- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Re: If you had 5 years of active service as of August 12, 198...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC state taxes for military retired

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC state taxes for military retired

If you had 5 years of active service as of August 12, 1989, your military retirement is exempt from NC tax. If not, it is fully taxable.

From the NC DOR website:

North Carolina may not tax certain retirement benefits received by retirees (or by beneficiaries of retirees) of the State of North Carolina and its local governments or by United States government retirees (including military).

The exclusion applies to retirement benefits received from certain defined benefit plans, if the retiree had five or more years of creditable service as of August 12, 1989.

NC does not tax SS benefits.

From NC DOR website: If your social security or railroad retirement benefits were taxed on your federal return, you may take a deduction for those benefits on your North Carolina individual income tax return. You may take this deduction because this income has already been included as part of your federal adjusted gross income and North Carolina does not tax this income. This deduction will increase your refund or decrease the amount you must pay.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC state taxes for military retired

If you had 5 years of active service as of August 12, 1989, your military retirement is exempt from NC tax. If not, it is fully taxable.

From the NC DOR website:

North Carolina may not tax certain retirement benefits received by retirees (or by beneficiaries of retirees) of the State of North Carolina and its local governments or by United States government retirees (including military).

The exclusion applies to retirement benefits received from certain defined benefit plans, if the retiree had five or more years of creditable service as of August 12, 1989.

NC does not tax SS benefits.

From NC DOR website: If your social security or railroad retirement benefits were taxed on your federal return, you may take a deduction for those benefits on your North Carolina individual income tax return. You may take this deduction because this income has already been included as part of your federal adjusted gross income and North Carolina does not tax this income. This deduction will increase your refund or decrease the amount you must pay.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC state taxes for military retired

Intuit Question

I purchased the Deluxe Turbo Tax from Costco. I’m a resident of North Carolina (NC). I received a 1099R from the Defense Finance and Accounting Service identifying my military retirement. Military retirement is not taxed in the state of NC if the retiree had five or more years of creditable service as of August 12,1989. I do meet this requirement. However, I cannot find within the NC program where to exempt my military retirement. I need your help!

Thank you,

Herb

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC state taxes for military retired

Please select this hyperlink, for instructions on excluding your North Carolina retirement income. Please follow these exact steps outlined in the link.

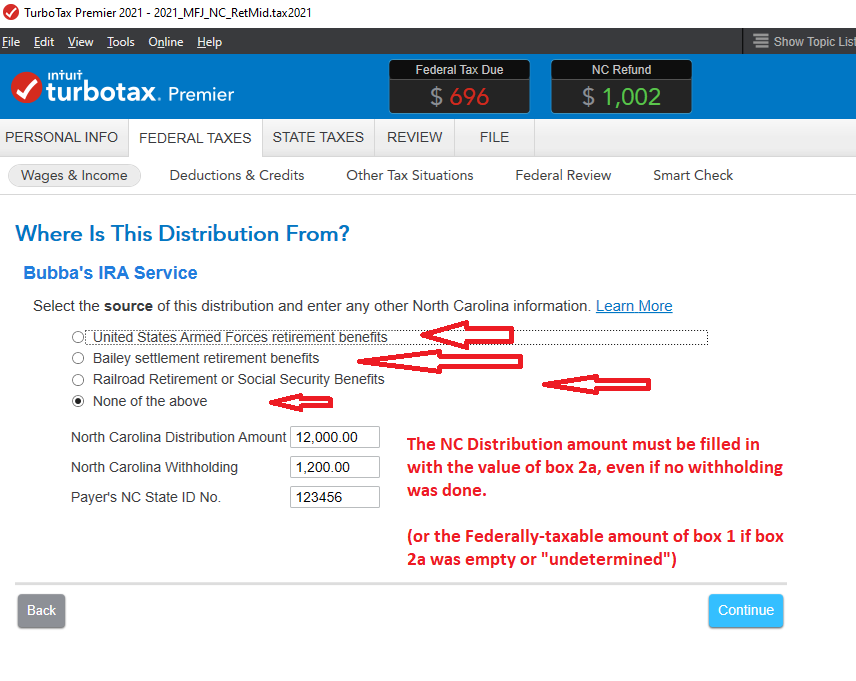

1) Go back and edit the 1099-R form in the Federal section.

2) After you enter your 1099-R form, and "Continue" thru the pages that follow it...until you find the selections for:

1) "Bailey settlement.

2) "Faulkenbury settlement...."

3) "Railroad Ret-SS.........."

4) "None of the above"

3) You need to select the "Bailey Settlement..."

Your NC Distribution amount is the same a box 2a of the 1099-R form (or the calculated federally-taxable amount for box 2a, if 2a is empty)....... that $$ will be removed in the NC section depending on what selection you made above.

4) Since you meet the requirement that you had five or more years of creditable service as of August 12,1989. You can choose the Bailey Settlement and all of that particular 1099-R will be exempted from NC taxation.

5) That 5-years employment by the Feds/Military, or NC-State Gov't-related plan, by 12 Aug 1989 is critical.

See if these steps work out for you and if reported correctly, your military retirement pay should automatically be excluded from North Carolina State income.

.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC state taxes for military retired

NC passed law saying all retires that did over 20 years are state tax free. I do not see how to claim this without taking bailey act.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC state taxes for military retired

Here is a link Military Retirement | NCDOR that says 20 years or more of service no date as in the Bailey act. It also states it is retroactive to Jan 2021. Please advise me how to do this in

Turbo Tax. Do I need to select the Bailey act?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC state taxes for military retired

No. Bailey is still only for those 5-year vested in their State/Federal?mMilitary Retirment as of 12 Aug of 1989.

1) For just the Military who do not meet that deadline...when you enter your 1099-R in the Federal section, you select the US Armed Forces Retirment button on a page following the main form:

____________________________________

__________________________________________________

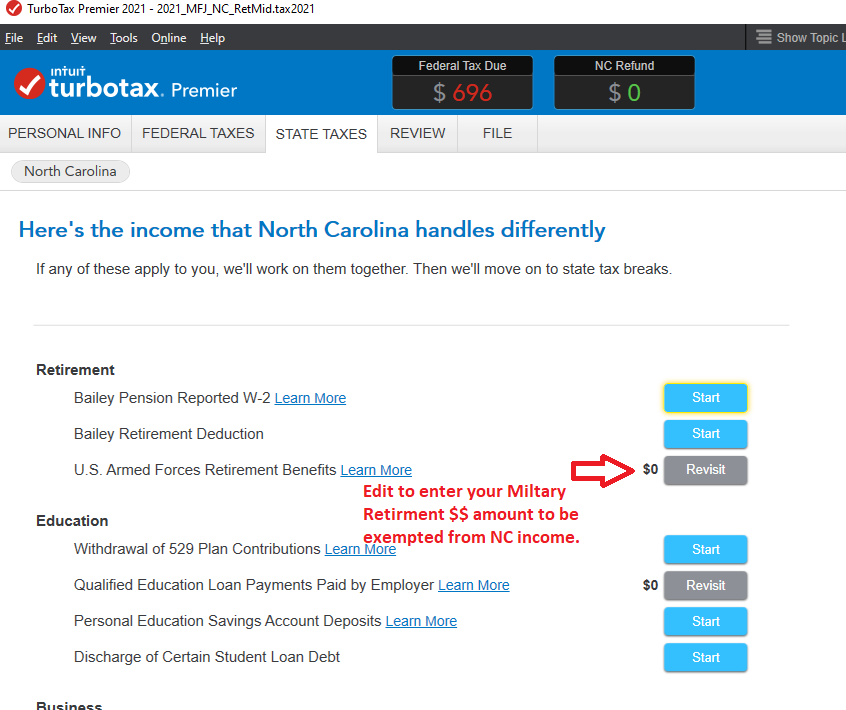

2) Then after you have entered everything possible in the Federal section (AND error checked), You go thru the NC Interview and the r is a place there to indicate the amount that was from the non-Bailey Military retirement....putting in the proper amount if not already displayed.

3) Don't attempt to file NC for another week....perhaps wait until 7 March...a major update is coming Thurs or Friday of this week, but we don't know if it fixes all that is still wrong with NC software yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC state taxes for military retired

https://www.ncdor.gov/taxes-forms/individual-income-tax/military-retirement

Military Retirement

Session Law 2021-180 created a new North Carolina deduction for certain military retirement payments. Effective for taxable years beginning on or after January 1, 2021, a taxpayer may deduct the amount received during the taxable year from the United States government for the following payments:

- Retirement pay for service in the Armed Forces of the United States to a retired member that meets either of the following:

- Served at least 20 years.

- Medically retired under 10 U.S.C. Chapter 61. This deduction does not apply to severance pay received by a member due to separation from the member's armed forces.

- Payments of a Plan defined in 10 U.S.C. § 1447 to a beneficiary of a retired member eligible to deduct retirement pay under sub-subdivision a. of this subdivision.

The deduction is only allowed to the extent the payments are included in the taxpayer's adjusted gross income.

Note: Amounts deducted under G.S. 153.5(b)(5a) may not also be deducted under G.S. 153.5(b)(5).

The Department will issue additional guidance about this deduction in 2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC state taxes for military retired

Yes, you are correct. NC now excludes military retirement pay from NC taxable income.

First be sure in the "My Info" or "Personal Info" section you have indicated you served in the military and select retired. Then after entering your 1099R information in the "Income" section you will arrive at a page asking "Where is this distribution from?" One of the options is "US Armed Forces retirement benefits." You should select that one if you are not part of the Bailey settlement. The NC distribution amount should be populated from your prior 1099R entry.

You may need to delete the 1099R and re-enter the information manually if you are not seeing the "Armed Forces retirement" option.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jackkgan

Level 5

tawellman

New Member

tylergagnon0

New Member

tonyxray8

New Member

colomboanac

New Member