- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Do I complete both: 1099-INT and Installment Sales Summary?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I complete both: 1099-INT and Installment Sales Summary?

I already entered my 1099-INT information. In another section it asked me if I was collecting payments and now it is asking me to enter in Installment Sales Summary.

So I have to do both?

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I complete both: 1099-INT and Installment Sales Summary?

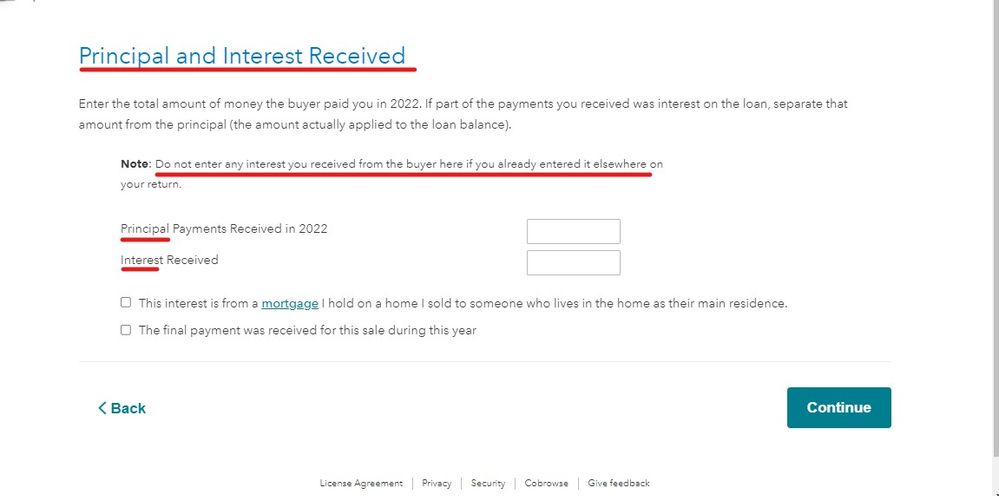

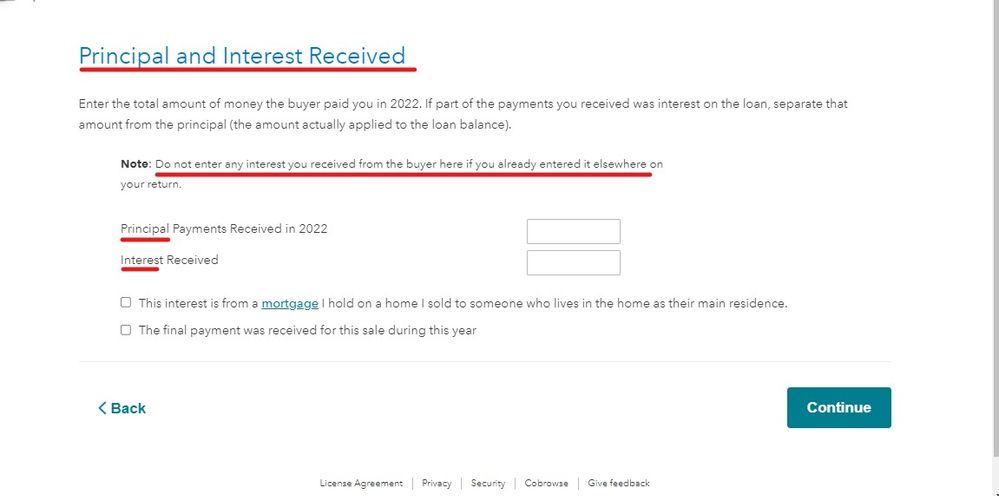

OK ... so you have entered both the interest and principle as required so you are DONE. Going forward, you can enter both in the 6252 section ... see my screenshot below where it shows that both items may be entered at the same time. However entering them individually is also allowed just don't enter the interest twice unless you like paying more in taxes than you need to.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I complete both: 1099-INT and Installment Sales Summary?

You do NOT do both ... if you have an installment sale form 6252 then the principle & interest paid are both entered there only unless you like paying taxes twice. The 1099-INT section is only used if you were not reporting the sale on the 6252.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I complete both: 1099-INT and Installment Sales Summary?

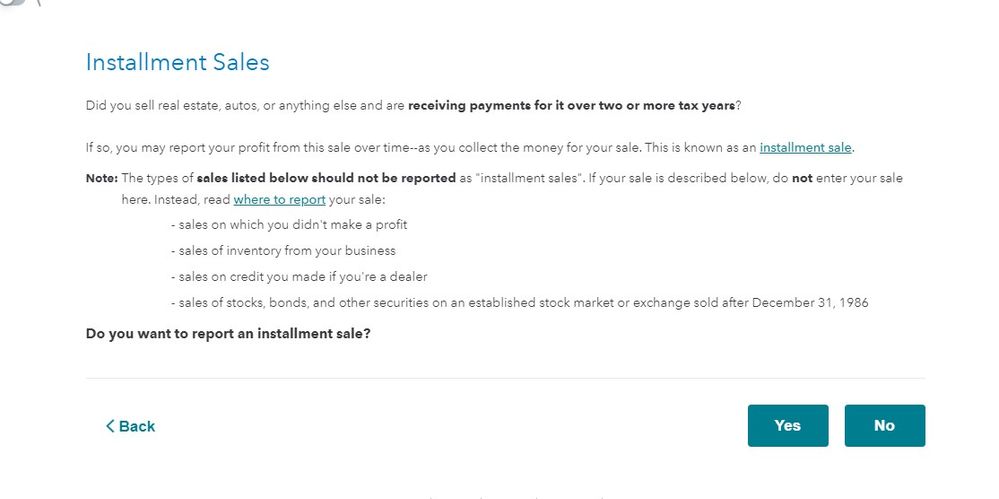

if you are reporting income using the installment sale method Turpotax will ask for the priipal amount received which is separate from th interest included in the payment o needs to be reported separately.

installment sale reporting can't be used for the following

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I complete both: 1099-INT and Installment Sales Summary?

@TaxLu I am not sure that I really understand the issue. To be clear , 1099_INT would usually be issued by a bank or a financial entity whom has paid you interest on monies that they hold as deposit for you.

On the other hand, in an installment sale you sell something ( like land, house etc. ) and act as the lender, you collect interest ( usually from an individual and not an entity ) till the original sales amount is fully paid off. In this case you have report/recognize the interest you have earned. So yes , generally you will report 1099-INT and also the "installment sale " interest ( select not reported on 1099-INT ).

Is this what you are dealing with or am I in left field ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I complete both: 1099-INT and Installment Sales Summary?

@pk, @Critter-3

I sold the house owner finance and have a servicing company collecting the payments. The servicing company deposits into my account. The servicing company sent me a 1099-INT at the end of year. The 1099-INT only has INTEREST INCOME, no thing else. In turbo tax I entered a 1099-INT.

Later turbo taxed if I sold anything on payments and it looks it is asking for interest separate from income. That is what confused me. The servicing company did not send me 6252 .

So you are saying I should NOT enter the installment sales area?

Should I ask the servicing company for a 6252?

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I complete both: 1099-INT and Installment Sales Summary?

OK ... let's start with the sale. In the year you sold this item did you report it on a form 6252 as an installment or did you report the sale in full on that tax return? Are you reporting the sale over multiple tax years ?

Now since you are using a processing company you will enter the interest earned in some way ... either in the 1099-INT section OR in the 6252 section of the program but not both. READ the screen instructions ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I complete both: 1099-INT and Installment Sales Summary?

1- I did not report on form 6252.

2- I've only been using the 1099-INT each year.

3- After reading the instructions again, I will only enter the principal portion and NOT the interest.

Thank you

@Critter-3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I complete both: 1099-INT and Installment Sales Summary?

1- I did not report on form 6252. Then you don't have an installment sale to report if you did not do one in the year of sale.

2- I've only been using the 1099-INT each year. Good ... then you know you MUST report the interest income that has been reported. Since you have no 6252 it only goes in the interest income section.

3- After reading the instructions again, I will only enter the principal portion and NOT the interest. I hope that was a typo ... you MUST report the interest since the IRS knows about it ... failure to do so will result in getting a CP2000 in a couple of years for the missing income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I complete both: 1099-INT and Installment Sales Summary?

1- The 1099-INT form I received only has Interest Income amount. I added that in TurboTax 1099-INT section.

2- Then I added the Total Principal under the installment sale section. The property was already listed here, since it carried over from the previous year.

Is that correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I complete both: 1099-INT and Installment Sales Summary?

OK ... so you have entered both the interest and principle as required so you are DONE. Going forward, you can enter both in the 6252 section ... see my screenshot below where it shows that both items may be entered at the same time. However entering them individually is also allowed just don't enter the interest twice unless you like paying more in taxes than you need to.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I complete both: 1099-INT and Installment Sales Summary?

@Critter-3- Thank you for all your help. I knew that with some help I could get it done.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

odunham

New Member

nahoku

New Member

Marija

New Member

agall2575

New Member

maple1122

New Member