- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interest leftover from Schedule E not showing up on Schedule A for part time rental

I have a second home that is used 41 days as vacation rental.

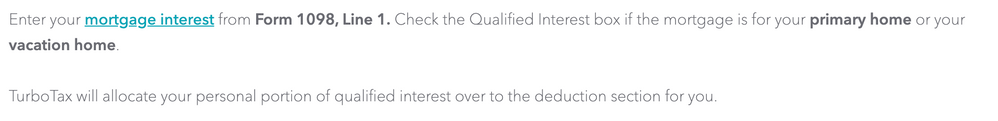

Leftover, non-deducted Mortgage interest and Property Taxes from Schedule E are supposed to automatically be applied to the deductions on Schedule A. Here's the Turbotax message from the Mortgage Interest page:

I followed the instructions, but the remainder of the Mortgage Interest is not showing up on Schedule A, whereas the prorated Property Taxes do show up there.

Any idea whether this is a bug or if it is represented elsewhere for Mortgage Interest. A TurboTax rep just walked me through manually adding the 1098 which would end up double counting. I don't need a CPA, I just need someone to tell me if this is a bug or to point me to where I can verify that this is captured since I can't access the forms from the online version.

Thanks!