- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

If you are a member of the Uniformed Services or the Foreign Service, or an employee of the intelligence community in the Unites States, you may choose to suspend the 5-year test period for ownership and use if you are on qualified official extended duty. This means you may be able to meet the 2-year residence test even if, because of your service, you didn’t actually live in your home for at least the 2 years during the 5-year period ending on the date of sale.

Example.

John bought and moved into a home in 2007. He lived in it as his main home for 2½ years. For the next 6 years, he didn’t live in it because he was on qualified official extended duty with the Army. He then sold the home at a gain in 2015. To meet the use test, John chooses to suspend the 5-year test period for the 6 years he was on qualified official extended duty. This means he can disregard those 6 years. Therefore, John's 5-year test period consists of the 5 years before he went on qualified official extended duty. He meets the ownership and use tests because he owned and lived in the home for 2½ years during this test period.

Qualified extended duty. You are on qualified extended duty if:

- You are called or ordered to active duty for an indefinite period, or for a definite period of more than 90 days.

- You are serving at a duty station at least 50 miles from your main home, or you are living in government quarters under government orders.

- You are one of the following:

- A member of the armed forces (Army, Navy, Air Force, Marine Corps, Coast Guard);

- A member of the commissioned corps of National Oceanic and Atmospheric Administration (NOAA) or the Public Health Service;

- A Foreign Service chief of mission, ambassador-at-large, or officer;

- A member of the Senior Foreign Service or the Foreign Service personnel; or

-

An employee, enrolled volunteer, or enrolled volunteer

leader of the Peace Corps serving outside the United States.

Period of suspension. The period of suspension can’t last more than 10 years. Together, the 10-year suspension period and the 5-year test period can be as long as, but no more than, 15 years. You can’t suspend the 5-year period for more than one property at a time. You can revoke your choice to suspend the 5-year period at any time.

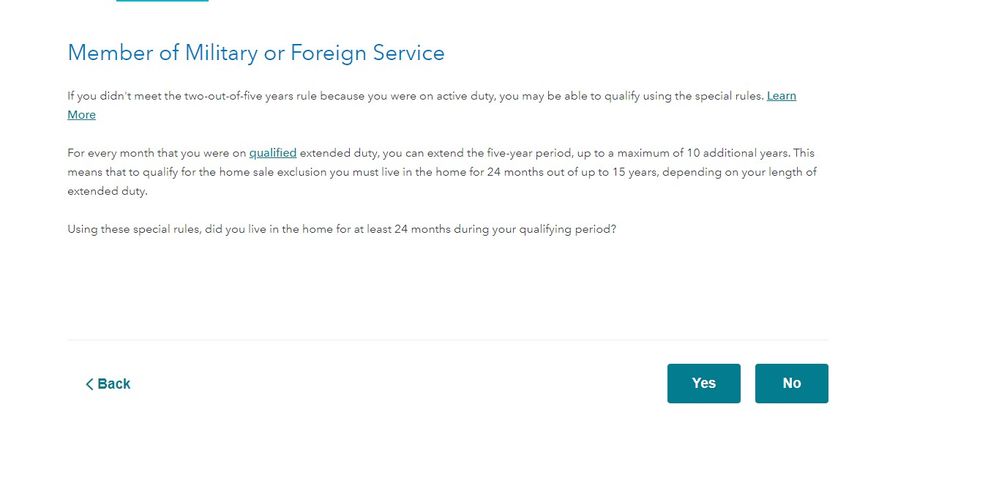

(See the attached screenshot below. Click to enlarge.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

Where (or how) in the turbo tax software can we enter information about the sale of our home that was used as a rental property for the last 7.5 years but that is eligible for the “military extension” of the capital gains exclusion? (We lived in the home for more than 2.5 of the past 10 consecutive years and were away from the home only while under travel orders.) Do we enter the sale and claim the military extension under the “sale of RENTAL property” section? If not, can you provide us with clear instructions on how to do this using your software? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

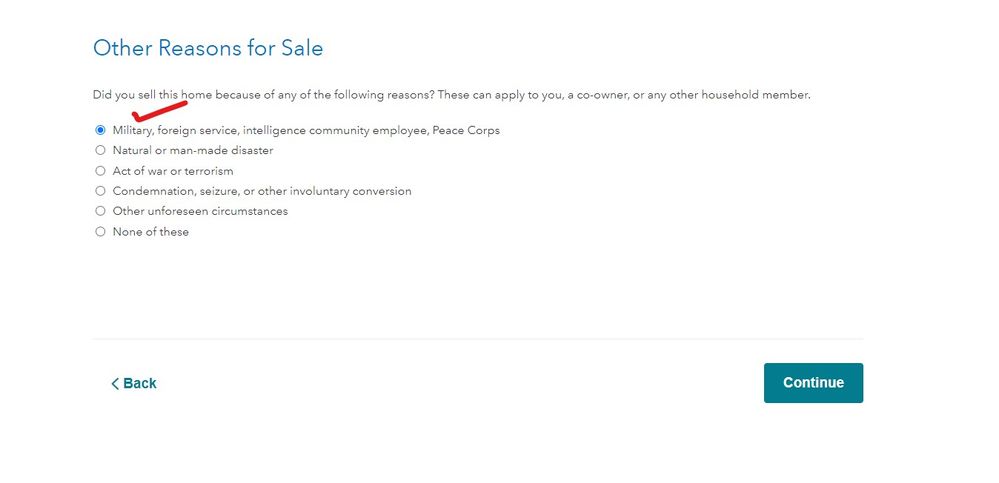

You have to sell as a personal home sale and mark "Military" for 'Other reason for sale". The new law allows persons on qualified extended duty in the U.S. Armed Services or the Foreign Service to suspend this five-year test period for up to 10 years of such duty time.

Keep in mind, the capital gains will be excluded from your property but ordinary gains will still be taxable if have taken depreciation from your rental property in the past. Here is how to report.

- Go to federal>income and expenses>less common income>sale of a home

- Next few screens will ask address and sales information about the home including purchase information

- Next question about the time you lived in the home, here you will answer no

- Next question will ask did you use this home for any other purpose than your primary home, you will say yes and list the numbers of days you did not live in the home after 2008.

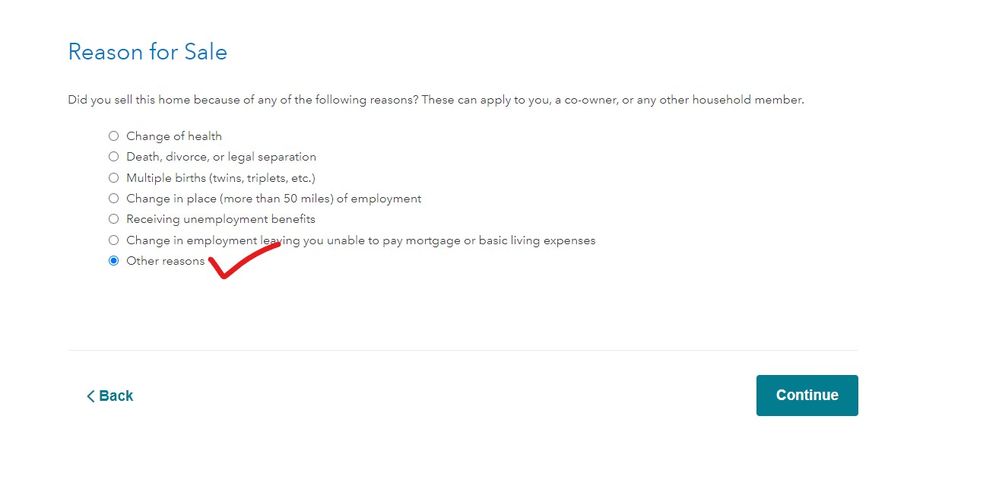

- Scroll and answer questions when it asks for the reason for the sale, select other reasons

- Next screen is where you indicate you are in the military.

- Next screen asks if you are in the military or foreign service. Here you would say yes in order to get the capital gains exclusion.

- Next questions will ask how long you lived in the house and how long you owned the house.

- Next question asks how much depreciation you deducted or allowed to be deducted since 1997. If you rented the house, you would have claimed depreciation in past years.

- Continue through the rest of the section. At the end, the program will inform you of the excluded gain and then the ordinary gain on the sale of your house. Remember being in the military does not exclude the ordinary gain from the sale of this house.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

You still have to do this from within the Rental Section. Do not do it from the Sale of home section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

Why do you have to do it in the rental section? The answer above has details on how to do it in the sale of home section.

If you think it has to be done in rental section, can you please list steps how to do that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

In the rental section you will take the property out of service and then complete the sale in the home sale section as described already.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

I am SO confused! If I try to take the rental house out of service from the rental section, and I say No, I did not use this home for anything other than my primary home (because my husband was in the military so it was not nonqualified use), our tax is MUCH lower than if I say Yes, we rented it for 3000 days, and still state that we were military and lived in it for 2 out of the last 15 years. If I do the latter, it says we do not qualify for the military exclusion.

I cannot see how to take the house out of service as an asset without going through the sale questions, so I can't just take it out of service and then go report it under Personal as a Sale of Home.

Please help! I've spent hours trying different ways of entering it and I can't figure out what is correct and gets us the military exclusion that I am 99% sure we qualify for. (We lived in the house for 3 years, then rented it for 8 years, then sold it.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

You are correct you will not enter any sales information in the Rental section. You will however enter/verify the purchase and business use information in the Rental section. This will calculate the depreciation for the part of the year it was a rental in 2021 and past depreciation that will be taxed due to the disposal of the property.

- "Revisit" the Rental topic

- "Edit" the Rental business

- "Edit" the "Property information"

- In the "General Information" section "Edit" the "Situation" area

- Be sure to select "Sold/disposed" and "Converted" tiles

- Select "From rental to personal use"

- Put in "Fair Rented days for 2021"

- Leave the personal use days blank (unless you lived in the home during the rental time)

- "Looks Good"

- Scroll to Assets

- "Edit" the asset (property)

- Identify the property

- Put in your purchase price and cost of land

- Date of purchase

- Check "Item was sold/disposed/converted..."

- Enter date of conversion

- "No" you have not always used for business

- Select "Personal use before..."

- Enter date you started as a rental

- Enter the percent of business use in 2021. (percent of year it was a rental)

- Confirm prior depreciation populated

- "Yes"

- "Done"

- Follow @DaveF1006 instructions given earlier to report the sale in "Sale of Home" section now.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

I just went through all of these steps, why is it telling me that I don't qualify for a capital gains exclusion? I lived in the home for the first 4 years and have rented it out the last 6. Even with the net proceeds from the sale and depreciation added together, I am still under $100,000. What am I missing here?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

If you owned the home for 10 years, and lived in it for the first 4 years, then rented it out the last 6 years, you do not meet the home ownership and use test. In order to exclude the sale, you would need to live in the home for 2 out of the last 5 years.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

What you describe is true for most sellers, however, being consistent with the topic of this thread, I thought since I was active duty Military that time was extended. Wouldn't this mean my timelines would exempt me from paying income taxes on the sale?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

What you probably need to so is NOT sell the rental in the rental section ... only take the assets out of service (use the converted to personal) as of the date of sale and then use the SALE OF HOME section to enter the sale and recapture the depreciation. Calling TT support for assistance if needed or better still upgrading to one of the LIVE help options would be wise to get this done correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

Again, being consistent with this thread, I have understood and followed all of the previous comments about how to convert to personal use and sell the home under personal income. This still leads me to my original post about TurboTax showing the income as taxable gains. I am not ready for live support yet, as I don't have much confidence in paying extra only to only to get the same answers we have discussed on this thread. So back to my original question, am I missing anything based on my situation I have descend that wouldn't allow me to qualify for the Military tax exemption on the income from the sale?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you claim capital gains exclusion from sale of rental property under the Military Families Tax Relief Act?

IN the sale of home section you will say you did NOT use your home personally for the last 2 out of 5 years and then continue until you see the screen below ... then follow the interview carefully ... you will have to get the total depreciation taken amount before you complete this section ... use the PRINT center to get the amounts for the prior + current year depreciation before you complete this section (look at the depreciation worksheet for these amounts)... go slow and read the questions carefully and answer honestly and it will work in the end. Do click the box saying you had a 1099-S form for the sale ... it should be with all your other closing paperwork.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cpo695

Returning Member

Atlanta Girl

Level 1

mainiac68

New Member

johnruss18

New Member

mtufani2000

New Member