- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Return with PTET Credit not available for E-File

Update: Realized after original posting that I posted this question is the wrong forum. Reposted question in the State Filing forum here:

https://ttlc.intuit.com/community/state-taxes/discussion/turbotax-online-virginia-individual-return-...

Please disregard/delete this one.

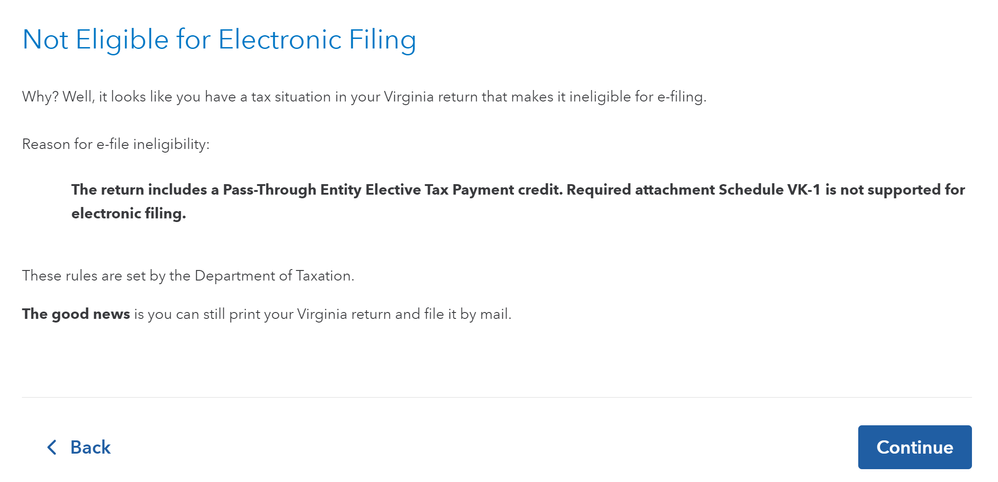

TurboTax Online is telling me that my individual Virginia tax return is not available for e-file due to the fact that I have a Pass Through Entity Tax (PTET) credit. The error message states, "The return includes a Pass-Through Entity Elective Tax Payment credit. Required attachment Schedule VK-1 is not supported for electronic filing." See screenshot below:

The error message appears to be correct about the fact that the VK-1 form is required to be attached to the return when claiming a PTET credit, per Virginia's Schedule CR instructions:

"Pass-Through Entity Elective Tax Payment Credit: Enclose Form 502 Schedule VK-1."

https://www.tax.virginia.gov/sites/default/files/taxforms/individual-income-tax/2023/schedule-cr-202...

However, I couldn't find any documentation on Virginia's website stating that a VK-1 form can't be attached to a return when e-filing.

Is there really no way for me to just upload my VK-1 to TurboTax and have TurboTax include it as an attachment to the e-filing? If not, can this functionality be added? I'd really like to avoid having to print out and physically mail my return in because I'm sure I'll mess something up. One of the reasons I paid for the Premium edition of TurboTax Online is to make filing convenient and somewhat idiot proof. This scenario seems like something that should be supported.