- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Mortgage interest leftover from Schedule E not showing up on Schedule A for part time rental

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interest leftover from Schedule E not showing up on Schedule A for part time rental

I have a second home that is used 41 days as vacation rental.

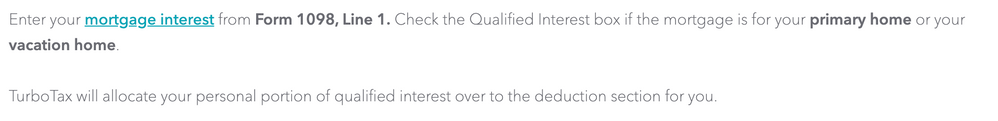

Leftover, non-deducted Mortgage interest and Property Taxes from Schedule E are supposed to automatically be applied to the deductions on Schedule A. Here's the Turbotax message from the Mortgage Interest page:

I followed the instructions, but the remainder of the Mortgage Interest is not showing up on Schedule A, whereas the prorated Property Taxes do show up there.

Any idea whether this is a bug or if it is represented elsewhere for Mortgage Interest. A TurboTax rep just walked me through manually adding the 1098 which would end up double counting. I don't need a CPA, I just need someone to tell me if this is a bug or to point me to where I can verify that this is captured since I can't access the forms from the online version.

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interest leftover from Schedule E not showing up on Schedule A for part time rental

No, there is not a bug, the best way to make sure that TurboTax is calculating this correctly is to make sure that all questions in regards to your rental properties are entered correctly. When you have a vacation home that you are renting out, follow these steps in TurboTax:

- While in your Tax Home,

- Select Rental Properties,

- Select Go to Schedule E,

- Follow through the on screen prompts until you see your Rental Properties,

- Select Edit next to your vacation home,

- Select Update next to expenses.

- Select Walk me through everything,

- Follow through the on screen prompts until you get to Was this property rented for all of 2019? Answer No.

- Answer the question on how many days the property was rented at fair market value.

By answering these questions, TurboTax will adjust the % of your Mortgage Interest and Property Taxes and reflect them on your Schedule A.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interest leftover from Schedule E not showing up on Schedule A for part time rental

Regina I did exactly the steps you list below but I still don't see the mortgage interest transferring over to my schedule a . On the Schedule E Worksheet it shows the amount that is personal for mortgage, real estate taxes etc. and on the schedule e worksheet schedule A smart worksheet it shows the real estate taxes portion but nothing for mortgage interest. I max out on the 10K for real estate taxes so does nothing for me there ,but the mortgage piece should not be an issue... (not over limits on mortgage amt for two homes). Any other ideas...I would think it would add to my mortgage amt from my principal home but it does not..thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interest leftover from Schedule E not showing up on Schedule A for part time rental

If you did not enter any personal use days, TurboTax will not consider it a 2nd home and won't transfer over the excess interest.

Right under the days rented at fair market value, be sure to enter the days that you used it as your 2nd home. (The days entered for personal use should be the remaining number of the days not rented.)

If you are still having this issue, please try deleting that mortgage interest and going back through the rental questions all over again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interest leftover from Schedule E not showing up on Schedule A for part time rental

Karen thanks for the quick response. The issue is currently I have this set up as a vacation home (Which my understanding is that owner stays can only be 14 days or 10%). In my case I stayed in the unit 10 days, rented 184 days and vacant was 171 days.. If I do as you state and put the rent at 184 days and the remaining as personal (181 days)... then you are correct it takes the % of mortgage and puts it on schedule A...

the directions in turbo tax state "Do not include days when property was vacant". So the problem is if I only put the 10 days as personal stay and the 184 days rented ... it does not take that mortgage amount and put on schedule a . Unless the rules have changed for vacation home I think it would show I am over the max allowed days the way turbo tax is set up...I don't recall this being an issue in the past...has the IRS laws changed or did Turbotax change their program?

Thanks again for the your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interest leftover from Schedule E not showing up on Schedule A for part time rental

The IRS rules on this have not changed. Another option would be to enter the mortgage interest allowed for schedule A purposes as a separate entry in the home mortgage interest section in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interest leftover from Schedule E not showing up on Schedule A for part time rental

Thanks Thomas..the manual workaround worked...I took the personal part of the mortgage and added it into my mortgage amount..thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interest leftover from Schedule E not showing up on Schedule A for part time rental

I ended up having to do this too and I just made sure that the total amount reflected added up to what was on my 1098. Did you check the box to say that the amount differs than what is on your 1098? Or did you leave it unchecked since the total amount is accurately calculated?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interest leftover from Schedule E not showing up on Schedule A for part time rental

@LindseyM84 No, you don't need to check the box for '..amount differs from what is on my 1098..' since you are reporting the full amount of Mortgage Interest shown on your 1098 in your return.

Click this link for more info on Allocating Mortgage Interest Between Home and Rental.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interest leftover from Schedule E not showing up on Schedule A for part time rental

I totally agree that itis a bug in the software! The same thing happened to me. In addition, the software prorated the rental property repairs which is completely ridiculous!! The repairs entered are only for the time it was a rental, I know that I cannot deduct home repairs for a primary or secondary home. Luckily, the prorated amount was so low that I didn't bother trying to recoup the deduction.

If it wasn't a bug, why would it list the amounts "Allocated for Personal Use" in the Schedule E Worksheet but only transfer the amount for real estate taxes. Turbotax needs to fix this!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

spunky_twist

New Member

user17555657897

New Member

user17555332003

New Member

MaxRLC

Level 3

techonecommunication

New Member