- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Claiming depreciation is not an option. When you sell a property, the IRS requires you to add back depreciation "allowed or allowable," meaning you still have to claim depreciation on the sale even if you never claimed a deduction. The IRS says: " All allowed or allowable depreciation must be considered at the time of sale."

TurboTax will not automatically split your depreciation using the rental/personal percentage for expenses. You have to another step by either (1) only enter the rental portion of your house for depreciation or (2) entering the whole house as an asset and enter a rental percentage in that section.

Rental portion only

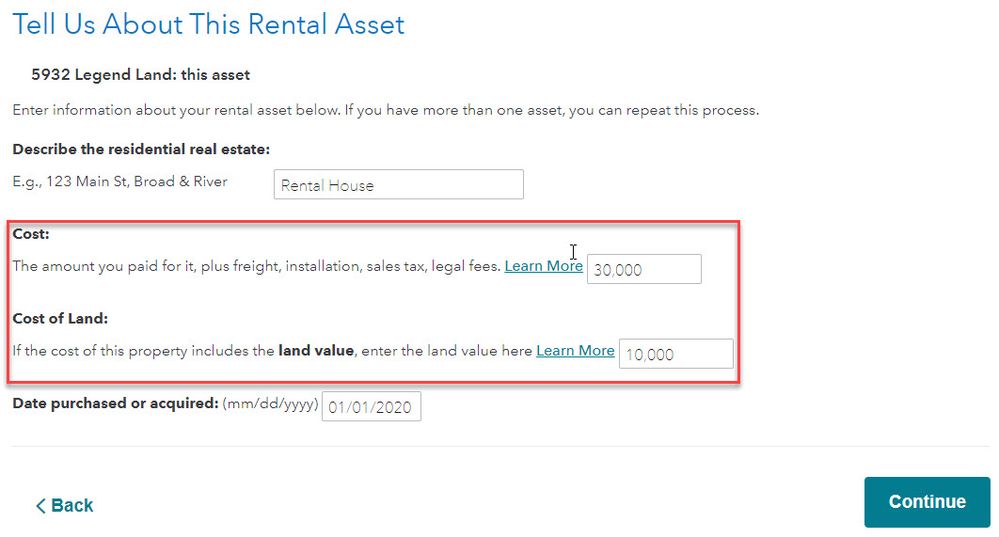

For example, suppose you paid $90,000 for your house, including $30,000 for land. In your case, enter 1/3 x $90,000 or $30,000 for the cost and 1/3 x $10,000 for the land. TurboTax will depreciate the rental portion of your property ($30,000 - $10,000 = $20,000) which is one third of the total house - less land.

- On the rental property info screen – select Add expense or asset

- Select Rental property

- EDIT your rental property under Assets

- Select Rental Real Estate Property

- Choose Residential Rental Real Estate

- On Tell Us About This Enter Asset, enter one-third (1/3) of the total cost and one-third of the land price. This will depreciation one-third of your property.

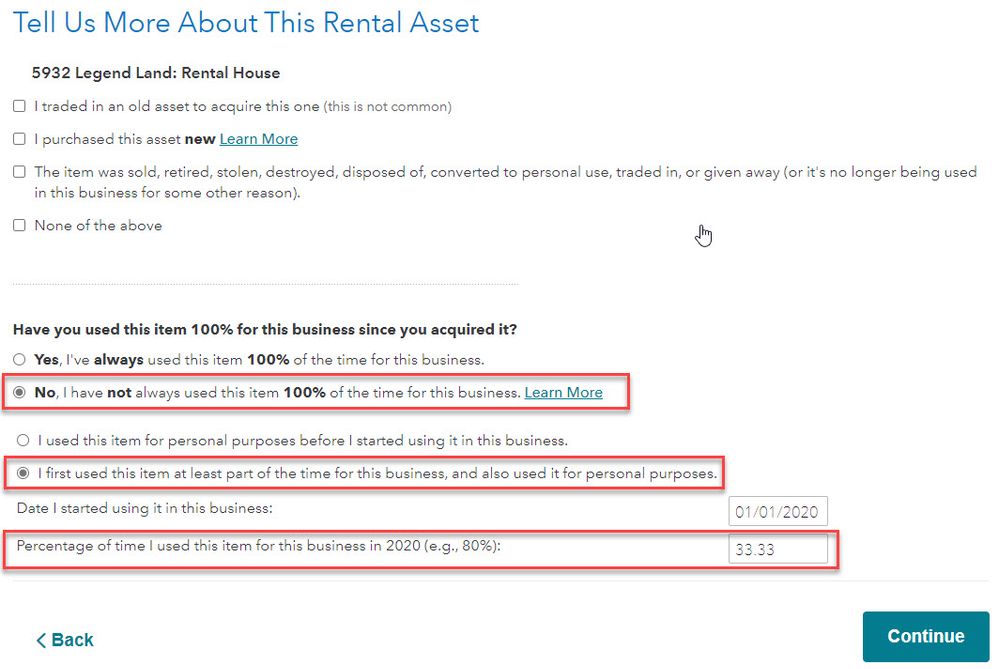

Business use percentage

Your second option is to enter the full amount for the house and enter the business percentage (33%). TurboTax will depreciate one third of the home.

- On the rental property info screen – select Add expense or asset

- Select Rental property

- EDIT your rental property under Assets

- Select Rental Real Estate Property

- Choose Residential Rental Real Estate

- On Tell Us About This Enter Asset, enter the total cost and total land price.

- On Tell Us More About This Rental Asset enter 33.33% as your business use.

Enter option will produce the same depreciation within a few dollars.