- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

No. Bailey is still only for those 5-year vested in their State/Federal?mMilitary Retirment as of 12 Aug of 1989.

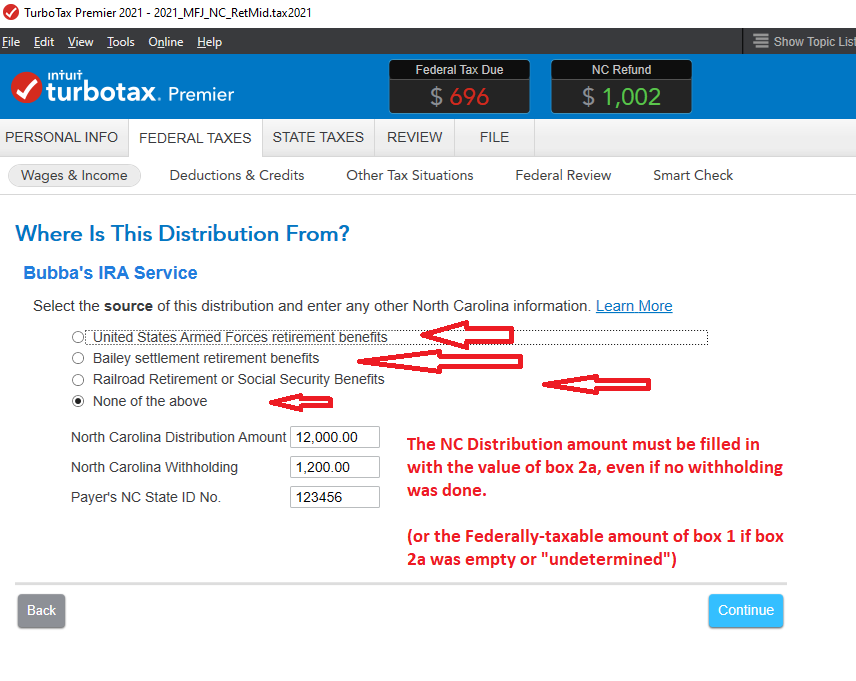

1) For just the Military who do not meet that deadline...when you enter your 1099-R in the Federal section, you select the US Armed Forces Retirment button on a page following the main form:

____________________________________

__________________________________________________

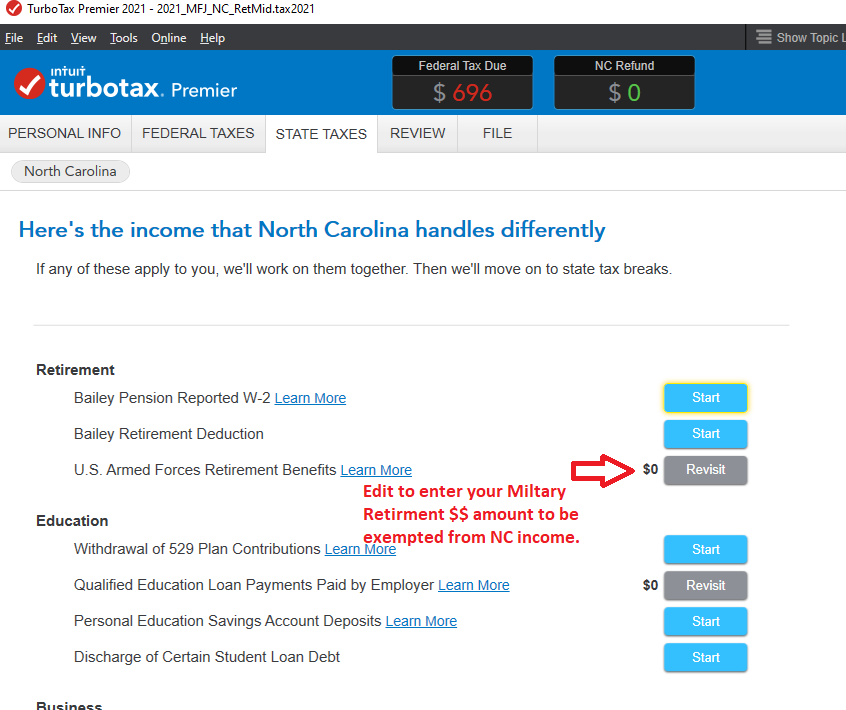

2) Then after you have entered everything possible in the Federal section (AND error checked), You go thru the NC Interview and the r is a place there to indicate the amount that was from the non-Bailey Military retirement....putting in the proper amount if not already displayed.

3) Don't attempt to file NC for another week....perhaps wait until 7 March...a major update is coming Thurs or Friday of this week, but we don't know if it fixes all that is still wrong with NC software yet.