- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@marinchip wrote:

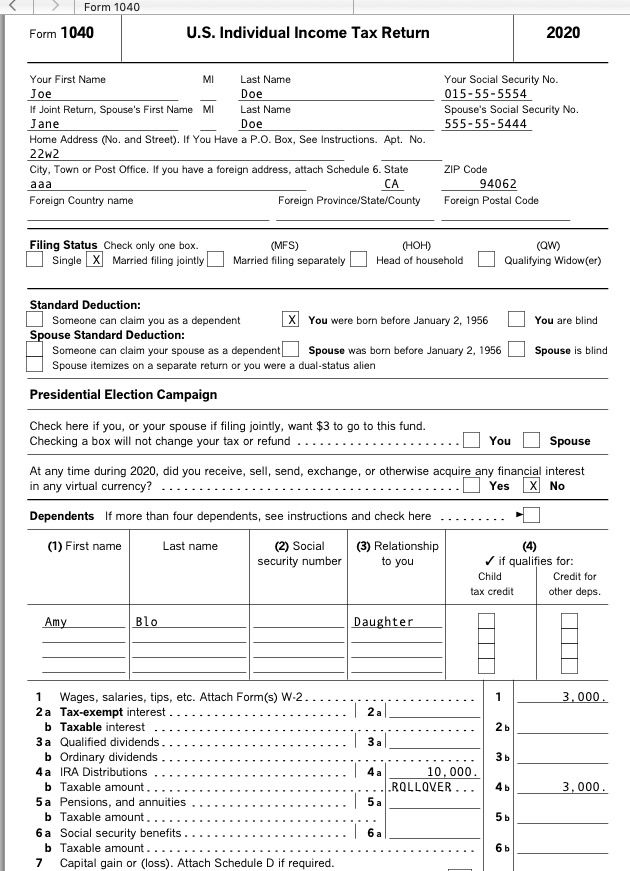

If I split into two 1099Rs and use 7 for the code of the IRA to Roth conversion and G for the code of the RMD withdrawal and restoration it results in 1040 4a becoming the total of the withdrawal and conversion with ROLLOVER printed below it and the correct taxable amount of the conversion entered in 4b. This results in the proper income being reported in 1040 line 9.

The form 4852 seems to be a place to explain why you had to split the 1099Rs into two. Before I did any of this I contacted my broker's tax department and they insisted they were required by IRS rules to issue only one 1099R.

I don't see why you are saying I shouldn't file substitute 1099Rs now when earlier replies from you and others indicated I should.

A substitute is ONLY to be used if the original 1099-R that was issued bu the financial institution was wrong and the financial in institution refused to correcrt it. That is not your case here. There is no reason that you cannot split into two both with box 7 being a 7.

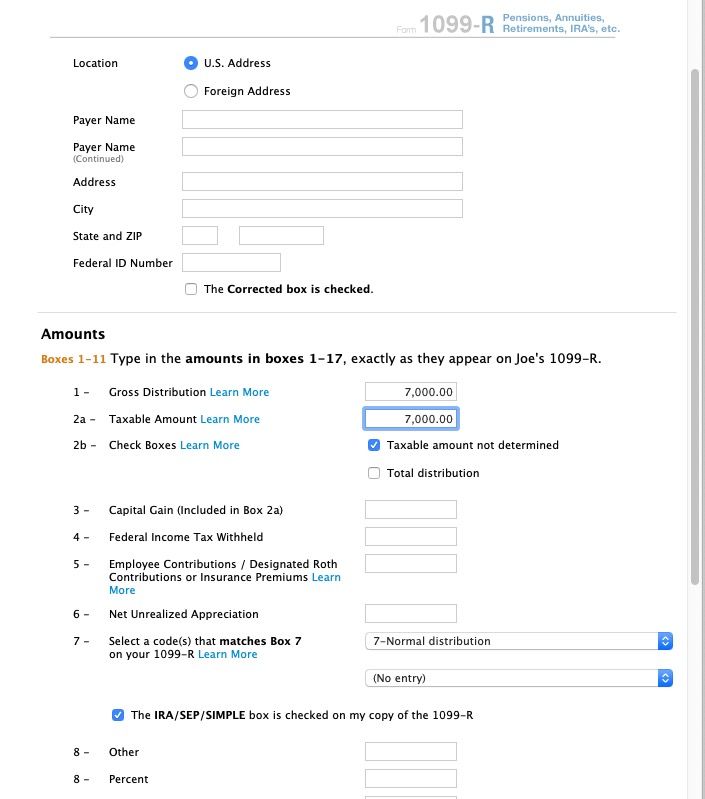

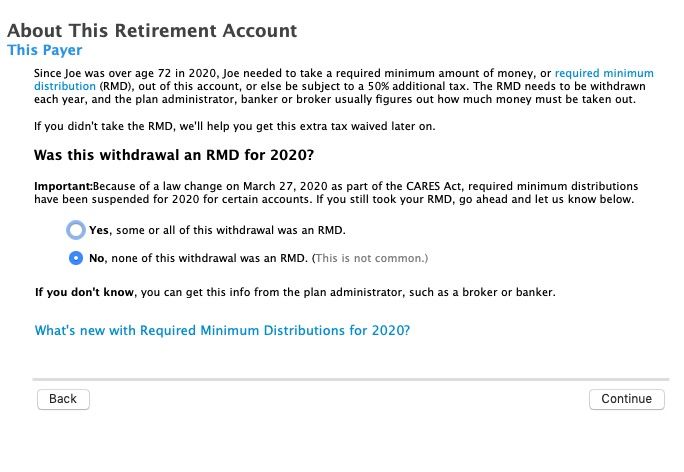

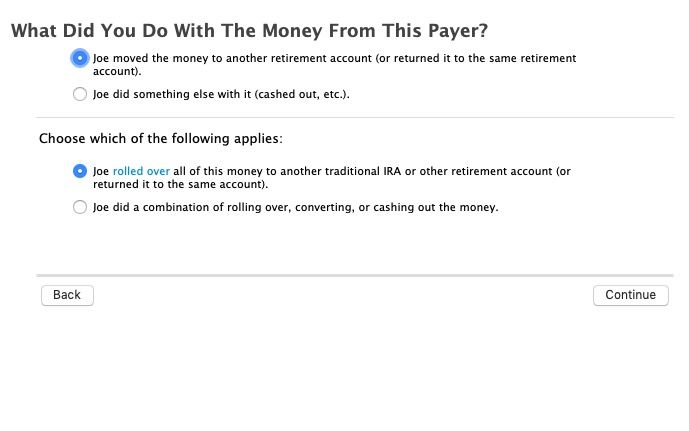

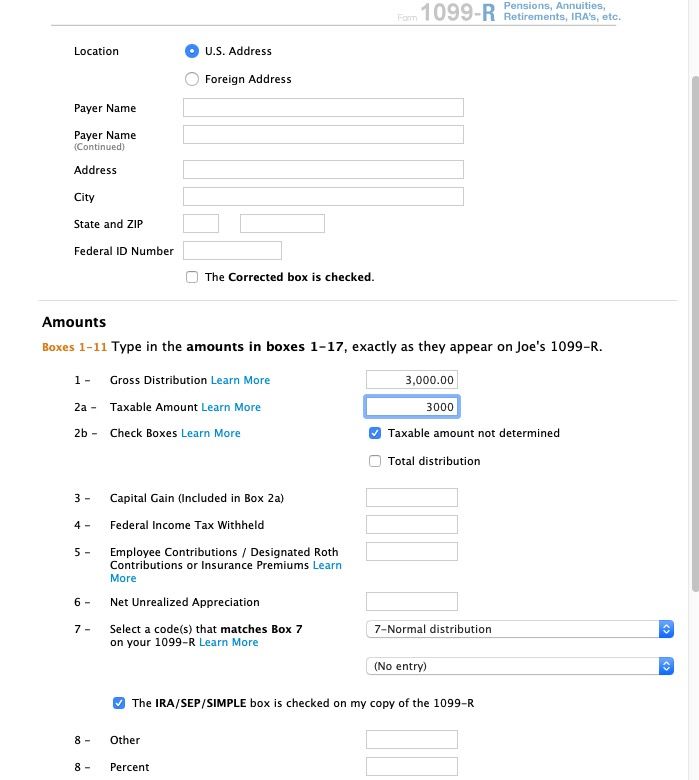

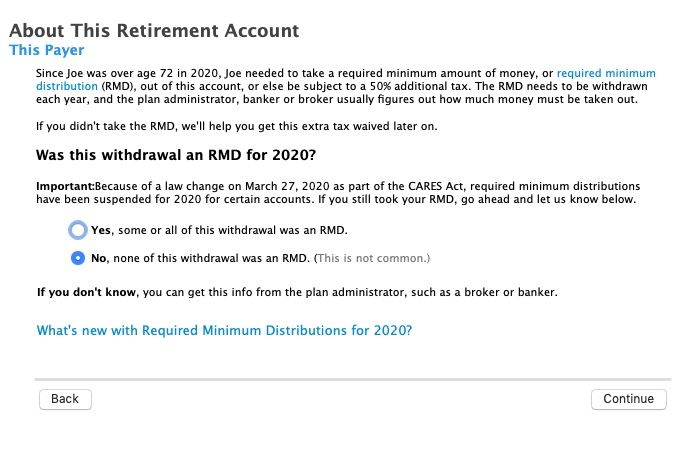

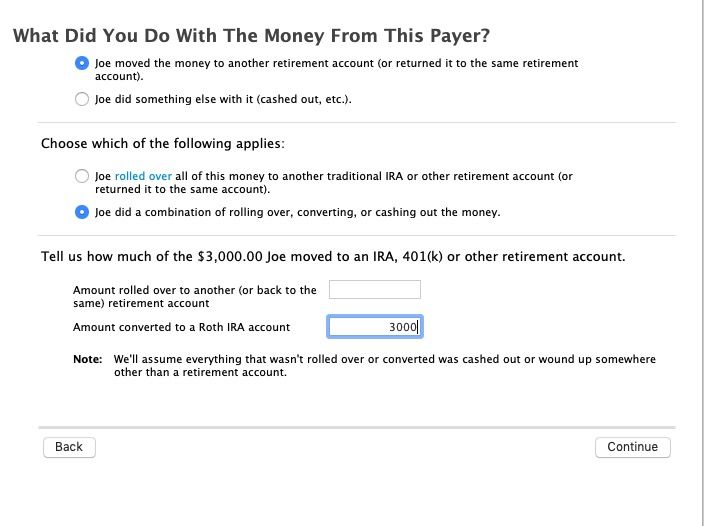

Here is an example of a 1099-R with $10,000 in box 1 and 2a, IRA box checked and code 7, with $7,000 being rolled back and $3,000 being converted to a Roth. (Note that in the 1099-R interview if the RMD questions is asked, it MUST be answered that "none of this distribution was a RMD" because for 2020 there was not RMD so it was not a RMD.)

The resultant 1040 will show the total if $10,000 on line 4a and $3,000 (the taxable Roth conversion amount) in line 4b with the word ROLLOVER next to it. Which is the proper entry for this.

What are you doing that is different?