- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- What amount have you been depreciating? If you have been...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

If you are not sure, I agree with pk, a tax professional may be a good idea, and be sure to bring your tax return from the year of the 1031 exchange (specifically, Form 8824).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

It is complicated, especially if you had boot at the original time of performing the exchange. Assuming that you used TurboTax ( preferably the CD version i.e. everything is on your computer) and that you have continued throught the years to diligently use TurboTax for filing your returns including the rental income --- all you have to do is tell Turbo, the rental property has been disposed off -- it will ask questions and figure out the taxes for you.

If you did not use Tubro through all these years and/or did not enter the exchange details into Turbo at that time, I would suggest go seek professional help and take with you the original QI ( Qualified Intermediary) report of the exchange and the following years of returns -- to make sure that everything tracks.

I have done it i.e. 1031 property disposed off , but I had everything all lined up over the years , but I still had to go over with a spread sheet to make sure I am not missing anything.

Good Luck

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

If you are not sure, I agree with pk, a tax professional may be a good idea, and be sure to bring your tax return from the year of the 1031 exchange (specifically, Form 8824).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

It is complicated, especially if you had boot at the original time of performing the exchange. Assuming that you used TurboTax ( preferably the CD version i.e. everything is on your computer) and that you have continued throught the years to diligently use TurboTax for filing your returns including the rental income --- all you have to do is tell Turbo, the rental property has been disposed off -- it will ask questions and figure out the taxes for you.

If you did not use Tubro through all these years and/or did not enter the exchange details into Turbo at that time, I would suggest go seek professional help and take with you the original QI ( Qualified Intermediary) report of the exchange and the following years of returns -- to make sure that everything tracks.

I have done it i.e. 1031 property disposed off , but I had everything all lined up over the years , but I still had to go over with a spread sheet to make sure I am not missing anything.

Good Luck

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

Maybe I am overthinking this.

During the disposition I incurred expenses to repair the property. Where is that entered?

Also I did not see where to enter into the dialog of disposition.

Thanks, Fred

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

On the Sch E as repairs just like usual.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

To make sure I am in the right mindset.

1. Since the house was sold, I don't need to add anything to the depreciation schedule, correct?

Cause it won't be depreciated.

2. When I "tell" Turbo Tax it was sold it will launch the form 4797?

Thanks, Fred

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

Assuming you have been using Turbotax since "at least" the tax year of the exchange, and further assuming you entered all data correctly in the year of the exchange, the program has been tracking all that for you, including depreciation. All you have to do is use the program the way it is designed and intended to be used for reporting the sale. The program takes care of all the math "for you". The below guidance is provided.

Reporting the Sale of Rental Property

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion.

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will have a selection on it for "I sold or otherwise disposed of this property in 2019". Select it. After you select the "I sold or otherwise disposed of this property in 2019" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even it it's zero. Then you MUST work through the "Sale of Assets/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1

Basically, when working through an asset you select the option for "I stopped using this asset in 2019" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

Thank you so very much for all the insight and pointing me in the proper direction. I'm convinced, right now, that I have my head firmly wrapped around the process.

Cheers, Fred

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

Glad you have a grasp on this now. But do remember, the only stupid question is the one you didn't ask. So if in doubt, by all means ask!

Now I myself am not knowledgeable on 1031 exchanges. But since that was done years ago the cost basis was determined at that time. So reporting the sale now really shouldn't be any different from a "normal" purchase style acquisition.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

Hopefully you are correct.

My concern centers about the fact this property was acquired via a 1031 exchange in 2012 (in CA) from a property acquired in 1990 (in OR). A lot of water has passed under the bridge. I never do things simple.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

But since that was done years ago the cost basis was determined at that time. So reporting the sale now really shouldn't be any different from a "normal" purchase style acquisition.

This is a true statement ... the work on the 1031 exchange happened in the year of the sale/purchase ... now it is simply treated as a regular sale ... don't make it harder than it is. If you did not properly report the sale/purchase then seek local professional assistance ASAP.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

Fear not, it was all done properly through a 1031 Exchange Company and I have a ream of paper to prove it. 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

"properly done " as in the TT system is what I meant ... not thru the third party facilitator.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

Hope so and we shall see. I entered everything in TT when I purchased the first property and was using the depreciation schedule, etc. Again for the second property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to sell rental property I acquired thru 1031 exchange, how do i figure the tax due on sale of the property?

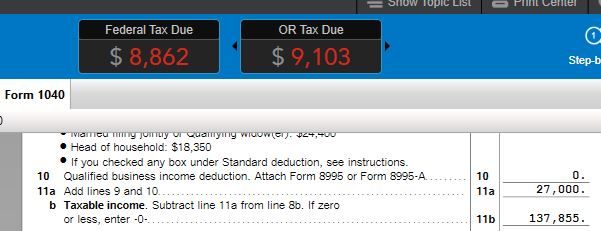

All the data is in and there are no errors, EXCEPT for the one below.

Obviously I owe more than $8862 on a Taxable Income of $137,855, more like $34K.

The Oregon Tax is within reason, but the CA Tax is worse it is $0.

My methodology was to copy my 2019 return to a new folder and use step by step to enter/update the data.

Any clues as where to start?

Thanks, Fred

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

elgato81

Level 2

benzaquenbills

New Member

freedom_111_07

New Member

user17515633536

New Member

skylarmckenzie60

New Member