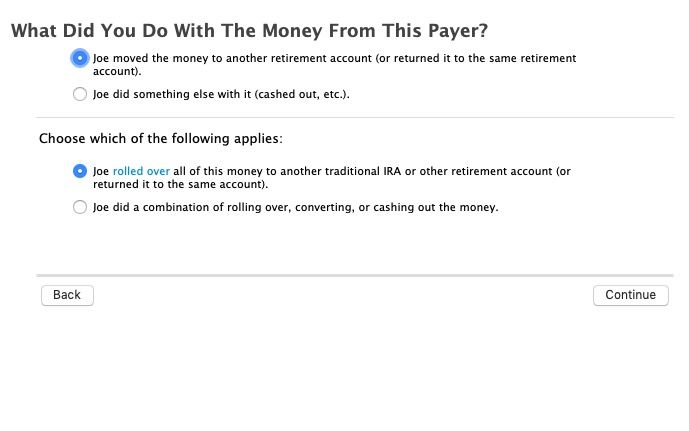

For the rollover enter the amount in box 1 & 2a, then on the what you did with the money say you rolled all over,

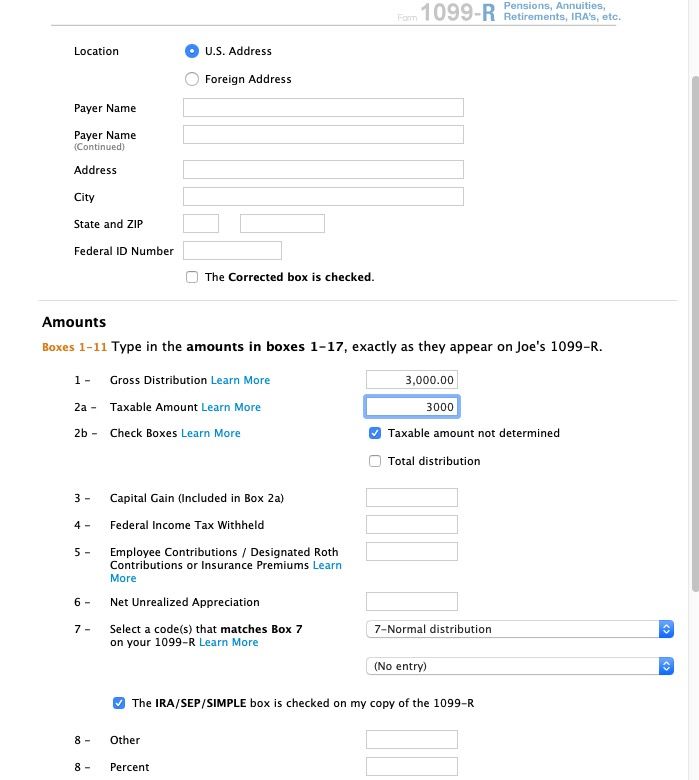

For the conversion again enter the amounts in box 1 & 2a and say that you converted it all to a Roth IRA.

The 1040 line 4 should have the total for both box 1 amounts on line 1a and the amount of the conversion (taxable amount) on line 4b. That should match the original 1099-R.

If you had any tax withheld in box 4 on the original 1099-R, box 4, include that in box 4 on the separate 1099-R for the conversion amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

@marinchip wrote:

In your example you enter the $7000 (the rollover and restoration) in one query after it says to enter the exact amount from the 1099R line 1 which would be $10,000.

In the following query you enter $3000 (the conversion) after it again says to enter the exact amount from the 1099R.

That is only general information for "normal" 1099-R's, and you *are* entering the exact information only it is split between two TurboTax data entry screens. The 1099-R screen in TurboTax is NOT a 1099-R form, it is just a data entry screen. As long as the two box 1 and 2a amounts when added together match the original 1099-R then you have entered the "exact" amounts - you just did it on separate data entry screens.

The only thing that is sent to the IRS is the 1040 form line 4a & 4b that will match the original 1099-R.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

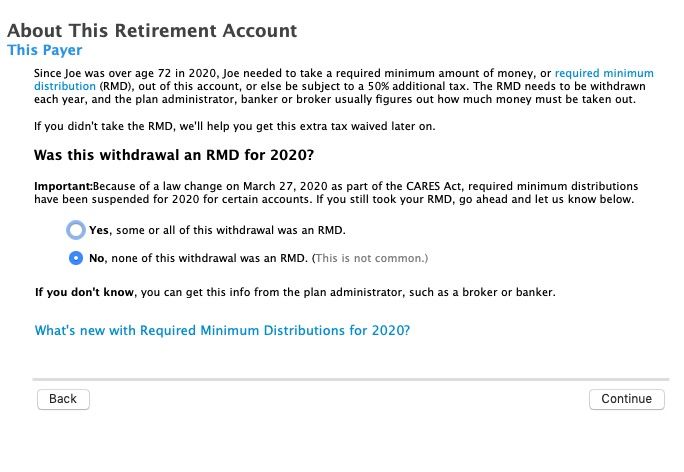

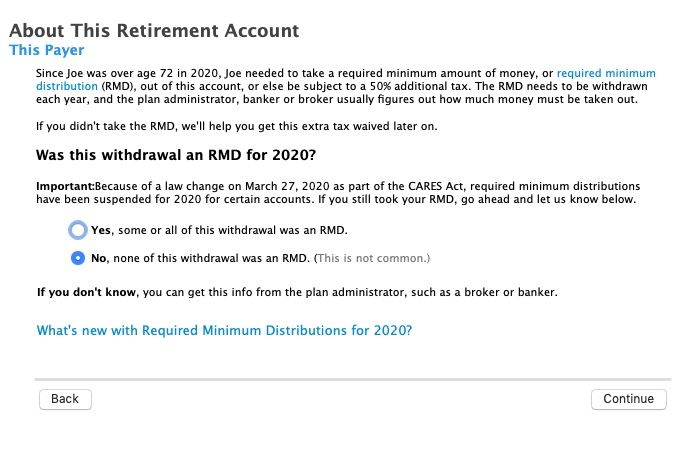

Since there is no RMD required for 2020, after you enter the 1099R say it was NOT an RMD and then that you rolled it over (even if back into the same account).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

If you have one 1099-R for both things when you are asked what you did with the distribution you can choose the mixed option then you will be able to split out what went where. Follow the screen instructions carefully.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

Thanks for your reply. I went to a point in the 1009R query where it says I need to create separate 1099Rs. One for the withdrawal and payback and one for the Roth conversion. Doesn't seem legitimate but I made proceed and see what happens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

Ok ... if the program requires it then do so ... it is not illegal. The IRS gets the 1099-R form from the issuer and on the return only sees a total ... so if you have to split the figures onto more than one entry screen then do so.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

Critter

Started to do the split but very uncertain how to make the entries. Is the PAYER,S name still my broker?

I had tax deducted when I did the RMD withdrawal. Do I enter it on the the RMD 1099R? Do I enter the RMD amount in Box 1 and then enter zero for Box2a. What distribution code do I use?

On the conversion 1099R do I enter the full amount as taxable? What distribution code do I use?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

Just pretend you got 2 forms instead of one ... everything will be the same except the amounts.

On the RMD the box 1 & 2a will be the same amount and the fed tax withheld goes in box 4.

On the conversion box 1 & 2a will also be the same. Use the same codes in box 7 that are on the form which should be either a 7 or a 2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

Yes you must split it into two 1099-Rs. TurboTax cannot handle two different destinations on one 1099-R.

Enter them both exactally the same as the original except for the box 1, and 2a amounts.

For the rollover enter the amount in box 1 & 2a, then on the what you did with the money say you rolled all over,

For the conversion again enter the amounts in box 1 & 2a and say that you converted it all to a Roth IRA.

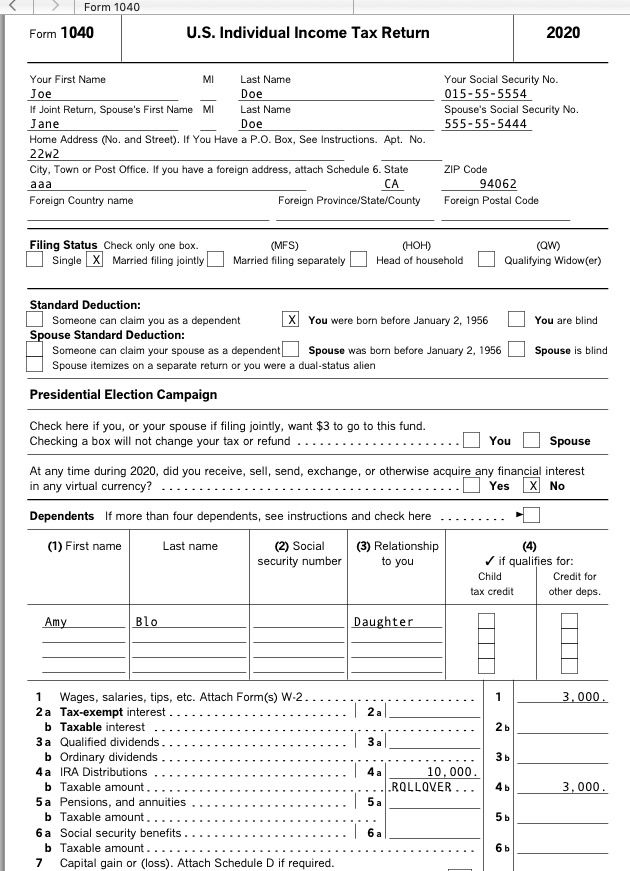

The 1040 line 4 should have the total for both box 1 amounts on line 1a and the amount of the conversion (taxable amount) on line 4b. That should match the original 1099-R.

If you had any tax withheld in box 4 on the original 1099-R, box 4, include that in box 4 on the separate 1099-R for the conversion amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

Thanks for all the suggestions. Will continue with this tomorrow and hopefully it will be resolved.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

Finally got back to this. I've split into two 1099R's, one for the RMD withdrawal and restoration and one for the Roth conversion.

I can make it appear correctly on my 1040 now only by using a Code G in Distribution Box 7 for the withdrawal substitute 1099R and a Code 7 in the Box 7 for the Roth conversion.

The explanation for when to use Code G does not make me comfortable that it is the right thing to do but it seems to work.

Any further clarification would be appreciated.

It appears I also have to create a Form 4852 to explain why I have created these substitute 1099R's.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

@marinchip wrote:

Finally got back to this. I've split into two 1099R's, one for the RMD withdrawal and restoration and one for the Roth conversion.

I can make it appear correctly on my 1040 now only by using a Code G in Distribution Box 7 for the withdrawal substitute 1099R and a Code 7 in the Box 7 for the Roth conversion.

The explanation for when to use Code G does not make me comfortable that it is the right thing to do but it seems to work.

Any further clarification would be appreciated.

It appears I also have to create a Form 4852 to explain why I have created these substitute 1099R's.

You do NOT use a code G unless a code G was on the 1099-R that you received.

You do NOT use a substitute 1099-R (4852) to do this. Filing a 4862 is sure to generate an audit letter from the IRS.

What code is in box 7 on the original 1099-R?

Is the IRA/SEP/SIMPLE box checked?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

Thanks for your reply but although the original 1099R has a Code 7 entered into Box 7 and IRA/SEP/SIMPLE Box checked. Using this information does not transfer the proper numbers to the 1040 whether I try it with one or two 1099Rs. I don't believe Code 7 is proper for the withdrawal part of the lump sum reported in this case. At least it doesn't work, only Code G works.

If I split into two 1099Rs and use 7 for the code of the IRA to Roth conversion and G for the code of the RMD withdrawal and restoration it results in 1040 4a becoming the total of the withdrawal and conversion with ROLLOVER printed below it and the correct taxable amount of the conversion entered in 4b. This results in the proper income being reported in 1040 line 9.

The form 4852 seems to be a place to explain why you had to split the 1099Rs into two. Before I did any of this I contacted my broker's tax department and they insisted they were required by IRS rules to issue only one 1099R.

I don't see why you are saying I shouldn't file substitute 1099Rs now when earlier replies from you and others indicated I should.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

@marinchip wrote:

If I split into two 1099Rs and use 7 for the code of the IRA to Roth conversion and G for the code of the RMD withdrawal and restoration it results in 1040 4a becoming the total of the withdrawal and conversion with ROLLOVER printed below it and the correct taxable amount of the conversion entered in 4b. This results in the proper income being reported in 1040 line 9.

The form 4852 seems to be a place to explain why you had to split the 1099Rs into two. Before I did any of this I contacted my broker's tax department and they insisted they were required by IRS rules to issue only one 1099R.

I don't see why you are saying I shouldn't file substitute 1099Rs now when earlier replies from you and others indicated I should.

A substitute is ONLY to be used if the original 1099-R that was issued bu the financial institution was wrong and the financial in institution refused to correcrt it. That is not your case here. There is no reason that you cannot split into two both with box 7 being a 7.

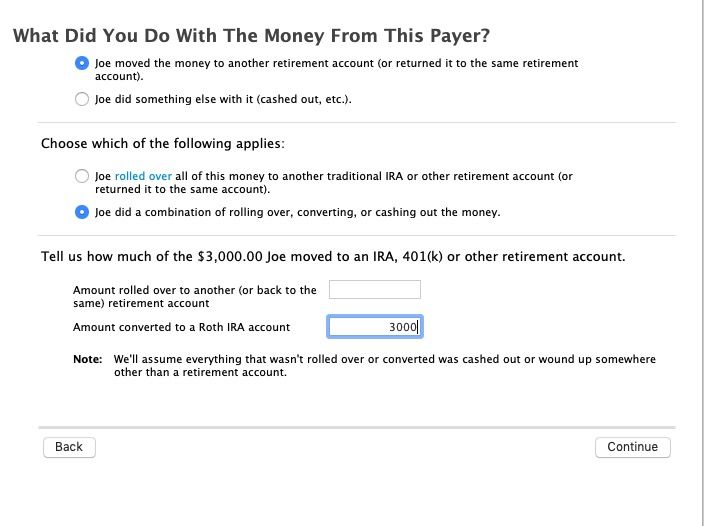

Here is an example of a 1099-R with $10,000 in box 1 and 2a, IRA box checked and code 7, with $7,000 being rolled back and $3,000 being converted to a Roth. (Note that in the 1099-R interview if the RMD questions is asked, it MUST be answered that "none of this distribution was a RMD" because for 2020 there was not RMD so it was not a RMD.)

The resultant 1040 will show the total if $10,000 on line 4a and $3,000 (the taxable Roth conversion amount) in line 4b with the word ROLLOVER next to it. Which is the proper entry for this.

What are you doing that is different?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

Thank you or your quick reply.

In your example you enter the $7000 (the rollover and restoration) in one query after it says to enter the exact amount from the 1099R line 1 which would be $10,000.

In the following query you enter $3000 (the conversion) after it again says to enter the exact amount from the 1099R.

Don't understand. Looks like your are taking numbers from two fictitious 1099Rs although i agree it works properly in the end on the 1040.

Haven't tried this with my case but I will.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

!099R lumps Roth conversion and RMD withdrawal in Box 1

My Schwab account is now posting this message for my situation.

Separate your rollover and conversion

Rollovers and conversions need to be treated as separate transactions in TurboTax to report them accurately.

Here's what you need to do next:

First, we’ll remove this 1099-R so you can report separate transactions.

Then, split your 1099-R into two 1099-Rs, one for rollover and one for the conversion. Allocate the numbers on your actual 1099-R between the two new 1099-Rs so that the combined total of them equals the amount on your original 1099-R.

Once you've entered two separate 1099-Rs you can indicate the amount that you rolled over or converted for each one.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Dolf3

New Member

Edge10

Level 2

marinchip

Level 2