- Community

- Topics

- Community

- :

- Discussions

- :

- Other financial discussions

- :

- Other finance talk

- :

- Re: Stimulus Check for "Your Spouse as a dependent"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

@needvacay wrote:

Hi,

I also had the same box " your spouse can be claimed as a dependent" mysteriously checked on my 2018 taxes filed with Turbo Tax. I file as Head of Household & my former spouse is not listed on my taxes. It seems to be a Turbo Tax glitch for sure. Can I skip amending my 2018 taxes and just claim the stimulus on my 2020 return or will I be required to amend the 2018 in order to received the $1200 stimulus payment as a credit on my 2020 return? My 2019 taxes were filed correctly -- not done through Turbo Tax!! Not sure why the stimulus payment wasn't based on my 2019 taxes anyway.. Thanks for any and all help!

Did you use the same Turbotax account that you previously used when you were married, did you previously file a joint return with your spouse using this online account? If so, the spouse info worksheet might not have been deleted when you switch to HOH.

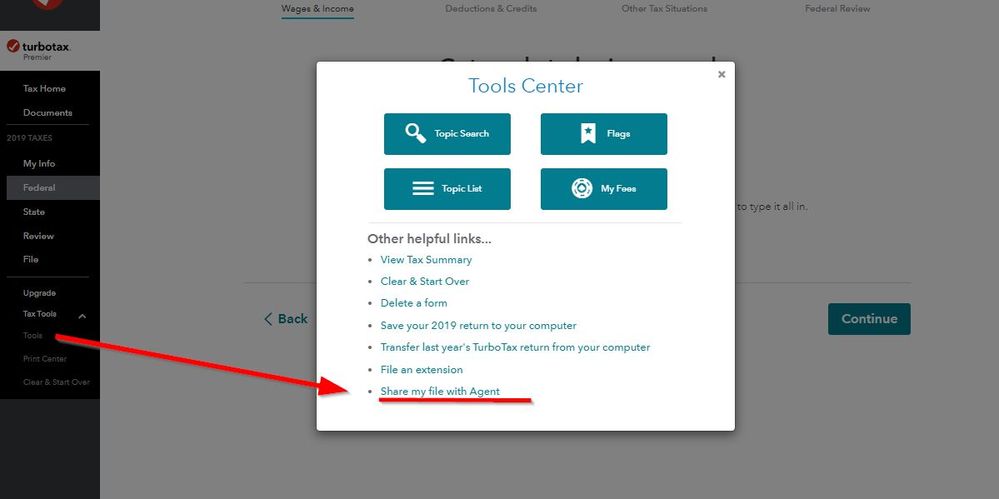

If you want to provide a diagnostic code, I will pass it on. Somewhere in the help menu is the command "Send file to agent." This uploads an anonymous version of your file to tech support and gives you a token number that can post here so I can pass it on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

I was MFS for 2018 and 2019.

In 2018 I was concerned that it kept checking that box when I didn't want it checked and was told not to worry about it, it was just me stating that someone else was free to claim him as a dependent because I wasn't.

2019, same thing so I followed that same advice. And now I got screwed out of money I need to try and keep a roof over my head and pay for medical care I need.

I don't know what these codes or anything are that you are talking about.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

Go to Tax Tools/ Tools / share my file with Agent. This creates an anonymous copy of your file which is stripped of your Personal Info and uploads it to a diagnostic database for tech support and gives you a token number to identify the file. Post the token number here for the Moderator.

Here's a screen shot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

@Tobakett wrote:

I was MFS for 2018 and 2019.

In 2018 I was concerned that it kept checking that box when I didn't want it checked and was told not to worry about it, it was just me stating that someone else was free to claim him as a dependent because I wasn't.

2019, same thing so I followed that same advice. And now I got screwed out of money I need to try and keep a roof over my head and pay for medical care I need.

I don't know what these codes or anything are that you are talking about.

Go to the "Tax Tools" item on the left hand menu and click on "Share file with agent." You will get a code, post it here.

Your statement that "you were told" not to worry about your spouse being checked as "can be claimed as a dependent" doesn't make a lot of sense. While checking that box has less effect after tax reform than it did before, and while it is true that it does not affect your MFS refund, it could mess up your spouse's attempt to claim certain tax benefits. I can't think of why someone would tell you that.

Also, if you filed MFS, you would never get a stimulus payment for your spouse no matter what box was checked or not checked. Your spouse would get a separate payment in their name if they are eligible. Is there anything unusual about your situation? Is your spouse a non-resident alien? Is your spouse non-working and does not file a return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

I filed as married filing jointly for 2017, married filing separately for 2018 then married filing separately for 2019. Prior to that I filed as single. I have used the same TurboTax account going back to 2013.

It appears the same “someone can claim your spouse as a dependent” box was also checked on my 2018 return but went unnoticed as there weren’t any stimulus payments. I really don’t see myself making the same fairly important mistake two years in a row.

I am unable to determine how to obtain the diagnostic code reference above but I would love to provide that if possible. Do you have any more information on how?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

I posted a screen shot. You will get a 6 digit code to post here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

Hmmm, I suppose they would want to see your prior years. But to get a file to share I think you would have to download the .tax file and open it in the Desktop program to get the diagnostic file and code. @Opus 17 maybe ask if they would want the prior years and how. Can they do it from Online?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

I was able to obtain a diagnostic code. It is 691673. Hopefully this forum won’t remove it as NPI. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

I don't know why I would have been told that either? Lazy rep? Incompetent? Who knows.

And no nothing unusual. Both he and I were born in the US to parents who were born in the US.

I checked to see if he had gotten my stimulus in case there was something weird where because we were still legally married it would have gone to him.

I am not a tax person. The entire time we were married he handled money stuff. So if some of my statements are confusing it's probably because I'm ignorant of how it works. Kinda left me high and dry with nothing so I'm basically learning it all myself for the first time.

When I am home tonight I will try and do that log thing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

Should we start a class action suit against Turbo Tax as they are not recognizing that this problem was caused by them?... I am in a similar situation. I have spent hours on the phone with the IRS trying to resolve. I know that I did not check those boxes and as the previous post said it appears to carry over from previous tax forms. I have been told by the IRS that someone can claim me as a dependent but will not tell me who and beings as I am sure that it was caused by this I asked if they could tell me if my husband is showing as my dependent as it is also checked on his return. I have been told that this has marked us as ineligible for the economic stimulus and even amending the return ... which last night I tried to do and when TurboTax completed said the system said that it didn't see any difference....will not get us the economic stimulus package we are entitled to receive. Turbo Tax needs to step up to the plate and work with the Federal Government to get this resolved. I have been told by an IRS representative that I can do a recovery rebate credit on our 2020 taxes but this is money that we are entitled to now. This is not going to be an easy conversation for me to have with my husband.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

SAME

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

Not sure who this ChampOpus17 guy is but I don't care to hear about your invalid comments concerning our legitimate claim that Turbo Tax has screwed us over. Who are you? What's your purpose of commenting on this thread? To try and cause more confusion? Do you work for Turbo Tax? Many of us here on this thread have been screwed over and are in dire need of our stimulus NOW! I have reached out to my local representative here in Chicago and there will more than likely be a class action against Turbo Tax unless they compensate and correct their problem immediately.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

@VolvoGirl wrote:

Hmmm, I suppose they would want to see your prior years. But to get a file to share I think you would have to download the .tax file and open it in the Desktop program to get the diagnostic file and code. @Opus 17 maybe ask if they would want the prior years and how. Can they do it from Online?

Assuming they are willing to open a case, I suspect either the moderator or tech support would contact the customer directly. It's also possible that, once they know which account to look at, they will be able to see the prior accounts. I would start with 2019 and see if they even open a case at all first.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

@jonpkt01 wrote:

Not sure who this ChampOpus17 guy is but I don't care to hear about your invalid comments concerning our legitimate claim that Turbo Tax has screwed us over. Who are you? What's your purpose of commenting on this thread? To try and cause more confusion? Do you work for Turbo Tax? Many of us here on this thread have been screwed over and are in dire need of our stimulus NOW! I have reached out to my local representative here in Chicago and there will more than likely be a class action against Turbo Tax unless they compensate and correct their problem immediately.

1. I am a 10 year volunteer. But I have a certain amount of respect with the moderators, and they will sometimes escalate error reports if they believe that I or the other long time volunteers have found an important issue.

2. Screaming won't help. Understand that, once you filed incorrectly, no matter whose fault it was, the IRS is not going to pay a stimulus payment to you in 2020. That's an issue with the IRS--they lack the ability to process the change that needs to happen in time for it to do any good.

3. If you file correctly in 2020, you will receive any extra payment amounts as part of your tax refund.

4. Tech support currently says this is not a bug. If the "dependent" box is checked on the internal spouse worksheet, it may be difficult to prove whether it was a user error or a program glitch. The assistance of a customer who both (a) has a support phone call on record documenting the problem at the time and (b) provides a diagnostic code now, may help get the issue escalated to a higher level. Yelling will not help escalate the issue.

5. My goal here is not to get you a payment (because that's impossible) but to understand why this happened so that it does not happen again next year. You can help by posting a diagnostic code, (especially if you also have a support call on record) or not. If you want to use this discussion thread to yell about the company, feel free, but some of us are trying to help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dierings

New Member

ninelives

New Member

brt1895

Level 1

chrissmithgl

New Member

bbPrescott

Level 2