- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Land entry as asset

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land entry as asset

How do I enter Land as an asset, like building? When I select Land as Residential Rental Property the sale ends up on F4797 in Part and I read it should be in Part 1 (with no depreciation taken)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land entry as asset

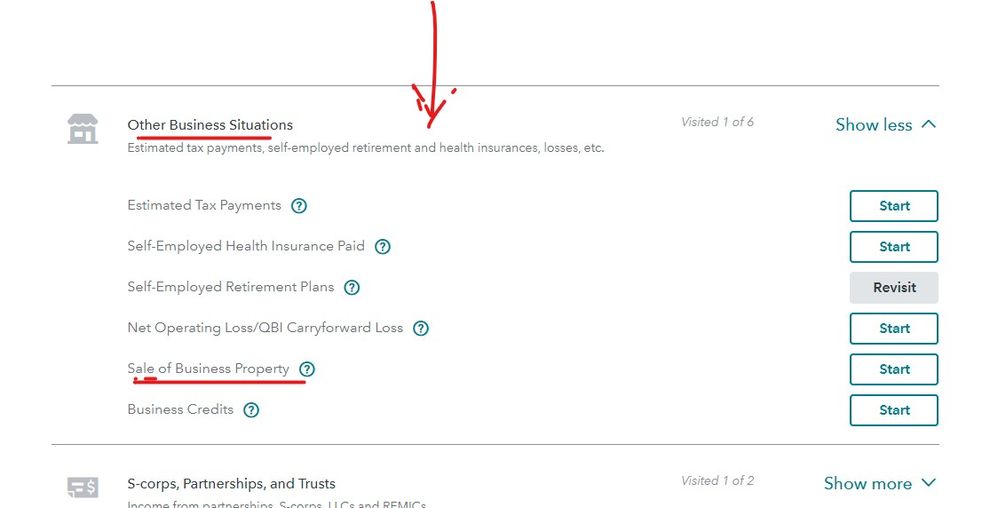

Enter your land sale in Sale of Business Property

- Type sale of business property in Search in the upper right

- Select Jump to sale of business property

- On Any Other Property Sales? check "Sales of business or rental property that you haven't already reported."

- Say NO on Sales of Business or Rental Property

- Say YES on Sales of Other Business Property

- Follow the prompts and fill in your information. The sale will appear on Form 4797 Part 1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land entry as asset

Enter the building in the asset section and one of the screens will ask how much of the purchase price belongs to the land. Then when you sell it the program will split out the land sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land entry as asset

Should the Land portion of a Residential Rental Property sale(building + Land) need to show up on F4797 in Part I or Part III (with no depreciation taken) ? The building, roof, kitchen remodel etc show up on Part III.

I am doing this Land entry now cause I did not enter the land value in 1996 when this started as a rental property converted from personal use/residence.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land entry as asset

Yes, land should be reported in section I of the 4797 and if you did not enter the land as part of the building costs in the Sch E section to begin with then you may enter this portion of the sale in the sale of business assets later in the interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land entry as asset

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land entry as asset

THanks, but this building only asset (no land entered in 1996 when converted to rental) entry doesn't ask about land value now, that's why I think I need a separate entry for Land now that the property was sold. Should Land sale be in F4797 Part 1 or Part 3?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land entry as asset

Land sold at a profit is part I of the 4797 ... use the Sale of Business Property section later in the program for the land sale.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

shane-jeremich

New Member

orenl

New Member

congdons

New Member

HSTX

New Member

matto1

Level 2