- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Re: If you are a member of the Uniformed Services or the Fore...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

I deleted and started over as others recommended with the sale captured apart from the rental income. Only then did I get to the options for the military exception to the capital gains exclusion and only then it worked.

Thanks to the members that helped with the comments. The software is terrible for supporting this military exception. Needs work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

As you know, your "2 of last 5" can be extended to a maximum of "2 of last 15". But to call it an extension is actually incorrect. What it is, is a "suspension" of the 5-year count. say you lived in the property for let's say, 2 yaers and then vacated the property under military orders and were gone for 5 years. During that 5 years you rented it out.

Then you sold the property 5 or more years of it being a rental. For the sole purpose of the capital gains tax exclusion, that 5 years "doesn't exist", because they were suspended. So they don't get counted. For tax purposes and to qualify for the "2 of last 5" capital gains tax exemption, treat it "as if" you sold it within 3 years after you vacated it. You'll be fine, because you have military orders to back you up. Besides, you've already indicated on your tax return that you were military for all these years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

For those that are still having issues, paying for the live help is pointless. I was given incorrect information several times. Finally I deleted my entire return (very frustrating) and started over.

You need to take the home out of service in the rental section but the actual SALE of the house is as a primary sale. When you are asked "Did you use this home for anything other than your primary home", the answer is NO. Live help was repeatedly trying to tell me to put yes but the answer should be NO.

The reason for sale is as seen in the message thread - other, then military, then yes, then enter your depreciation taken.

This finally worked for me and only showed my depreciation amount as the taxable amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

These directions don't seem to work for Tax Year 2021 Turbotax. Is there an update to step 12 and beyond for tax year 2021? There doesn't seem to be a 'Check "Item was sold/disposed/converted..."' button that I can find. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

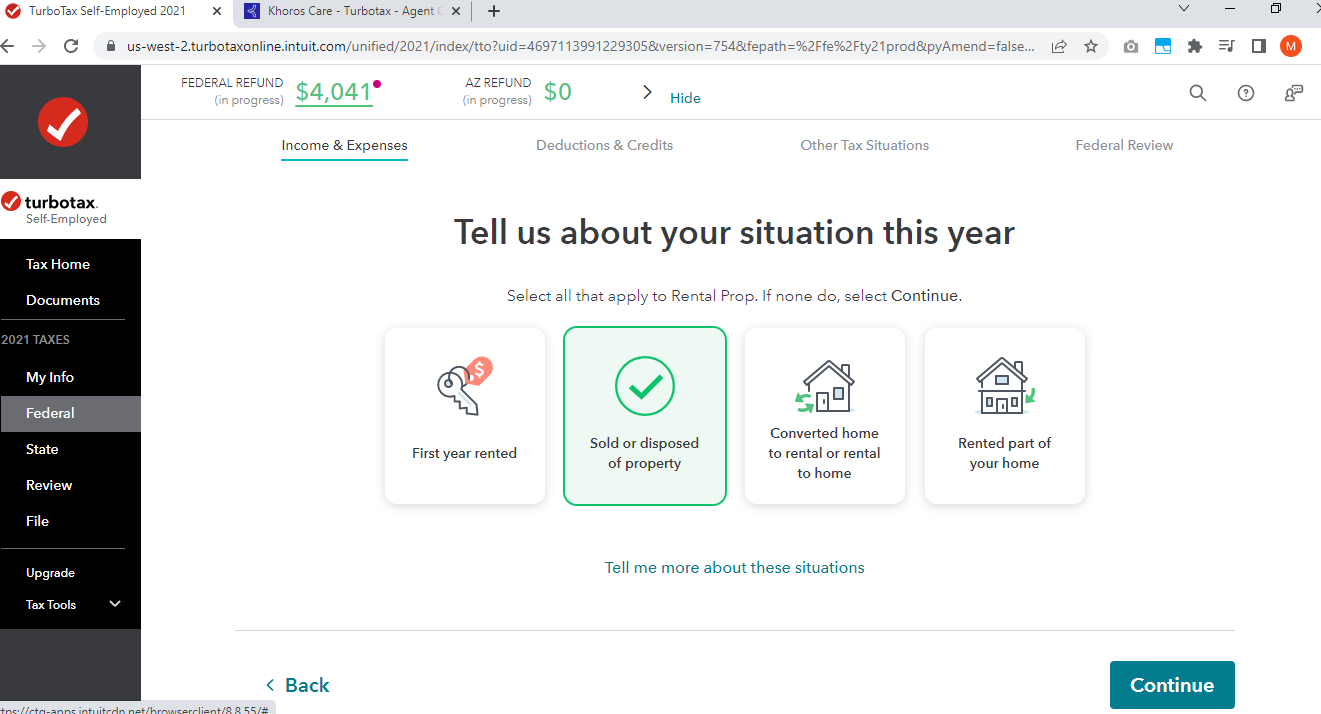

In the Rental section (under Wages & Income), EDIT your Rental Property Info.

You may get an icon to click on saying you sold the property (screenshot).

Then you get a question asking whether the property was 'rented all year' (say Yes if rented up to date of sale).

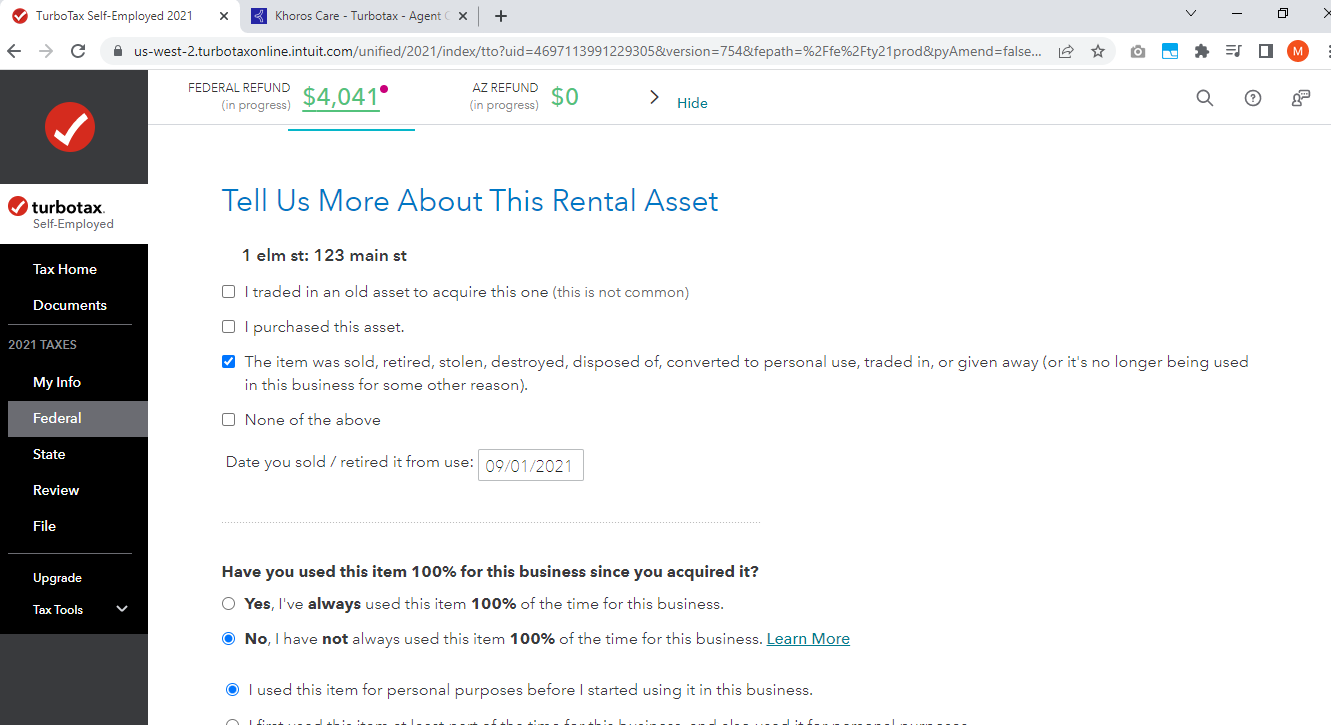

At the 'Rental Property Info' page, scroll down to Assets and EDIT the property.

You will come to a screen asking again about Date Sold, etc. (screenshot).

Click this link for more info on How to Report Sale of Rental Property.

@A8skyhawk

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

Hi,

My case:

I lived in the house as my main residence from 2000 to June 2012.

In June 2012 , I moved out the house due to permanent change of station orders.

I rented the house from June 2012 until December 2017.

The house remained empty, but as a rental property for tax purposes, from December 2017 until December 2021. I have 10 years of "captured depreciation."

I sold the house on December 2021. I am still on active duty orders.

I haven't computed the basis yet, but how could it affect me if I have a loss on the sale of the house?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

What may appear as a loss based on your unadjusted basis may become a gain once you adjust your basis for the depreciation recapture. Having said that you will only be taxed on the gain. So it's possible not all of the depreciation recaptured will be taxable.

Here is a simple example.

Unadjusted basis - 10,000

Sales proceeds - 5,000

Loss - 5000

However if you have depreciation to recapture - 6,000

Adjusted basis is - 4,000

Sales proceeds - 5000

Gain - 1000

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

eemr19841

Level 2

spartanxzay

New Member

AOBabin

New Member

tylergagnon0

New Member

WL1969

Level 1