- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

I have a sale from a PTP. In the sales worksheet of the K-1, there is a value in column 7, Gain Subject to Recapture as Ordinary Income. This value is supposed to be entered on Form 4797 Part II Line 10. However, nothing is in Part II. The total amount, $4321, is the same as the K-1s box 20AB, Section 751 Gain, totaled from 3 separate passive activities within the Energy Transfer Partnership. I cannot fill in the Form 4797 manually and I obviously haven't done something right to enter the information accurately. Where should the information come from or be entered to fill it in properly using TurboTax Deluxe?

The K-1 instructions for column 7 say "Column 7: The instructions to Form 8949 are unclear in the determination of capital gain where total gain on the sale of units is partially ordinary gain. Reporting this amount as a negative adjustment in Column G of Form 8949 should generally result in the correct capital gain or loss. The amount reported as ordinary gain is qualified PTP income for Section 199A and has not been included in the amount reported on Schedule K-1, Line 20Z. If you have ordinary gain, a Section 751 Statement (refer to the Individualized Income Tax Reporting Package & Instructions) must be attached to your return."

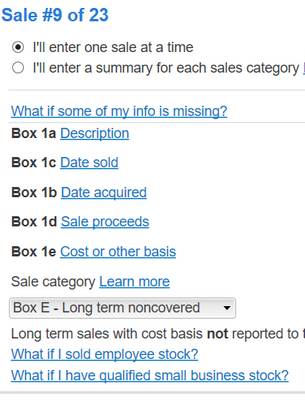

I understand this amount, $4321, is also 199A income, even though it is not a K-1 box 20Z value. When I called the partnership I was told only to use box 20Z for 199A income (they did not include a Statement A). $4321 is the same value as box 20 AB, Section 751 Gain, which I did enter as I went through the K-1 interview. Actually, there are 3 separate passive activities so the total of the 3 20 ABs is $4321. However, at the interview screen called "We need some information about your 199A income", I have only entered the 20Z Section 199A PTP Income (actually loss). Do I add this Section 751 Gain at this screen, maybe under the Total ordinary 4797 gain/loss included above?? Once Form 4797 does have a Part II value, would this belong in the 199A income?

Are there other adjustments that I need to make in the Deluxe version that do not automatically get handled by TurboTax for the sale of PTP units, or the entry of K-1 boxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

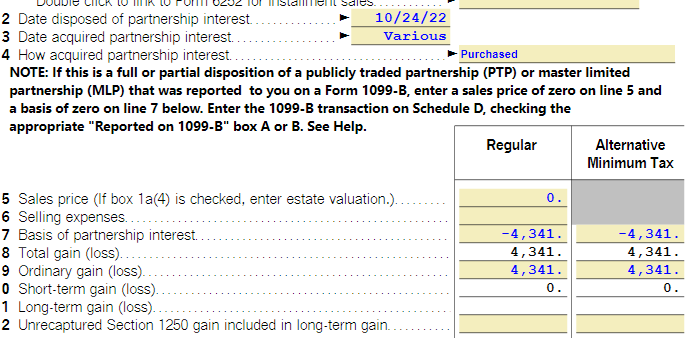

There's a screen during the interview that asks you about the sale of the MLP ("Enter Sale Information"). There are rows for sale price, selling expense, basis, and Ordinary Gain. The Ordinary Gain row is where you enter the "Gain Subject to Recapture". TT will then transfer it to Form 4797.

Note, you have to set Sale Price and Selling Expense to $0, and set the Basis to the inverse of whatever you enter for Ordinary Gain (e.g., if you have $43 for 'Regular', and $40 for AMT, you'd enter -43 and -40 for basis). You do this to prevent TT from calculating any Cap Gain or Loss for this K-1.

You report the Cap Gain by adjusting the cost that came to you on the 1099-B from your broker. The correct cost will be the adjusted cost shown on your Sales Schedule + the Ord Gain.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

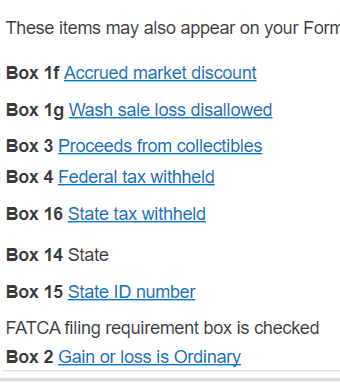

Where is this screen in the interview? It is not under the K-1 entry. Would it be in the 1099-B entry? These are the fields for a single sale entry on the 1099-B interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

@taxquestions44 When you start the K-1 interview, there's a "Describe the Partnership" screen. Since you sold some of your partnership, check the box for "Disposed of a portion of my interest..." On the next screen ("Tell us about your sale") you'd check "Sold Partnership Interest". That will prompt TT to ask the K-1 sales questions.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

Your response was super helpful! Thank you. I am still wondering about the second part of my post, 199A income. I understand the $4341 Gain Subject to Recapture as Ordinary Income in the Sales Worksheet, and now in Form 4797 Part II, is 199A income. The K-1 field for 199A income entries is below. Maybe the amount now in Part II of Form 4797 is to go into the Total Ordinary Form 4797 gain box seen below? However, the instructions for that box (learn more) are below the screen shot. There are no values in 11 I on the K-1 and there is no Statement A. There is a K-1 box that matches the $4341 and that is 20 AB, Section 751 Gain. But that category is not listed below as a field to fill in, and I did already enter 20 AB into the Turbo Tax fields as I entered all the boxes values. But then I had already entered the ordinary income from 20Z too, and I'm adding that again below.

Ordinary gain/(loss) on Form 4797 included in qualified business income (QBI)

If your Schedule K-1 reports ordinary gain/(loss) on Form 4797, this will need to be separately identified as part of the QBI on Statement A. (Ordinary Form 4797 gains/losses are gains from the sale of business assets that are treated as ordinary income rather than capital gains.) These ordinary gains/losses would be found in Box 11 with a code I on a partnership Schedule K-1 (Form 1065), or in Box 10 with a code H on an S Corporation Schedule K-1 (Form 1120S).

These gains/losses are not usually separately stated on Schedule K-1, but if they are separately stated, and if any business activity (including the sale of business assets) has a net loss, it may be necessary to separately state the ordinary gains/losses included in QBI on Statement A to insure an accurate result. You may need to contact the K-1 preparer to find this information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

@taxquestions44 TT is doing very little to make this simple. In this case, the $4341is the same as the "Ordinary Form 4797 Income" on your screen shot below. Note that the text on that line mentions "included above". So you also add that $4341 to the amount you're putting into the "Ordinary business income (loss)" line. Typically, the amount reported on line 20Z is what goes there, so you'd add the 2 together.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

Thank you. Is it okay that one value is negative and the other positive? I just subtract the PTP Ordinary Business Loss from the 4797 income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

@taxquestions44 Yes.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

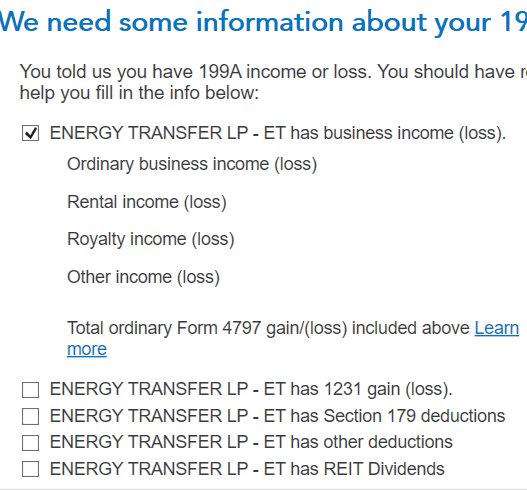

Again, thank you. As a result of the 2 processes that I've added now; the addition of the sale information and the additional amount from form 4797 (Section 751 Gain), I've seen a number of other changes. I am hoping they are okay, but I want to confirm.

Before I go any further though, I realize I have a potential problem. Energy Transfer had 3 activities: Energy Transfer-ET, -USAC and -SUN. I've been splitting the amount that went to form 4797 (section 751 gain) between the 3 activities because they are already split on the K-1. While the sales worksheet does NOT split the sale, nor does the 1099-B, I am thinking I should just split the sale information between the 3, just like the 751 gain since they are the same money values (or at least if I add the 751 gain values, the sum is equal to the Ordinary gain on the Sales Worksheet. So far I just tried this for the largest of the 3 activities and the following is what I found in changes.

1. There is a new line on Schedule E called PYA (prior year unallowed losses) below the matching entity's PTP line. Now in Part II, line 28, there is a value in Passive Income and Loss (matching the section 751 gain) added to the 199A PTP income. This now results in a Total partnership loss on line 32 of ~3900. Likewise, on the K-1 worksheet there is a PYA line with the loss.

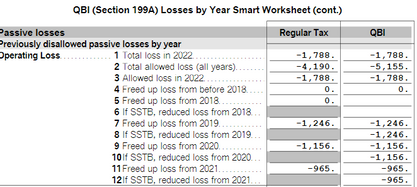

2. Apparently, these steps resulted in "Freed up loss" from previous years that I see on the Turbo Tax K-1 form, at least for the first and largest of the 3 activities (Energy Transfer - ET) that had a-1,788 ordinary PTP loss. (The other 2 have a -5 loss and 34 gain.)

3. I do wonder about the QBI column above, because I have specified NO to SSTB for every year, yet there is information in the If SSTB boxes. This is from the K-1 now, where I'm seeing the freed up loss. My understanding about PTPs is that losses cannot be recovered unless it is a total sale, and this was not.

4. Below is from an additional K-1 form that has the sale with the inverse of the gain in the partnership box as a loss, as you said to enter into the interview for the sale. This form is indicating that this box 7 should be 0. Is what is below okay?

It seems like every time a change is made, other questions come up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

@taxquestions44 I'll try to hit each of your questions:

- Losses from prior years can be freed up either through a complete sale, or when the partnership earns income. The "Ord Income" reported as part of your sale counts as income from the partnership, so its allowed to free up losses. Those allowed losses will show up on Sched E

- Splitting the Ord Income between USAC, SUN, and ET is correct. You're not allowed to let losses/income from one PTP be combined with a different one, so each has to be handled separately.

- If you look at the K-1 worksheet for each partnership, "Section A" shows you current year income and losses, and makes it clear what's flowing where.

- I'm not sure why those SSTB lines are showing up. You'd have to check prior year returns to see if something was entered incorrectly, or if there's a bug with TT's carryover routine.

- On Q4, that bold text is part of TT's bug: its only right if you have no Ord Gain. The way you entered it is correct.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

Thank you again. I feel more comfortable now, except for the SSTB. The K-1 table says 0% for all SSTB possibilities (year and category). I'll look into that further.

I have gone back through this sequence and found a comment on the first response that I am not sure if I've addressed properly. "You report the Cap Gain by adjusting the cost that came to you on the 1099-B from your broker. The correct cost will be the adjusted cost shown on your Sales Schedule + the Ord Gain." I did report incorrect basis in the 1099-B interview for the sales and entered the new basis from the Sales Worksheet Average Cost Basis column 6. This column says it's value "belongs" on for 8949 column E. There were 2 sales on the same date so I split the value on the sales worksheet between those 2 sales based on # units sold. Right now the 1099-B Capital Gain Adjustments Worksheet for the larger sale has the Gain value as the Sales Price minus the adjusted Cost Basis. It does not include any ordinary income. This is Part 1, Values for Form 8949. Form 8949 has proceeds (d), cost basis (e) that I changed, and 0 in (g), amount of adjustment. Should I be putting something in g? if so, how - back to the 1099-B interview? Above you have Ord Gain (which I assume is the same Recapture Ordinary Income I've been working with from column 7). There is also a col 8 value that says Amt Gain/Loss Adjustment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

@taxquestions44 An example:

You sell for $100

You bought for $80

The K-1 tells you that your Cumulative Adjustments are -35, so your cost basis is 80-35 = 45.

So you have a profit on the sale of $55.

The $55 profit isn't all taxed at Capital Gain rates. Some of it is taxed at "Ordinary" rates. The K-1 tells you that $25 is "Ordinary Gain" (or Gain subject to recapture.... Same thing). So you should report $25 on form 4797 to be taxed at Ord Rates, and $30 on the 1099-B to be taxed at Capital Gain rates. The way you get $30 to show up on the 1099-B is to make your cost = 80-35+25 = $70.

Assuming the 1099-B from your broker was code B or E (meaning cost was not reported to the IRS), you can just change the cost in either the interview or directly on the form.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

So the profit, $65, is the Sales proceeds/sale price minus the cumulative adjustments to basis, $35, rather than the sale price minus the cost basis, $45?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

I am correlating your $100 with the Sales Proceeds on the Sales Worksheet column 3, as well as the 1099-B column 1d. I'm correlating your $80 with the Sales Worksheet column 4 and 1099-B Cost or other basis column 1e. In my case, that leaves a $3684.74 Realized loss.

Side note: There are 2 sales so I'm splitting everything for all calculations between them from the Sales Worksheet that only has the total values. There HAS to be a better way.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Steps in Turbotax Deluxe to report a PTP sale correctly for the Sales Worksheet and K-1

@taxquestions44 I shouldn't math early in the morning. I've edited my post above to fix the error and correctly state the profit. Sorry for the confusion.

I can't really match the numbers to columns in a sales schedule, since the schedules can be different. But the purpose of the example is to show you how to think about the problem. Once you know what the tax law expects / requires, its easier to a) find the info you need on the K-1 and b) make sure that what TT calculates is correct.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Micky2025

New Member

kkrana

Level 1

jshuep

Level 2

user17548719818

Level 2

VAer

Level 4