- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Virginia Return with PTET Credit not available for E-File

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Return with PTET Credit not available for E-File

Update: Realized after original posting that I posted this question is the wrong forum. Reposted question in the State Filing forum here:

https://ttlc.intuit.com/community/state-taxes/discussion/turbotax-online-virginia-individual-return-...

Please disregard/delete this one.

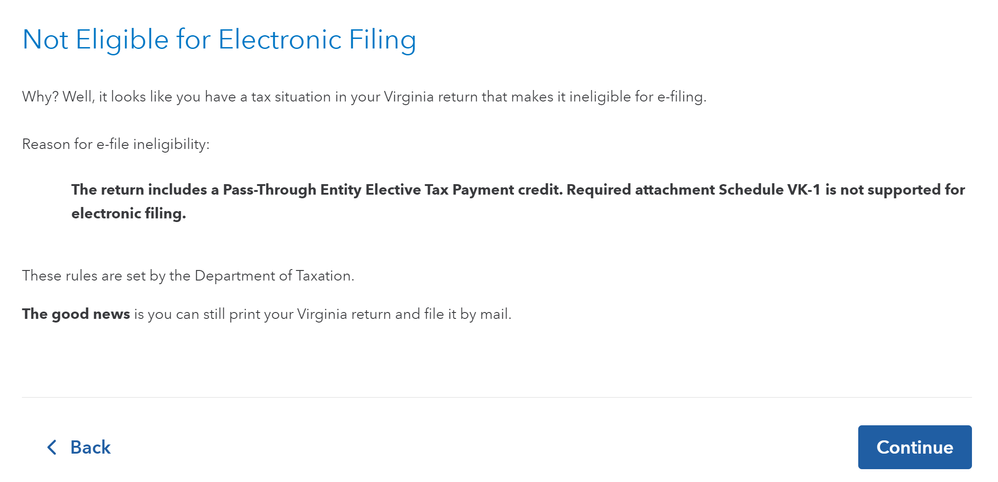

TurboTax Online is telling me that my individual Virginia tax return is not available for e-file due to the fact that I have a Pass Through Entity Tax (PTET) credit. The error message states, "The return includes a Pass-Through Entity Elective Tax Payment credit. Required attachment Schedule VK-1 is not supported for electronic filing." See screenshot below:

The error message appears to be correct about the fact that the VK-1 form is required to be attached to the return when claiming a PTET credit, per Virginia's Schedule CR instructions:

"Pass-Through Entity Elective Tax Payment Credit: Enclose Form 502 Schedule VK-1."

https://www.tax.virginia.gov/sites/default/files/taxforms/individual-income-tax/2023/schedule-cr-202...

However, I couldn't find any documentation on Virginia's website stating that a VK-1 form can't be attached to a return when e-filing.

Is there really no way for me to just upload my VK-1 to TurboTax and have TurboTax include it as an attachment to the e-filing? If not, can this functionality be added? I'd really like to avoid having to print out and physically mail my return in because I'm sure I'll mess something up. One of the reasons I paid for the Premium edition of TurboTax Online is to make filing convenient and somewhat idiot proof. This scenario seems like something that should be supported.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Return with PTET Credit not available for E-File

There is not a way to include an attachment to an e-file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Return with PTET Credit not available for E-File

Will TT fix this in the future? Seems like a box could be checked on the VK-1 to say "Include This Form with the Tax Return." Likewise this would be good for Maryland, as I always have to file paper because the MD K-1 is not auto included.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Return with PTET Credit not available for E-File

I had a similar problem with trying to e-file my Virginia State Return. It wouldn't let me e-file because I had a 1099-DIV. I have e-filed with this form in past years and had no problems. I talked with someone at the Virginia Department of Taxation and they told me that they have not made any changes in the Virginia Tax code and e-filing with a1099-DIV should not be a problem. Your situation seems to indicate that there is something wrong with Turbo Tax. I have spoken to them several times but they won't admit a problem at their end and only blame Virginia. As you expressed, this is very frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Return with PTET Credit not available for E-File

That's odd, because 1099s do not get transmitted with the e-file. You'll notice on the 1099-DIV form in TurboTax, it says in small print "Keep for your records." The amounts are included in the appropriate lines on the return, but the actual 1099 doesn't get submitted. The vendor that issued it must submit them to the IRS. It seems there is some other reason your e-file is not going through.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Return with PTET Credit not available for E-File

Can you clarify what the rejection you are receiving? Are you getting a rejection or is it causing issue at the review process?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Return with PTET Credit not available for E-File

i.e. filed my federal tax return with no problems and already got my refund. In your system I got a message that my return is not eligible for e-filing in Virginia. There is also a problem when I click on the run review again button. It only cycles and then does not do the review a second time. One message says not eligible for e-filing. “The return includes withholding from sources, other than the following forms…(several acceptable forms are then listed) “ forms 1099B, 1099DIV and 1099OID in addition to other types of tax withholdings are not supported for electronic filings”.

Then when I try to e-file I get the following message:” Virginia Return. this return is in a tax situation that does not allow you to e-file. You’ll need to print and file your return by mail”

I have spoken to three of your tax experts. One of whom spent about 40 minutes with me, trying to figure out the problem and finally stated it was due to a change with the Virginia Department of taxation. I spoke with Virginia Department of taxation and they said that it’s not true and there should not be a problem with the filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Return with PTET Credit not available for E-File

If there is a PTET credit, then Virginia requires a VK-1 to be attached to the return. Since this error is specifically due to TurboTax not including the form with the e-file transmittal, you have no choice but to print on paper and send the return in. I did this last year and although it takes longer to process and is not ideal, just consider it a throwback to an earlier time. Bummer that this is still a thing. Someone at TT should read this and fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Return with PTET Credit not available for E-File

We are currently looking into the issue. Thank you for your patience.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

blueeaglewenzl

New Member

user17555657897

New Member

trenton-mains

New Member

bpinto1979

New Member

latdriklatdrik

New Member