- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

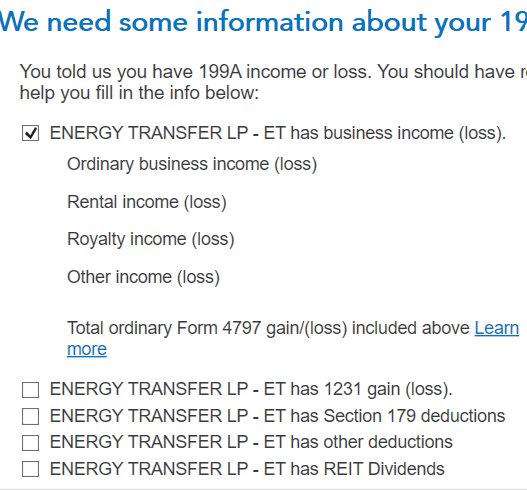

Your response was super helpful! Thank you. I am still wondering about the second part of my post, 199A income. I understand the $4341 Gain Subject to Recapture as Ordinary Income in the Sales Worksheet, and now in Form 4797 Part II, is 199A income. The K-1 field for 199A income entries is below. Maybe the amount now in Part II of Form 4797 is to go into the Total Ordinary Form 4797 gain box seen below? However, the instructions for that box (learn more) are below the screen shot. There are no values in 11 I on the K-1 and there is no Statement A. There is a K-1 box that matches the $4341 and that is 20 AB, Section 751 Gain. But that category is not listed below as a field to fill in, and I did already enter 20 AB into the Turbo Tax fields as I entered all the boxes values. But then I had already entered the ordinary income from 20Z too, and I'm adding that again below.

Ordinary gain/(loss) on Form 4797 included in qualified business income (QBI)

If your Schedule K-1 reports ordinary gain/(loss) on Form 4797, this will need to be separately identified as part of the QBI on Statement A. (Ordinary Form 4797 gains/losses are gains from the sale of business assets that are treated as ordinary income rather than capital gains.) These ordinary gains/losses would be found in Box 11 with a code I on a partnership Schedule K-1 (Form 1065), or in Box 10 with a code H on an S Corporation Schedule K-1 (Form 1120S).

These gains/losses are not usually separately stated on Schedule K-1, but if they are separately stated, and if any business activity (including the sale of business assets) has a net loss, it may be necessary to separately state the ordinary gains/losses included in QBI on Statement A to insure an accurate result. You may need to contact the K-1 preparer to find this information.