- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- I have nontaxable combat pay. When I go through the IRS site, that site calculates I can receive the EIC if I exclude my combat pay. TurboTax wont give me the option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have nontaxable combat pay. When I go through the IRS site, that site calculates I can receive the EIC if I exclude my combat pay. TurboTax wont give me the option.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have nontaxable combat pay. When I go through the IRS site, that site calculates I can receive the EIC if I exclude my combat pay. TurboTax wont give me the option.

Look at your W-2 box 12. Does it have a code of Q with an amount? This is your nontaxable combat pay.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have nontaxable combat pay. When I go through the IRS site, that site calculates I can receive the EIC if I exclude my combat pay. TurboTax wont give me the option.

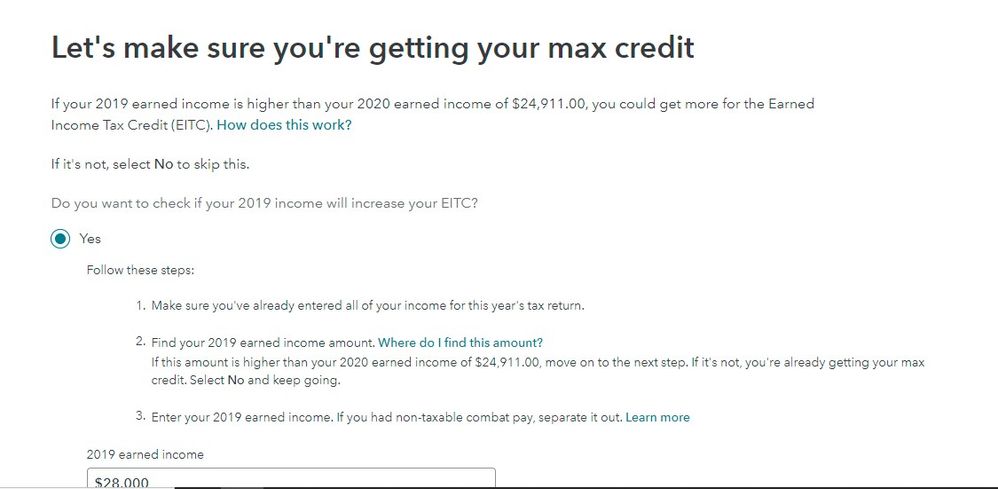

Actually the non combat pay is not considered unless you opt to include it for the EIC & CTC credits not the other way around. The program will automatically choose the better option for you. This year you will have the option to enter the 2019 earned income & combat pay to potentially get bigger credits. Follow the interview screens carefully in the Deductions & Credits section.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

_John__

Level 2

user17537184588

New Member

Harish1

Level 1

R-CBriarwood

Returning Member

rmsaliba

New Member