- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Again, thank you. As a result of the 2 processes that I've added now; the addition of the sale information and the additional amount from form 4797 (Section 751 Gain), I've seen a number of other changes. I am hoping they are okay, but I want to confirm.

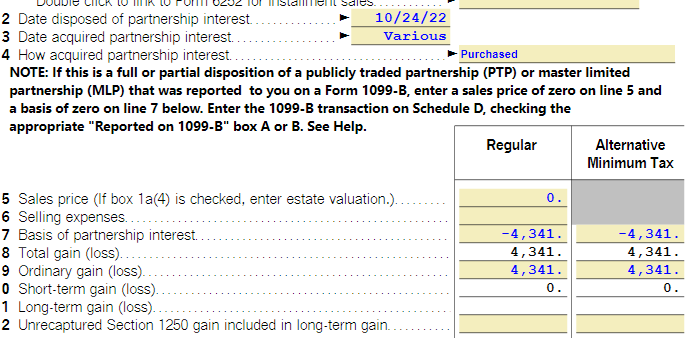

Before I go any further though, I realize I have a potential problem. Energy Transfer had 3 activities: Energy Transfer-ET, -USAC and -SUN. I've been splitting the amount that went to form 4797 (section 751 gain) between the 3 activities because they are already split on the K-1. While the sales worksheet does NOT split the sale, nor does the 1099-B, I am thinking I should just split the sale information between the 3, just like the 751 gain since they are the same money values (or at least if I add the 751 gain values, the sum is equal to the Ordinary gain on the Sales Worksheet. So far I just tried this for the largest of the 3 activities and the following is what I found in changes.

1. There is a new line on Schedule E called PYA (prior year unallowed losses) below the matching entity's PTP line. Now in Part II, line 28, there is a value in Passive Income and Loss (matching the section 751 gain) added to the 199A PTP income. This now results in a Total partnership loss on line 32 of ~3900. Likewise, on the K-1 worksheet there is a PYA line with the loss.

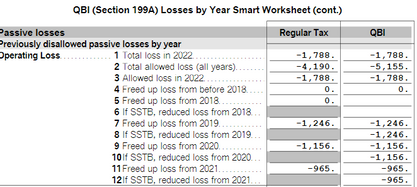

2. Apparently, these steps resulted in "Freed up loss" from previous years that I see on the Turbo Tax K-1 form, at least for the first and largest of the 3 activities (Energy Transfer - ET) that had a-1,788 ordinary PTP loss. (The other 2 have a -5 loss and 34 gain.)

3. I do wonder about the QBI column above, because I have specified NO to SSTB for every year, yet there is information in the If SSTB boxes. This is from the K-1 now, where I'm seeing the freed up loss. My understanding about PTPs is that losses cannot be recovered unless it is a total sale, and this was not.

4. Below is from an additional K-1 form that has the sale with the inverse of the gain in the partnership box as a loss, as you said to enter into the interview for the sale. This form is indicating that this box 7 should be 0. Is what is below okay?

It seems like every time a change is made, other questions come up.