- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

You will enter this under Income...Rentals, Royalties and Farm.

For the type of Rental, Select Other

Give the rental property a name like Third Floor Rental

Than follow the screens until you can pick Rented Part of Home

You will get to the question:

Since you rented part of your home, would you like us to automatically divide Third floor's expenses?

The easiest way is to put in the percentage of the home that is rented and let TurboTax do the math.

Enter your income and expenses for the rented portion of your home. For example if your home mortgage interest is 3,000 - enter 3,000 and TurboTax will divide it and enter $1000 for you rental expenses.

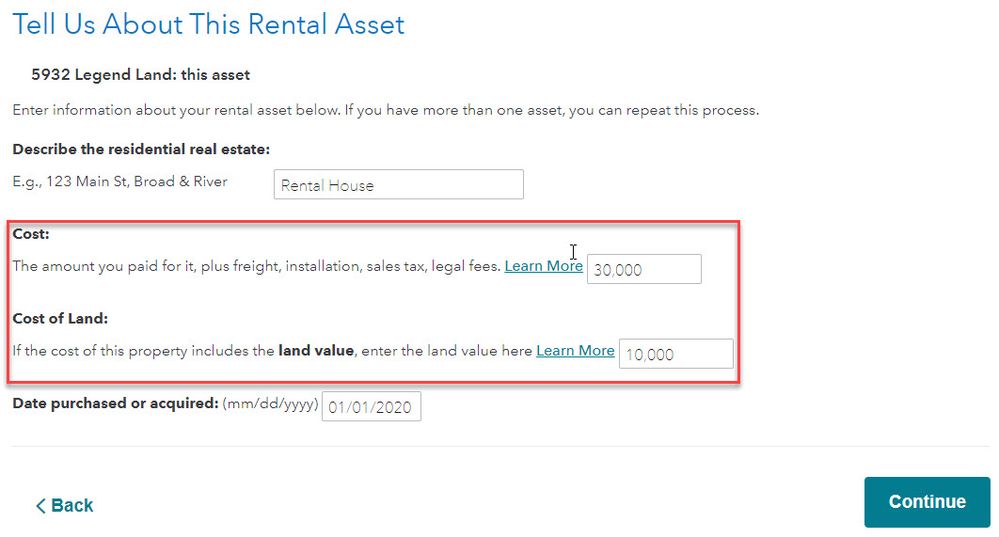

When you figure depreciation only put in the cost of the home. Do not include the land. Land does not depreciate.

Here is some rental property information from TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

Claiming depreciation is not an option. When you sell a property, the IRS requires you to add back depreciation "allowed or allowable," meaning you still have to claim depreciation on the sale even if you never claimed a deduction. The IRS says: " All allowed or allowable depreciation must be considered at the time of sale."

TurboTax will not automatically split your depreciation using the rental/personal percentage for expenses. You have to another step by either (1) only enter the rental portion of your house for depreciation or (2) entering the whole house as an asset and enter a rental percentage in that section.

Rental portion only

For example, suppose you paid $90,000 for your house, including $30,000 for land. In your case, enter 1/3 x $90,000 or $30,000 for the cost and 1/3 x $10,000 for the land. TurboTax will depreciate the rental portion of your property ($30,000 - $10,000 = $20,000) which is one third of the total house - less land.

- On the rental property info screen – select Add expense or asset

- Select Rental property

- EDIT your rental property under Assets

- Select Rental Real Estate Property

- Choose Residential Rental Real Estate

- On Tell Us About This Enter Asset, enter one-third (1/3) of the total cost and one-third of the land price. This will depreciation one-third of your property.

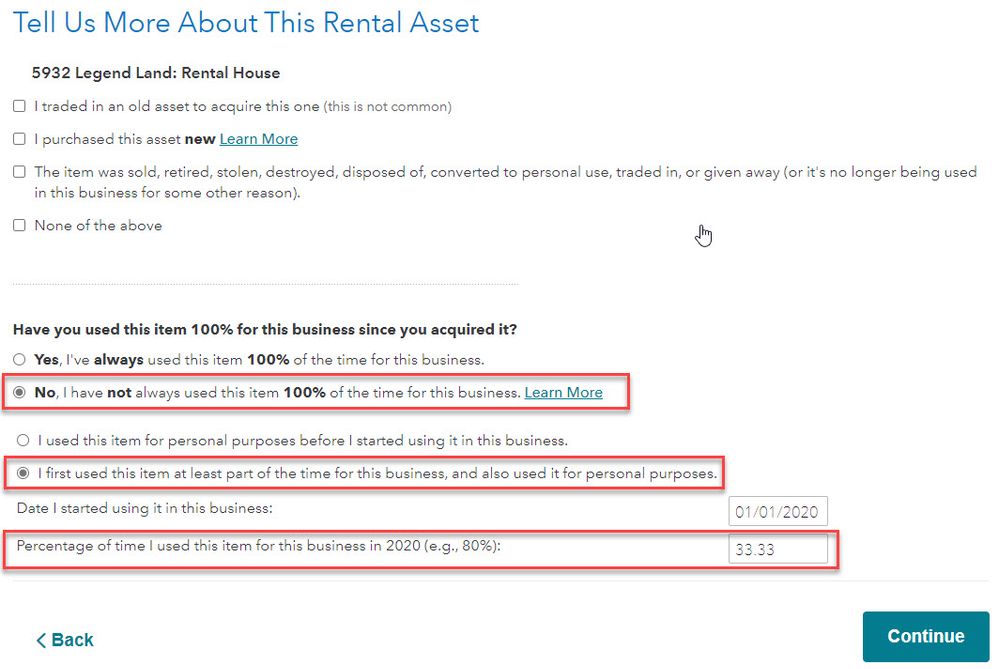

Business use percentage

Your second option is to enter the full amount for the house and enter the business percentage (33%). TurboTax will depreciate one third of the home.

- On the rental property info screen – select Add expense or asset

- Select Rental property

- EDIT your rental property under Assets

- Select Rental Real Estate Property

- Choose Residential Rental Real Estate

- On Tell Us About This Enter Asset, enter the total cost and total land price.

- On Tell Us More About This Rental Asset enter 33.33% as your business use.

Enter option will produce the same depreciation within a few dollars.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

TurboTax will not automatically split your depreciation using the rental/personal percentage

Yes it will. As you start working through the Rental & Royalty Income section of the program, you'll come to screen titled, "Do any of these situations apply to this property?" On this screen you must make three selections.

- 2020 was the first year I rented this property.

- I rent out part of my home.

- I converted this property from personal use to a rental in 2020.

Then on the screen, "Let us calculate your rental deductions for you" select YES and then enter the percentage of floor space that is exclusive to the renter.

Next, you enter the property in the assets/depreciation section. When you get to the screen titled, "Tell us more about this rental asset" you will select "I purchased this asset new", and select "No I have not always used this item 100% of the time for this business" then select "I used this item for personal purposes before I started using it in this business".

On that same screen where it asks "Percentage of time I used this item for business in 2020", you enter *not the percentage of time*, but the percentage of floor space that is exclusive to the tenant. The percentage entered here should be the same percentage you entered earlier. Then enter the date that space was converted to rental use.

Now the one thing that will not be pro-rated by the program is the property insurance. I don't know why, but I can speculate. (Won't waste your time with that.) So you will need to pro-rate the property insurance yourself.

The simplest way is to first divide the amount by 12 to get the cost of insurance per month. Then multiply that result by the number of months. Finally, multiply that result by the percentage of floor space rented.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

The specific question was "How do I set up depreciation on the portion I rent?"

As you correctly said, you have to manually enter the rental square footage percentage by yourself which is the second option Business use percentage above.

TurboTax does not automatically carry over the rental deduction percentage into “Percentage of time I used this item for this business in 2020 (e.g. 80%)."

Excellent point clarifying that percentage of time = rental square footage and that property insurance also requires a specific adjustment!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

That "percentage of time" question is the correct question *if* you are renting out the entire property. But the way the program is set up to work, if you are renting out a portion of your property that question should be "percentage of floor space". For me, this has been an ongoing thing for years. I don't know why the programmers don't fix this. But I suspect it's because fixing that problem will most likely create a number of new problems. So if the choice is to have one issue or 50 issues, I'd stick with having one issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

Thanks for the help. Your reply was spot on and I resolved the issue. Great assistance-thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

Yes. Thanks for the help!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

Does anyone know if this still works for 2021 taxes? I am not getting prompted anywhere to indicate the percentage used for my rental portion anywhere, yet I keep seeing this referred to for prior versions. Is the software bugged or am I looking in the wrong place?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

Yes, you can still enter into TurboTax your rental property depreciation for tax year 2021. Perhaps if you tell us the steps you are taking that might help us to focus on the issue. In TurboTax online, to enter rental property information, including rental depreciation,

- go to Income & Expenses,

- scroll down the page to Rentals, Royalties, and Farm,

- select Rental Properties and Royalties (Sch E),

- follow the prompts and respond to the questions

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

I select Rental properties, then enter the address info. I answer who owns it and select "Both of us"

I then select "Single Family" on the "What type of rental" it is.

I then select "First year rented, Converted home to rental or rental to home (I am under the assumption I have to select this option since the space went from being just part of our home to a rental space), Rented part of home" options.

On the how was it converted, I select "From primary residence to rental"

I then receive this note:

- If this is the first time you've used this property as rental, make sure you selected First year rented situation on the previous screen.

- In this section, only enter expenses for when the property was a rental.

- Later, in Deductions and Credits, we'll ask about your expenses when you lived in the home.

It then asks if it was rented every single day in 2021? I answered No.

For fair rented days I entered the number of days actually rented starting in August through the end of the year for those days.

It then asks me if I have an Office:

- You own at least 10% of the property

- You made major management decisions for this property such as approving tenants and authorizing repairs

It asks me if I made any payments to contractors. I clicked No

It then asks me if I have any of the uncommon situations that apply and I answered None of these apply.

It then summarizes it and allows me to click "Looks good"

I then click Continue and it prompts me for what type of income. I select "Cash, checks, Venmo/Paypal, and/or Form 1099-K"

I then enter the income

It then asks me to select the Expense categories I have.

I then can select the different expense categories and this is where the confusion lies. If I enter the mortgage interest for the whole property it seems to be deducting all of it. Is there no point where the software asks for a percentage size or sq/ft size of the rental compared to the whole home?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

TurboTax will not automatically calculate the deductible expenses based on the percentage of the rental space. You will have to calculate the deductible expenses manually and enter them into the program. @bentley311

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

I think what is being missed here is that it is not ever asking me or prompting me to put in the percentage for the rental space. That is the issue. I understand what it is "supposed" to do. The question I have is where and when will it ask me for that percentage number so that it can actually calculate these amounts based on that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

TurboTax will not automatically calculate the deductible expenses based on the percentage of the rental space.

yes it will. The issue is that the program is asking the wrong question for that specific scenario. Two times the question, "percentage of time" is asked. The first time it's asked, you enter the percentage of time it was rented starting from the date of conversion to rental. So that would be 100%.

The 2nd time the "percentage of time" is asked, that question should be "percentage of floor space". So if you enter the percentage of floor space, the program will correctly figure the allowed depreciation.

Take note that this only applies to a situation where you are renting out a part of your residence or a part of other personal use property.

This has been an issue for years, yet it's got to the point where I'm being ignored when I point it out. So be it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a home last year and rent out one third of the house. How do I set up depreciation on the portion I rent?

Where in my step-by-step prompts did I miss the section to put in these entries? I am not asked percentage of time unless I am misunderstanding something still.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

realestatedude

Returning Member

Binoy1279

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

user17524531726

Level 1

kms369

Level 2

kevin167

New Member