- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

Thanks, they both have identical packaging and don't mention your comment - I will look closer. thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

I have a Partnership ( 3 members) with just 1099 Investment Income that I need to file a return for with the associated 3 K-1s. My tax account retired and was hoping to do on my own.....what is the best product for me to purchase to complete along with my personal returns??

Thoughts Suggestions??

Mark 257

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

Please visit our product comparison page where you will see a description for each TurboTax product offered online and for desktop along with the pricing. If you are unsure which product is right for you, click: Help me choose. From there you can tell us about your situation and we'll recommend the right tax solution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

Can turbo tax business be used to file 1040 as well

what is the person is having W2, 1099misc and 1065 (from rental multimember llc) ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

TurboTax Business does not handle the preparation and filing of personal returns. You would need TurboTax Home & Business or any other version of TurboTax, in order to prepare and file your individual tax return Form 1040.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

Thank you for the great information..very helpful.

I do want to clarify for my situation:

I have a LLC with a full paid property (paid cash, no lender) as a rental property. I understand that I must report the rental income on the Sch E and the rental expenses.

However, for all the improvements, furniture, etc., that I purchased for the property to get it 'rental ready', I was reporting on Sch C.

Is that correct? Or do I list everything as rental expeses?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

An LLC with only one member is a disregarded entity and you would file everything on the Sch E unless you are providing substantial services, then you use Sch C. Schedule C is also used for renting personal items as a business, like your car or boat.

An LLC with more than one member is a different story. If you are married and in a community property state, you can still file the sch E. Otherwise, you are in a partnership.

See:

IRS LLC - classifications

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

Can I use the Sch C to list depreciating business assets, i.e., everything that I purchased for the property (Funiture, appliances, etc.)

Also, list utilities, repairs, improvements, etc..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

Assuming you are a single-member LLC and filing on Schedule E, all those items are indicated on Schedule E and in the Rental topic in TurboTax as an expense/asset.

List each of the appliances/furnishings separately as an asset with the cost for each that you paid. You will be asked the date you acquired each and you will be asked the date you put them into service. The date you put them in service can be no earlier than the date the property was offered/available for rent. On the other hand the date acquired could be before the date available for rent.

Once you put them into service and assuming you did not use the property for something else after that date in 2023, be sure you indicate that the business use was 100%.

The other asset you will need to list is the property itself/with improvements. Your tax/purchase paperwork should have a breakdown of the cost for building and the land. You will be asked to separate out the two costs; the land cost is not depreciable.

Any improvements to the property like an add-on room/new roof, prior to putting it into service (available for rent), you add to the cost of the property. Again you will be asked the date you acquired and the date in service (available for rent). If, for example, you gutted the property and remodeled, then the whole project is a cost that is added to the cost of the building and acquired prior to the in service date.

Any improvements made after the date in service are listed as a separate asset.

Also, once you put them into service and assuming you didn't use the property for anything else after that in 2023, be sure you indicate that the business use was 100%.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

If I use the Rental property section in TT, then once your expenses go past the income, the net result is zero, and cant use any more expenses/depreciated assets.

With listing the assets as business assets, I get more depreciated deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

I think that you are saying that if you enter additional expenses into the rental property section, that the tax return only reports $0.

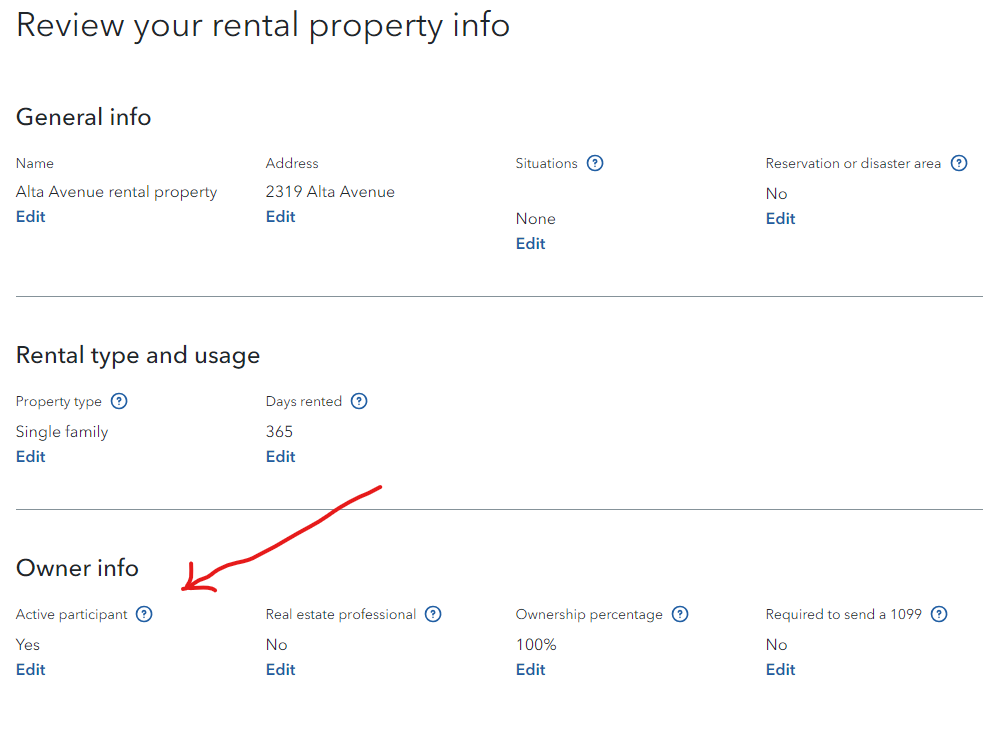

If so, you may want to review your answer as an active participant in the property.

If you qualify as an active participant, you may be allowed to offset some or all of your rental losses against nonpassive income.

The hyperlink How does being an active participant affect me states:

Generally, the active participation rules allow those in a real estate activity to offset up to $25,000 of rental losses each year against nonpassive sources. There are limitations, of course, and the key to qualifying is the requirement to "actively participate" in the rental activity.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

Yes, I'm Actively participating.

I am claiming the Rental Property income and expenses, which give me a net zero return.

I claim the property as an Asset, for which, I get the Depreciation.

I guess the direct question is:

Can I claim the assets as Business Assets (not the property iteself) under sch C that are used in the rental property? Doing so, I get depreciated value deductions. Claiming such assets on Sch E (as an expense) does nothing since I've already reached net zero.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

No you can't claim sch C. Sch C is for a real business (not a hobby) with the required time investment. Rentals are sch E unless you offer substantial services. If you have the required time, then you are a professional and take all deductions on sch E. Having an LLC just means you filled out some paperwork. It doesn't prove to the IRS that you are putting in real time and effort. Active participation takes little time.

There is a big difference between active participation and running a business.

You may be able to deduct up to $25,000 of losses from a Schedule E if you Actively Participate in the rentals.

Active participation: You actively participated in a rental real estate activity if you (and your spouse) owned at least 10% of the rental property and you made management decisions or arranged for others to provide services (such as repairs) in a significant and bona fide sense. Management decisions that may count as active participation include approving new tenants, deciding on rental terms, approving expenditures, and other similar decisions.

For more information please see: IRS Publication 527

If you want a bigger deduction, more time involved running the business is required. To surpass the $25,000 passive limitation, you must meet the requirements of a professional with real estate. It does not mean you are a sales agent, it is asking about the time involved. If you are putting in the time, you can take additional losses. Otherwise, you max out at $25,000 for loss.

The IRS offers this comparison: Earning side income: Is it a hobby or a business?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

It is a business - I rent the property and advertise as such. Purchased and Maintain the property as a rental under a LLC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We have an LLC for a personal business and rental properties. Which version of turbo tax should we use?

LLC means nothing here. It is about the time you spend on the activity. You don't qualify for a sch C with rental property. Let's try official IRS here.

A house is not your personal property, like your car. You use sch E.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

misschristian0711

New Member

fieldsmichelle70

New Member

Pmh-co-unltd

New Member

jlfarley13

New Member

TaxesForGetSmart

Level 1