- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

I think that you are saying that if you enter additional expenses into the rental property section, that the tax return only reports $0.

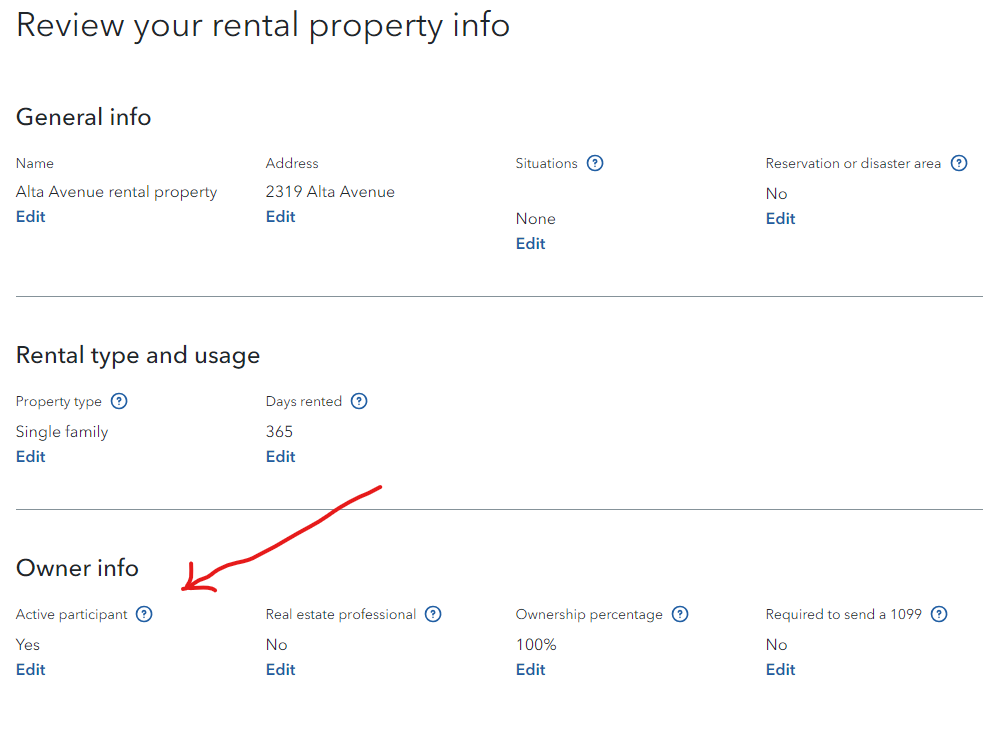

If so, you may want to review your answer as an active participant in the property.

If you qualify as an active participant, you may be allowed to offset some or all of your rental losses against nonpassive income.

The hyperlink How does being an active participant affect me states:

Generally, the active participation rules allow those in a real estate activity to offset up to $25,000 of rental losses each year against nonpassive sources. There are limitations, of course, and the key to qualifying is the requirement to "actively participate" in the rental activity.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 18, 2024

8:08 AM