- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Anyone else have an issue with importing 1099-INT from Chase Bank?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Anyone else have an issue with importing 1099-INT from Chase Bank?

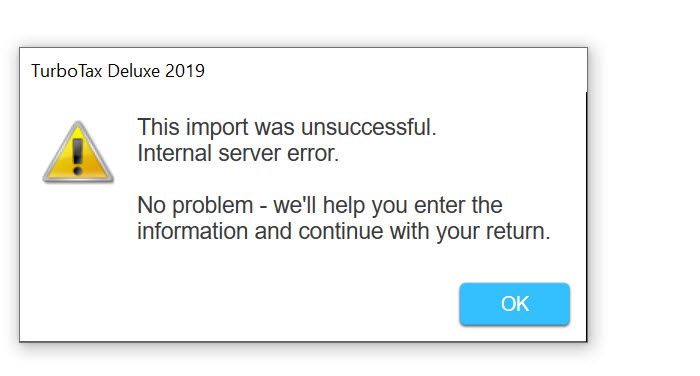

Seems to be a new problem this year. But every time I try to import my 1099-INT from Chase bank, I get an import not successful. In past years, it has been no problem.

Anyone else having this issue?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Anyone else have an issue with importing 1099-INT from Chase Bank?

You can securely import your 1099-B, 1099-DIV, 1099-INT, 1099-OID, or 1099-R into TurboTax, provided your broker or financial institution participates in our TurboTax Partner program.

When you get to the place in TurboTax where we ask if you received that form, answer Yes and we'll give you the option to import. You can also jump straight to the section for your specific 1099 form. Here's how:

- Sign in to TurboTax and open or continue your return.

- Search for 1099-B and select the Jump to link in the search results.

- Follow the screens and you’ll be able to import your form.

Tip: Be sure to select the right financial institution or brokerage from the list. For example, several participating partners' names start with First National Bank and if you select the wrong First National Bank, you won't be able to import.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Anyone else have an issue with importing 1099-INT from Chase Bank?

First, it is using the PC program.. not online.

Secondly, being a long time user, I understand and know how to import my bank information. Chase is and has been a long time participant with TurboTax, yet this year there is a problem with importing.

I appreciate your trying to help, but your response does not address the issue, which is a problem with TT and importing.. others online have reported the issue as well with other banks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Anyone else have an issue with importing 1099-INT from Chase Bank?

Please try importing your information again. We have been informed that the issue has been resolved now.

We apologize for the inconvenience!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Anyone else have an issue with importing 1099-INT from Chase Bank?

As far as I can tell it has not been resolved. Unless you have more specific information regarding the resolution or when it is supposed to occur. I was told 3 days ago that it was supposed to be resolved on 03/09/2020 (Monday), but that didn't happen either.

1099-Int (bank account interest information) will still not import using Chase Bank as an option. I get the same error, "unable to import"

Chase Investment 1099-DIV will import, however it imported previously and was not an issue. However, the link provided for getting the identification code for Chase Investments is an old Chase webpage that they no longer use. Chase sometime last year changed there webpage and web link.

I will try again tomorrow.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Anyone else have an issue with importing 1099-INT from Chase Bank?

I can report today that this has not been fixed. I still cannot import 1099-INT from Chase. I can verify that Chase is logging the attempt to access via turbotax when I check online. Please report that this issue is not fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Anyone else have an issue with importing 1099-INT from Chase Bank?

A 1099 INT? You could have manually entered it by now without the stress.

It is just as fast and easy to manually enter it. When you enter a 1099Int or 1099Div the first screen is How to Enter, by Import or Enter it Myself. Scroll down and click the last circle to enter it myself.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Anyone else have an issue with importing 1099-INT from Chase Bank?

Yes I am aware of that for 1099-INT as I have used this program for over 10 years.

However, it is indicative that there is an issue with importing with TurboTax. Especially when TurboTax is still accessing an obsolete Chase webpage for importing the 1099-DIV (investment) information, in order to import that and importing not working at all for 1099-INT.

I am trying to get this fixed for me and others, which is why I am trying to report it as a problem, not because I am stressed that I can't enter it. I would be stressed if my 40 page 1099-DIV failed to import, which I bet will happen next year, if they don't fix the issue with Chase.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Anyone else have an issue with importing 1099-INT from Chase Bank?

I'm having the same issue. What's the solution? I don't want to manually type in over 100 pages of information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Anyone else have an issue with importing 1099-INT from Chase Bank?

Make sure you're selecting the correct partner in TurboTax. Some institutions have similar-sounding names but are in fact separate entities. For example, J.P. Morgan Chase Bank, J.P. Morgan Funds, J.P. Morgan Private Bank, and J.P. Morgan Securities are all listed as TurboTax partners, and if you choose the wrong J.P. Morgan, you won't be able to import.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Anyone else have an issue with importing 1099-INT from Chase Bank?

I am having this issue as well. So its March 24 and Intuit has still not fixed this, is that correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Anyone else have an issue with importing 1099-INT from Chase Bank?

As far as I am aware as of 4/24/2020, Intuit has not fixed this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Anyone else have an issue with importing 1099-INT from Chase Bank?

@jmchome wrote:I am having this issue as well. So its March 24 and Intuit has still not fixed this, is that correct?

Obviously you meant to type "April 24" above and not March 24.

Speak to TurboTax Support so they can troubleshoot with you.

Support hours are 5AM-5PM Pacific (8AM-8PM Eastern), Mon-Fri

FAQ: What is the TurboTax phone number?

https://ttlc.intuit.com/community/using-turbotax/help/what-is-the-turbotax-phone-number/00/25632

Or use this contact form:

https://support.turbotax.intuit.com/contact

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Anyone else have an issue with importing 1099-INT from Chase Bank?

Again, I am aware of all that... that is not the issue...I understand you have to choose Chase Investments, for 1099-DIV and Chase Bank for 1099-INT... the issue is described in detail above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Anyone else have an issue with importing 1099-INT from Chase Bank?

Unfortunately, Intuit was of no help.. I ended up giving up and putting it in manually.. a pain I know..but maybe if others keep complaining...they will fix it eventually.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

fineIlldoitmyself7

Level 1

sbkiwi

Level 2

jeffreycoe

New Member

Sue Jones

Returning Member

heyfelix

New Member